Article Text

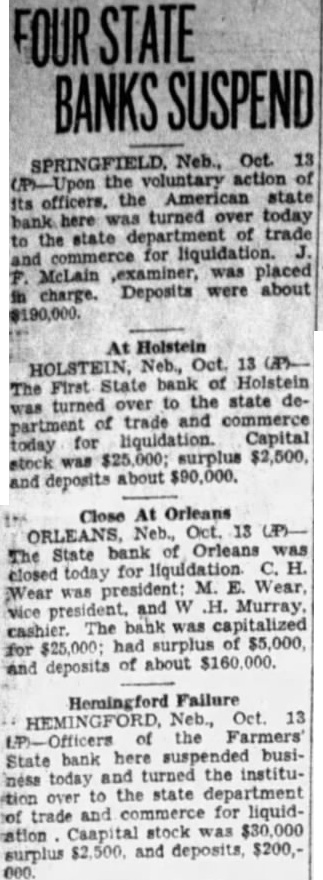

FOUR STATE BANKS SUSPEND SPRINGFIELD. Neb., Oct. 13 Upon the voluntary action its officers. the American state bank here was turned over today to the state department of trade and for liquidation. J. F. McLain ,examiner, was placed in charge. Deposits were about $190,000. At Holstein HOLSTEIN, Neb., Oct. 13 (P)The First State bank of Holstein was turned over to the state department of trade and commerce today for liquidation. Capital stock was $25,000; surplus $2,500, and deposits about $90,000. Close At Orleans ORLEANS, Neb., Oct. 13 (P)The State bank of Orleans was closed today for liquidation. C. H. Wear was president: M. E. Wear, cashier. The bank was capitalized for $25,000; had surplus of $5,000, and deposits of about $160,000. Hemingford Failure HEMINGFORD, Neb., Oct. 13 LP)-Officers of the Farmers' State bank here suspended business today and turned the institution over to the state department of trade and commerce for liquidation Caapital stock was $30,000 surplus $2,500. and deposits, $200,000.