Article Text

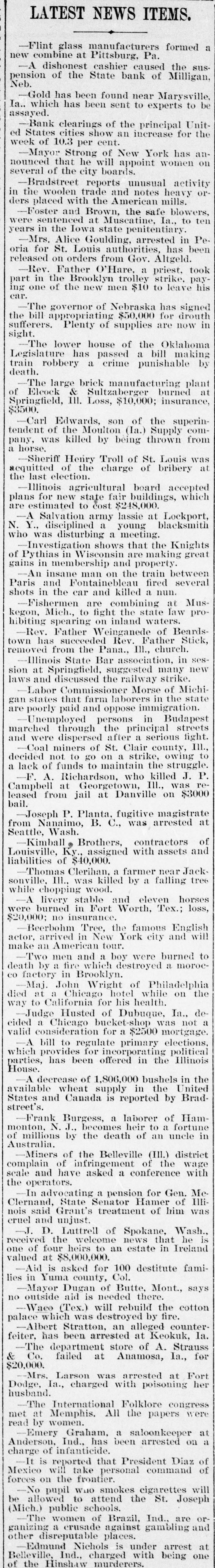

LATEST NEWS ITEMS. -Flint glass manufacturers formed a new combine at Pittsburg, Pa. -A dishonest cashier caused the suspension of the State bank of Milligan, Neb. -Gold has been found near Marysville, Ia.. which has been sent to experts to be assayed. -Bank clearings of the principal United States cities show an increase for the week of 10.3 per cent. -Mayor Strong of New York has announced that he will appoint women on several of the city boards. -Bradstreet reports unusual activity in the woolen trade and notes heavy orders placed with the American mills. -Foster and Brown, the safe blowers, were sentenced at Muscatine, Ia., to ten years in the Iowa state penitentiary. -Mrs. Alice Goulding, arrested in Peoria for St. Louis authorities, has been released on orders from Gov. Altgeld. -Rev. Father O'Hare, a priest, took part in the Brooklyn trolley strike, paying one of the new men $10 to leave his car. -The governor of Nebraska has signed the bill appropriating $50,000 for drouth sufferers. Plenty of supplies are now in sight. -The lower house of the Oklahoma Legislature has passed a bill making train robbery a crime punishable by death. -The large brick manufacturing plant of Eleock & Sultzaberger burned at Springfield, III. Loss, $10,000; insurance, $3500. -Carl Edwards, son of the superintendent of the Moulton (Ia.) Supply company, was killed by being thrown from a horse. -Sheriff Henry Troll of St. Louis was acquitted of the charge of bribery at the last election. -Illinois agricultural board accepted plans for new state fair buildings, which are estimated to cost $248,000. -A Salvation army lassie at Lockport, N. Y., disciplined a young blacksmith who was disturbing a meeting. -Investigation shows that the Knights of Pythias in Wisconsin are making great gains in membership and property. -An insane man on the train between Paris and Fontainebleau fired several shots in the car and killed a nun. -Fishermen are combining at Muskegon, Mich., to fight the state law prohibiting spearing on inland waters. -Rev. Father Weinganede of Beardstown has succeeded Rev. Father Stick, removed from the Pana., III., church. -Illinois State Bar association, in session at Springfield, suggested many new laws and discussed the railway strike. -Labor Commissioner Morse of Michigan states that farm laborers in the state are poorly paid and oppose immigration. -Unemployed persons in Budapest marched through the principal streets and were dispersed after a serious fight. -Coal miners of St. Clair county, III., decided not to go on a strike, owing to a lack of funds to maintain the struggle. -F. A. Richardson, who killed J. P. Campbell at Georgetown, III., was released from jail at Danville on $3000 bail. -Joseph P. Planta. fugitive magistrate from Nanaimo, B. C., was arrested at Seattle, Wash. -Kimball Brothers, contractors of Louisville, Ky., assigned with assets and liabilities of $40,000. -Thomas Clerihan, a farmer near Jacksonville, III., was killed by a falling tree while chopping wood. -A livery stable and eleven horses were burned in Fort Worth, Tex.; loss, $20,000; no insurance. -Beerbohm Tree, the famous English actor, arrived in New York city and will make an American tour. -Two men and a boy were burned to death by a fire which destroyed a morocCO factory in Brooklyn. -Maj. John Wright of Philadelphia died at a Chicago hotel while on the way to California for his health. -Judge Husted of Dubuque, Ia., decided a Chicago bucket-shop was not a valid consideration for a $2500 mortgage. -A bill to regulate primary elections, which provides for incorporating political parties, has been offered in the Illinois House. -A decrease of 1,806,000 bushels in the available wheat supply in the United States and Canada is reported by Bradstreet's. -Frank Burgess, a laborer of Hammonton, N. J., becomes heir to a fortune of millions by the death of an uncle in Australia. -Miners of the Belleville (III.) district complain of infringement of the wage scale and have asked a conference with the operators. -In advocating a pension for Gen. McClernand, State Senator Hamer of Illinois said Grant's treatment of him was cruel and unjust. -J. D. Luttrell of Spokane, Wash., received the welcome news that he is one of four heirs to an estate in Ireland valued at $8,000,000. f 100 lestitate fami