Article Text

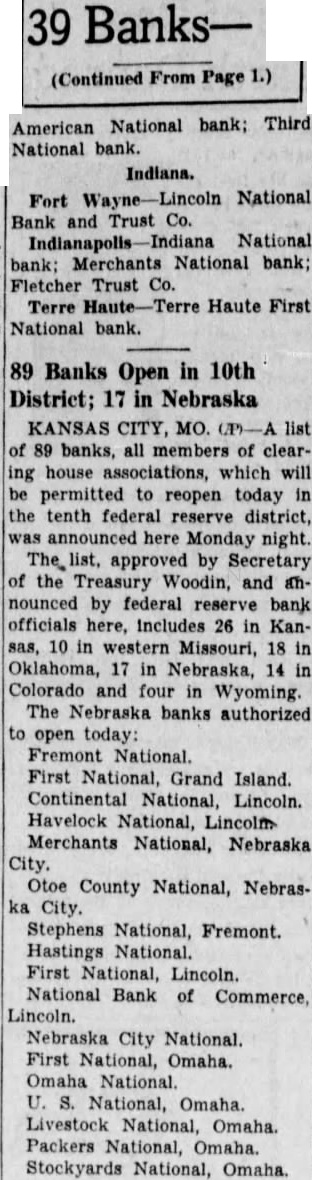

39 (Continued From Page National bank; Third American National bank. Indiana. Fort National Bank and Trust Co. National bank; Merchants National Fletcher Trust Terre Haute First National bank. 89 Banks Open in 10th District; 17 in Nebraska KANSAS CITY, MO. list 89 banks, all members of clearing house associations, which will be permitted to reopen today the tenth federal reserve district, here Monday night. approved by Secretary the Treasury Woodin, and nounced by federal reserve bank officials here, includes 26 in Kansas, 10 western Missouri, 18 Oklahoma, Nebraska, 14 Colorado and four in Wyoming. The Nebraska banks authorized open today: Fremont National. First National, Grand Island. Continental National, Lincoln. Havelock National, Lincoln Merchants National, Nebraska City. Otoe County National, Nebraska City. Stephens National, Fremont. Hastings National. First National, Lincoln. National Bank of Commerce Lincoln. Nebraska National. First National, Omaha. Omaha National, Omaha. Livestock National, Omaha. Packers National, Stockyards National, Omaha.