Article Text

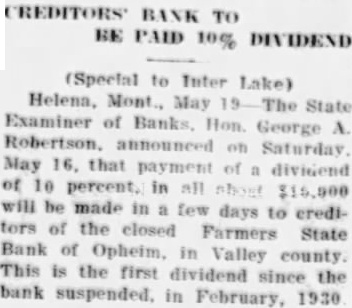

CREDITORS' BANK TO BE PAID 10% DIVIDEND (Special to Inter Lake) Helena, Mont., May 19. The State Examiner of Banks, Hon. George A. Robertson. announced on Saturday May 16, that payment of a dividend of 10 percent, in all shout $16,000 will be made in a few days to creditors of the closed Farmers State Bank of Opheim, in Valley county. This is the first dividend since the bank suspended. in February, 1930