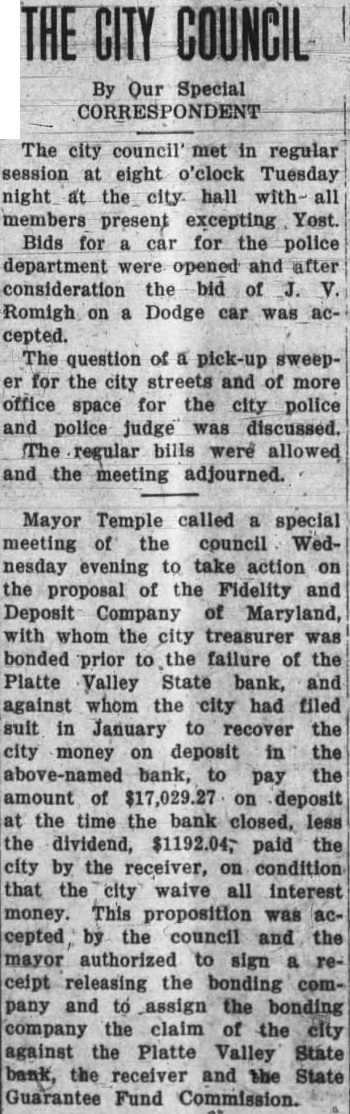

Article Text

By Our Special The city council' met in regular session eight o'clock Tuesday night at the city. hall with- all members present excepting Yest. Bids for car for the police department were opened and after consideration the bid of Romigh on a Dodge car was cepted. The question of pick-up sweepfor the city streets and of more office space for the city police and police judge was discussed. The regular bills were allowed and the meeting adjourned. Mayor Temple called special meeting of the council Wednesday evening to take action on the proposal of the Fidelity and Deposit Company of Maryland, with whom the city treasurer was bonded prior to the failure of the Platte Valley State bank, and against whom the city had filed suit in January to recover the city money on deposit in the bank, to pay the amount $17,029.27 on deposit at the time the bank less the dividend, paid the city by the receiver, on condition that the city waive all interest money. This proposition was by the council and the mayor authorized to sign ceipt releasing the bonding company and assign the bonding company the claim the city against the Platte Valley State bank, the receiver and the State Guarantee Fund Commission.