Article Text

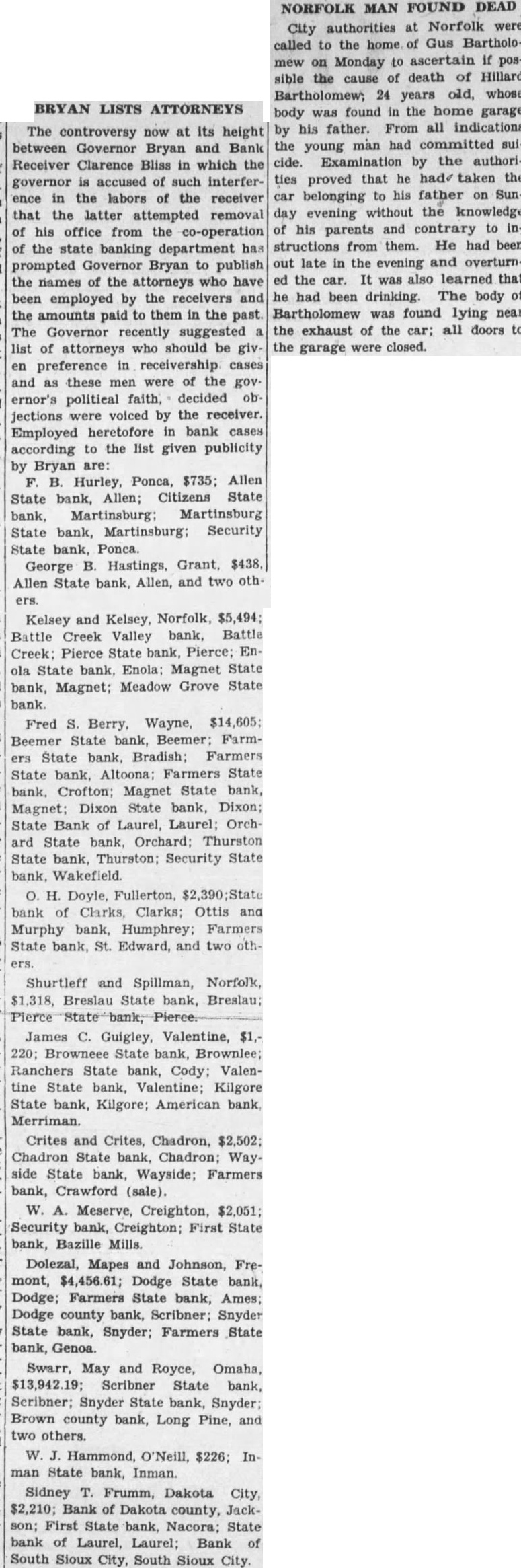

BLISS AVERS PLOT STORY RIDICULOUS Records Now in Possession of Receivers Who Plan to Work From State House. Clarence G. Bliss, former secretary of trade and in statement given out Friday Greeley, where he conducting sale said that he was surprised that Governor Bryan would charge plot existed to remove receivership records from the capitol and that he should presume discharge Bliss' counsel, D. Beynon. He says the story is ridiculous for the reason that the records are in the possession of the employes the Mr. Bryan would do with them he took them himself He added that far as he knows the only records that have been removed made up of part of the audit the Farmers State bank of Genoa, about which the senate ordered an investigation. Mr. Bliss says that the receivers as officers of the court have legal control these records and not the governor. The order naming each case recited "that Clarence G. Bliss, receiver is hereauthorized to take all the books, records and assets every kind and belonging said bank. He sug. gests that the governor look the law contempt that attaches to those who interfere with an order court. He added: "It has been apparent for some time that we could not continue our work of liquidating failed banks in connection with Mr. Bryan's administration. At meeting of all receivers this week to advise Mr. Bryan of our and at the same time we notified the heads our including Mr. Mr. Stall. There was no discussion of moving records and plans are that the work be in our quarters assigned to us by the capitol commission in the state house.' "The charge of Governor Bryan that we are to remove the records mere 'smoke screen' by which the pects to befog the real issue. The real question is, can the assets these banks be used for political regardless of the rights the "Before Governor Bryan's were lected of political filiation. did not know the politics of half dozen of the local am sure, however, that check of these attorneys would show that at least of them were Beynon Still Counsel. want made clear that Beynon is still my counsel and long as receiver. He has handled of the importlitigation for these receiverships is familiar with the work and pending cases and change now would result inevitably in serious losses and confusion. "Under our present plan of conducting the liquidation of these banks independently of the Bryan