Article Text

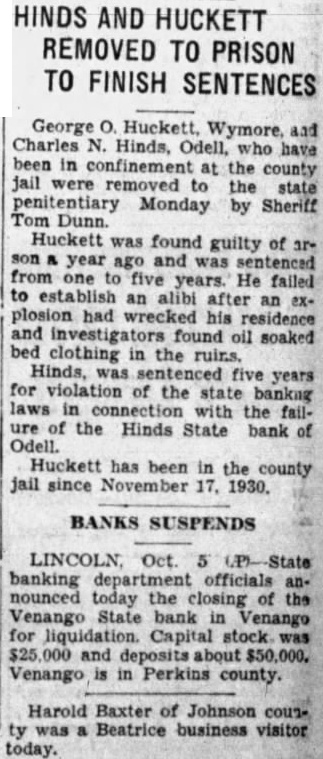

HINDS AND HUCKETT REMOVED TO PRISON TO FINISH SENTENCES George O. Huckett. Wymore, and Charles N. Hinds, Odell, who been in confinement at the county jail were removed the state penitentiary Monday by Sheriff Tom Dunn. Huckett was found guilty of son year ago and sentenced from five years. He failed to establish an alibi after plosion had wrecked his and investigators found oil soaked clothing in the ruins. Hinds, five years for violation of the state banking laws in with the failure of the Hinds State bank of Odell. Huckett has been in the county jail since November 1930. BANKS SUSPENDS banking department officials nounced today the closing of the Venango State bank Venango for liquidation. Capital stock was and deposits about $50,000. Venango in Perkins county. Harold Baxter of Johnson cousBeatrice business visitor today.