Article Text

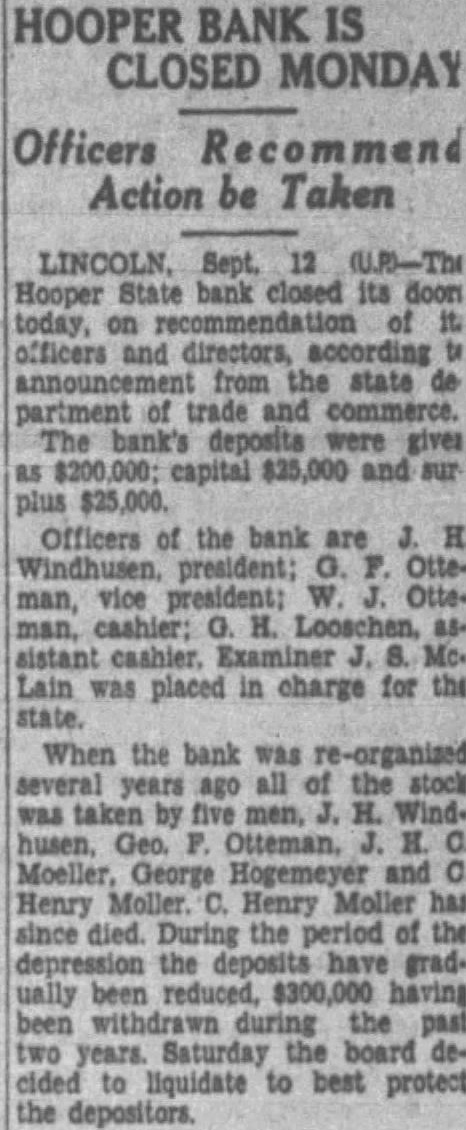

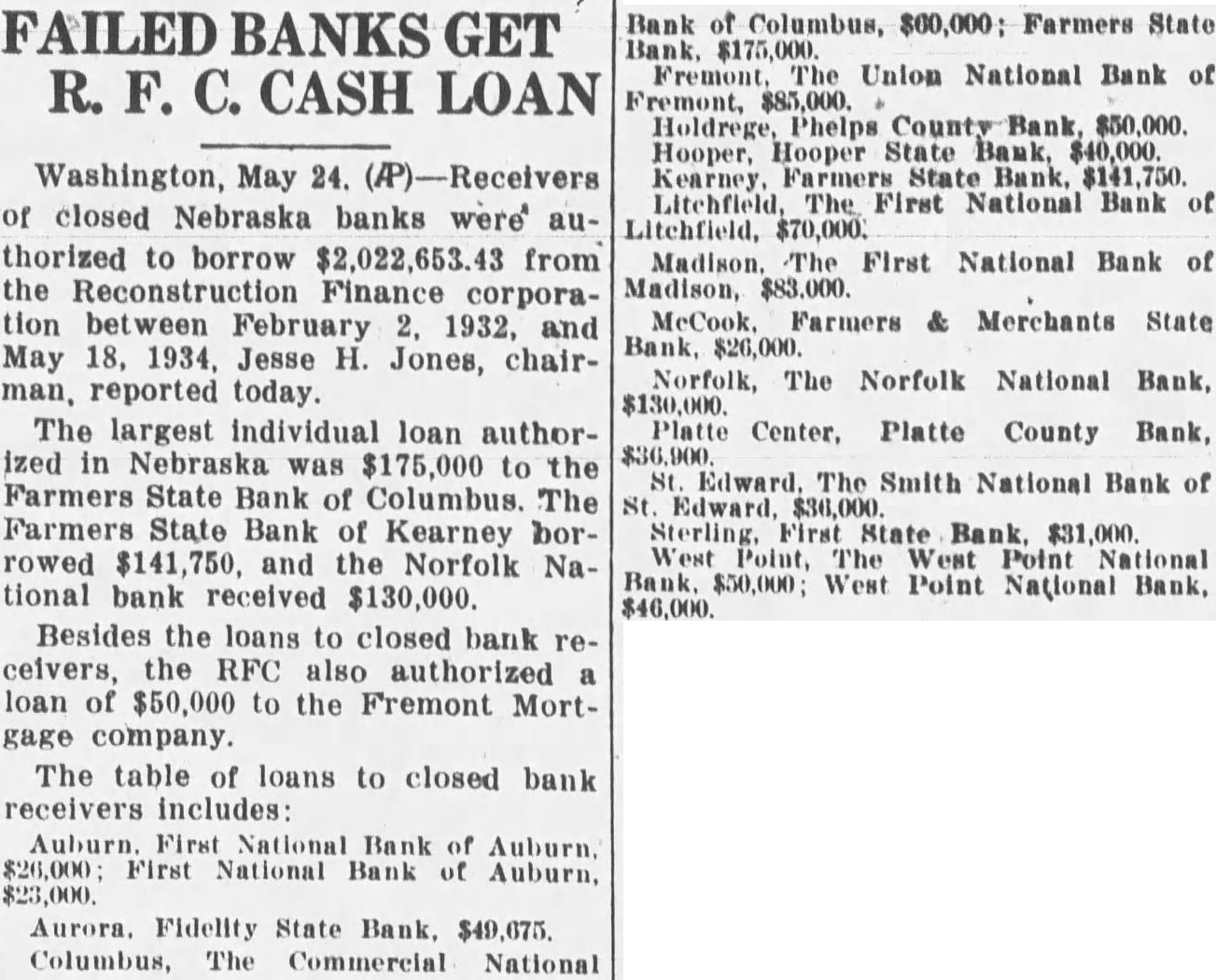

HOOPER BANK IS CLOSED MONDAY Officers Recommend Action be Taken LINCOLN. Sept. 12 (U.R)-Tht Hooper State bank closed its doon today, on of officers and directors, from the state partment of trade and The bank's deposits were gives as $200,000; capital $25,000 and sur plus $25,000. Officers of the bank are Windhusen, president; man, vice president: Ottesistant cashier, Examiner J. Mc. Lain was placed in charge for the When the bank was re-organized years ago all the was taken by five men, H. Windhusen, Geo. F. Otteman, J. H. Moeller, George Hogemeyer and Henry Moller. Henry Moller has since died. During the period of the depression the have gradually been reduced, $300,000 having been the past two years. the board decided liquidate to best protect the depositors.