Click image to open full size in new tab

Article Text

Local Bank Clearings -Other Quotations

Saturday Same day last year Decrease $ Same day last week For week 46,916,086.03 Same week last year Decrease Previous week

Products, Market Basis. meal com. rate 24.00@24.50 Atlanta. first clean mill run 011@

Suit Thrown Out.

Circuit Judge Lafon Allen today threw out of court the $25,000,000 resuit for alleged and ince instituted against officers and directors of the Bancokentucky Company, Louisville Trust National Bank of Kentucky and Louisville National Bank & Trust had admitted a "discrepancy. Cashier had himself locked up in the Hattiesburg jail until the audit had been completed, although no charges have been filed against him.

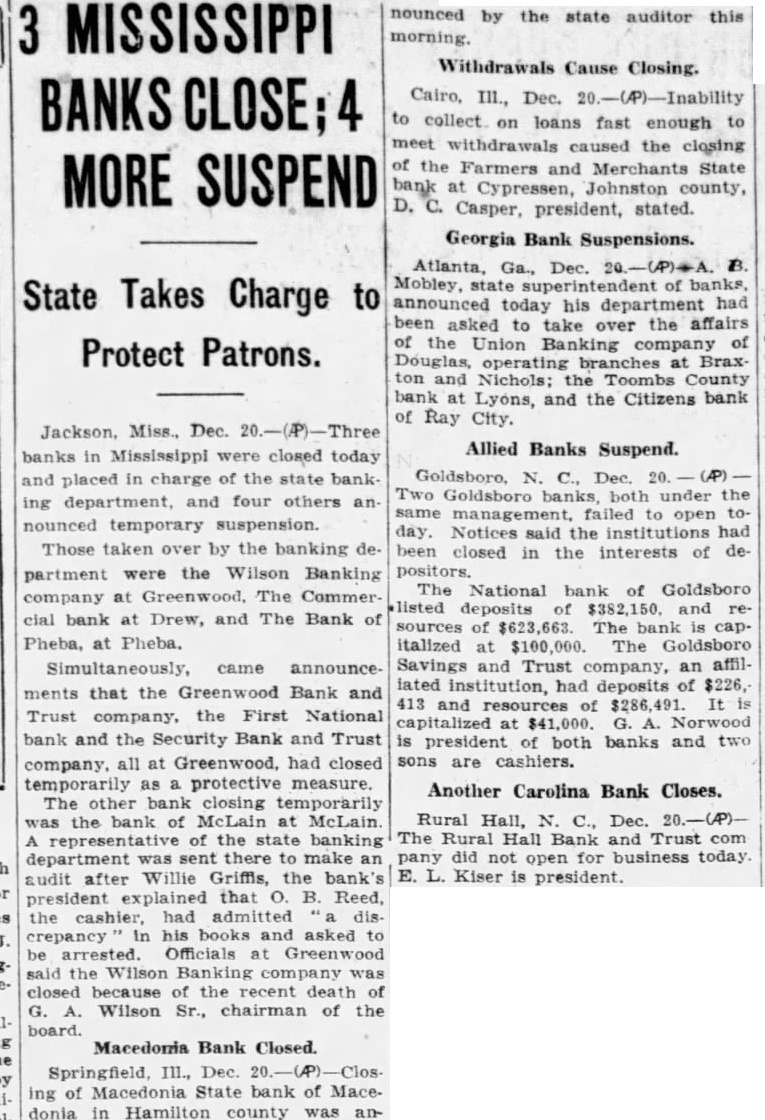

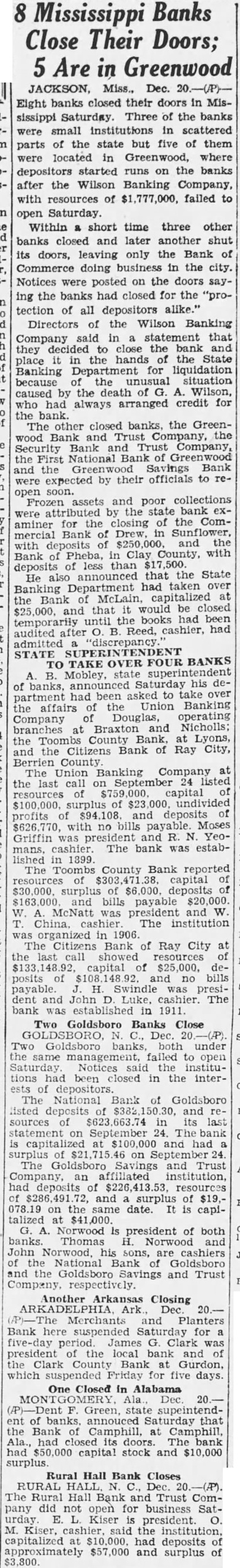

GOLDSBORO, N. BANKS FAIL TO OPEN GOLDSBORO, N. C., Dec. 20. Two Goldsboro banks. both under same management, failed to open today. Notices said the institutions been closed in the interests of depositors. The National Bank of Goldsboro listed deposits 30 and resources of $623,663.74 in its last state ment on September 24. The bank is capitalized at $100.000 and had sur of 46 on September 24. The Goldsboro Say tings Trust Company, an affiliated institution, had deposits $226, 413.53, resources 491 and surplus of $19,078. the same date. It is capitalized $41,000. Norwood is president of both Thomas H. Norwood and John Norwood, his sons, are cashiers National Bank of Goldsboro and Goldsboro vings & Trust Company, respectively

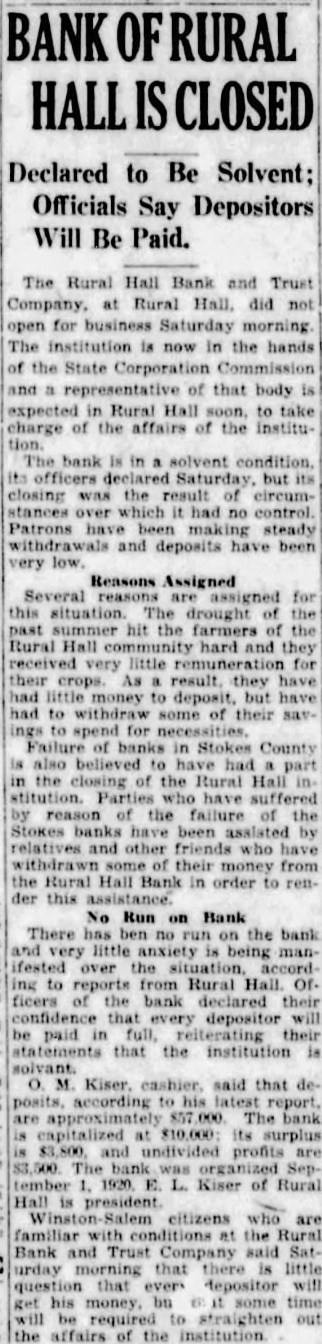

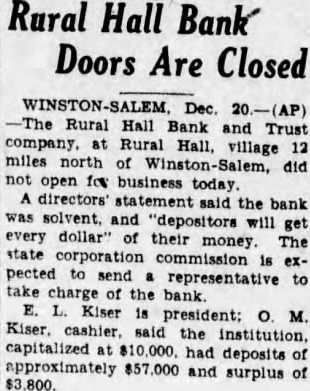

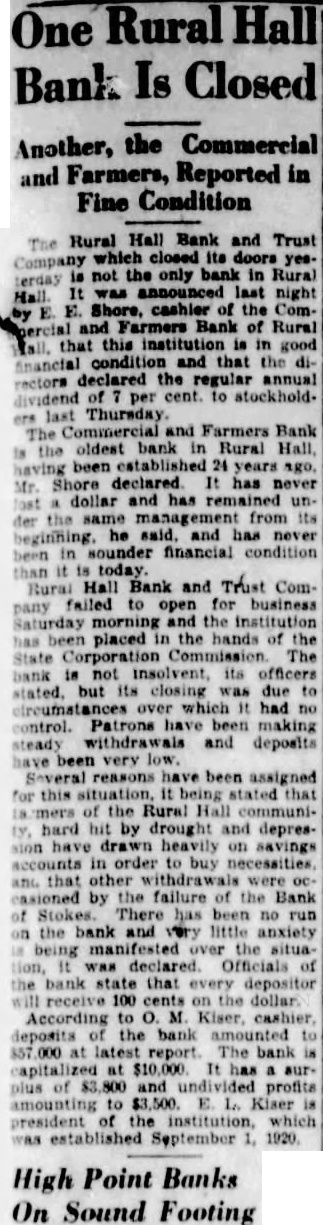

RURAL HALL N. C., Dec. The Rural Hall Bank Trust Company did not open for business today. E. L. Kiser is president. O. M. Kiser is eashier and said the institution, capitalized at $10,000. had posits of approximately $57,000 and surplus of $3,800.

ANOTHER BANK CLOSES IN ARKANSAS

ARKADELPHIA, Ark., Dec. 20. The Merchants and Planters bank here suspended today for a fiveday period. James G. Clark was president of the local bank and of the Clark County bank Gurdon, which suspended yes terday for five days. Officers of the bank said suspension was decided upon because of uneasiness caused by the Gurdon bank suspension. The Merchants and Planters bank had deposits of bout $750,000, with capital and surplus of $90,000.

SMALL ALABAMA

BANK CLOSES DOORS

MONTGOMERY, Ala., Dec. 20. (AP) Dent Green, state superintendof banks, announced today that the Bank of Camphill, at Camphill, had closed its doors today. Mr Green said closing of the bank was due to frozen assets, largely caused by poor crops and the extended drouth of last summer. The bank had $50,000 capital stock and $10,000 surplus.

DEFUNCT BANK

TO PAY DIVIDEND

JACKSONVILLE, Fla., Dec. 20 presents, in the form a per cent are to be given all creditors of the defunct Brotherhood State bank here, who are entitled of to participate in the distribution its assets. Joseph M. Glickstein, receiver, said today the dividend. the second since the institution failed last would mailed to depositors next Tuesday in time for Christmas.

GEORGIA BANKS

NAMED IN REQUEST BY ASSOCIATED PRESS State Superintendent of Banks A. B. Mobley Saturday inced that department had been asked to take over the Union Banking Company of which also branches at Braxton and Nicholls, the County Bank at Lyons, the Citizens' Bank of Ray City, in Berrien The last bank call, Septembed 24, showed the Union Banking Company to have resources of capi of of surplus, $23,000, undivided profits, $94,108, and deposits, No bills were payable at that according to the call. The County Bank on September 24 had resources of 471.38, capital, surplus, $6,000, deposits, $163,000 and bills $20,000. pay September 24 call shows the The Citizens' of Ray as ing of capital, and no bills Inspectors will placed in of the banks, Mr