Article Text

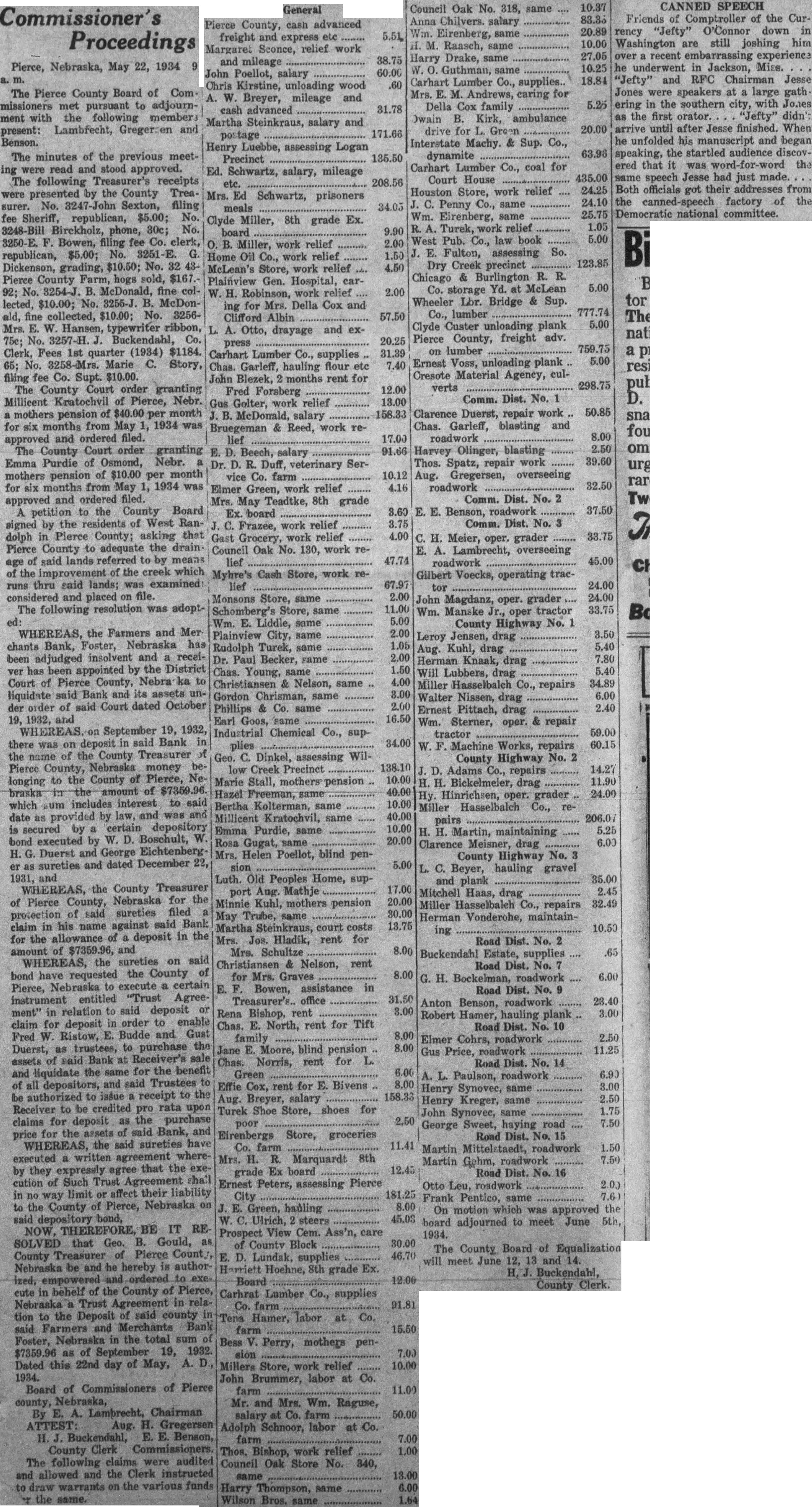

COMMISSIONERS' PROCEEDINGS Pierce, Nebr., May 22, 1934 The Pierce county board of commissioners met pursuant to adjourament with the following members present: Lambrecht, Gregersen and The minutes of the previous meeting were read and stood approved. The following treasurer's receipts were presented by the county treasurer. 3247-John Sexton, filing fee county sheriff, rep. $ 5.00 3248-Bill Birckholz, phone call .30 3249-Chas. Schlender, filing fee Co. Clk., rep. 5.00 3250-E. F. Bowen, filing fee Co. Clk., rep. 5.00 3251-E. G. Dickensen, grading 10.50 3252-Ed. Schwartz, filing fee Co. sheriff, dem. 5.00 3253-Pierce Co. Farm, hogs sold 167.92 10.00 3254-J. B. McDonald, fine collected 3255-J. B. McDonald, fine collected 10.00 3256-Mrs. E. W. Hansen, typewriter ribbon .75 3257-H. J. Buckendahl, Co. Clk., fees 1st quarter 1934 1184.65 3258-Mrs. Marie G. Story, filing fee, Co. Supt. 10.00 The county court order granting Millicent Kratochvil of Pierce, Nebraska, a mothers pension of $40 per month for six months from May 1, 1934, was approved and ordered filed. The county court order granting Emma Purdie of Osmond, Nebr., a mothers pension of $10.00 per month for six months from May 1, 1934, was approved and ordered filed. A petition to the county board signed by the residents of West Randolph in Pierce county asking that Pierce county make adequate the drainage of said lands referred to by means of the improvement of the creek which runs thru said lands was examined, considered and placed on file. The following resolution was adopted: WHEREAS, the Farmers & Merchants Bank, Foster, Nebr., has been adjudged insolvent and a receiver has been appointed by the district court of Pierce county, Nebraska, to liquidate said bank and its assets under order of said court dated October 19, 1932, and WHEREAS, on September 19, 1932 there was on deposit in said bank in the name of the county treasurer of Pierce county, Nebr., money belonging to the county of Pierce, Nebr., in the amount of $7,359.96, which sum includes interest to said date as provided by law, and was and is secured by a certain depository bond executed by W. D. Boschult, W. H. G. Duerst and George Eichberger as sureties and dated December 22, 1931 and WHEREAS, the county treasurer of Pierce county, Nebr., for the protection of said sureties filed a claim in his name against said bank for the allowance of a deposit in the amount of $7359.96, and WHEREAS, the sureties on said band have requested the county of Pierce, Nebr., to execute a certain instrument entitled "Trust Agreement" in relation to said deposit or claim for deposit in order to enable Fred W. Ristow, E. Budde and Gust Duerst, as trustees, to purchase the assets of said bank at Receiver's sale and liquidate the same for the benefit of all depositors, and said trustees to be authorized to issue a receipt to the Receiver to be credited pro rata upon claims for deposit as the purchase price for the assets of said bank, and WHEREAS, the said sureties have executed a written agreement whereby they expressly agree that the execution of such trust agreement shall in no way limit or affect their liability to the county of Pierce, Nebr., on said depository bond, NOW, THEREFORE, BE IT RESOLVED that Geo. B. Gould, as Co. Treasurer of Pierce county, Nebarska, be and he hereby is authorized, empowered and ordered to execute in behalf of the County of Pierce, Nebraska, a trust agreement in relation to the deposit of said county in said Farmers and Merchants Bank, Foster, Nebraska, in the total sum of $7359.96 as of September 19, 1932. Dated this 22nd day of May, A. D., 1934. ATTEST: H. J. Buckendahl, Co. Clk. BOARD OF COMMISSIONERS OF PIERCE COUNTY, NEBRASKA. By Lambrecht, Chairman Aug. Gregersen E. E. Benson, Commissioners. The following claims were audited and allowed and the clerk instructed to draw warrants on the various funds for the same. GENERAL Pierce Co., cash adv, frt. 5.51 Margaret Sconce, relief work and mileage 38.75 John Poellot, salary 60.00 Chris Kirstine, unloading wood .60 A. W. Breyer, mileage and cash advanced 31.78 Martha Steinkraus, salary and postage 171.66 Henry Luebbe, assessing Logan precinct 135.50 Ed. Schwartz, salary, mileage, etc. 208.56 Mrs. Ed. Schwartz, prisoners' meals 34.05 Clyde Miller, 8th grade exam. board 9.90 O. B. Miller, work relief 2.00 Home Oil Co., work relief 1.50 W. H. Robinson, work relief 2.00 McLean's Store, work relief 4.50 Plainview Gen. Hospital, caring for Mrs. Della Cox and Clifford Albin 57.50 L. A. Otto, drayage and express 20.25 Carhart Lumber Co., supplies 31.39 Chas. Garleff, hauling flour etc. 7.40 John Blezek, 2 mo. rent for Fred Forsberg 12.00 Gus Golter, work relief 13.00 J. B. McDonald, salary 158.33 Bruegman & Reed, work relief 17.00 E. D. Beech, salary 91.66 Dr. D. R. Duff, veterinary service at Co. farm 10.12 Elmer Green, work relief 4.16 Mrs. May Teadtke, 8th grade exam. board 3.60 J. C. Frazee, work relief 3.75 Gast Grocery, work relief 4.00 Council Oak No. 310, work relief 47.74 Myhre's Cash Store, work relief 67.97 Monson's Store, same 2.00 Schomberg,s Store, same 11.00 Wm. E. Liddle, same 5.00 Plainview City, same 2.00 Rudolph Turek, same 1.05 Dr. Paul Becker, same 2.00 Chas. Young, same 1.50 Christiansen & Nelson, same 4.00 Gordon Chrisman, same 3.00 Phillips & Co., same 2.00 Earl Goos, same 16.50 Industrial Chemical Co., supplies 34.00 Geo. C. Dinkel, assessing Willow Creek precinct 138.10 Marie Stall, mothers pension 10.00 Hazel Freeman, same 40.00 Bertha Kolterman, same 10.00 Millicent Kratochvil, same 40.00 Emma Purdie, same 10.00 Rosa Gugat, same 20.00 Mrs. Helen Poellot, blind pension 5.00 Luth. Old Peoples Home, support Aug. Mathje 17.00 Minnie Kuhl, mothers pension 20.00 May Trube, same 30.00 Martha Steinkraus, court costs 13.75 Mrs. Jos. Hladik, rent for Mrs. Schultze 8.00 Christiansen & Nelson, rent for Graves 8.00 E. F. Bowen, assistance in treasurer's office 31.50 Rena Bishop, rent 3.00 Chas. E. North, rent for Tift family Jane E. Moore, blind pension 8.00 Chas. Norris, rent for L. Green 6.00 Effie Cox, rent for F. Bivens 8.00 Aug. Breyer, salary 158.33 Turek Shoe Store, shoes for poor 2.50 Eirenberg's Store, groceries for Co. farm 11.41 Mrs. H. R. Marquardt, 8th grade exam. board 12.45 Ernest Peters, assessing Pierce city 181.25 J. E. Green, hauling 8.00 W. C. Ulrich, 2 steers 45.03 Prospect View Cem. Ass'n, care of County Block 30.00 E. D. Lundak, supplies 46.70 Harriet Hoehne, 8th grade ex. board 12.00 Carhart Lumber Co., supplies Co. farm 91.81 Tena Hamer, labor at Co. farm 15.50 Bess V. Perry, mothers pension 7.00 Miller's Store, work relief 10.50 John Brummer, labor at Co. farm 11.00 Mr. and Mrs. Wm. Raguse, salary ay Co. farm 50.00 Adolph Schnoor, labor at Co. farm 7.00 Thos. Bishop, work relief 1.00 Petersen's Store, work relief 2.00 Council Oak Store, same 13.00 Harry Thompson, same 6.00 Wilson Bros. Same 1.64 Council Oak No. 318, same 10.37 Anna Chilvers, salary 83.33 Wm. Eirenberg, same 20.89 H. M. Raasch, same 10.00 Harry Drake, same 27.05 W. O. Guthman, same 10.25 Carhart Lbr. Co., supplies 18.84 Mrs. E. M. Andrews, caring for Della Cox family 5.25 Dwain B. Kirk, ambulance drive for L Green 20.00 Interstate Machy & Sup. Co., dynamite 63.96 Houston's Store, work relief 24.25 Carhart Lbr. Co., coal for court house 435.00 J. C. Penny Co., same 24.10 Wm. Eirenberg, same 25.75 R. A. Turek, work relief 1.05 West Pub. Co., law book 5.00 J. E. Fulton, assessing So. Dry Creek precinct 123.85 Chicago and Burlington R. R. Co., storage Yd. at McLean 5.00 Wheeler Lbr. Bridge & Sup Co., lumber 777.74 Clyde Custer, unloading plank 5.00 Pierce county, freight adv. on lumber 759.75 Ernest Voss, unloading lumber 5.00 Cresote Material Agency, culverts 298.75 COMM. DIST. NO. Clarence Duerst, repair work 50.85 Chas. Garleff, blasting and roadwork 8.80 Harvey Olinger, blasting 2.50 Thos. Spatz, repairwork 39.60 Aug. Gregersen, overseeing roadwork 32.50 Aug. Gregersen, overseeing roadwork 32.50 COMM. DIST. NO. 2 E. E. Benson, roadwork 37.50 COMM. DIST. NO. 3 C. H. Meier, oper. grader 33.75 E. A. Lambrecht, overseeing roadwork 45.00 Glubert Voecks, operating tractor 24.00 John Magdanz, oper grader 24.00 Wm. Manske Jr., oper tractor 33.75 COUNTY HIGHWAY NO. 1 Leroy Jensen, drag 3.50 Aug. Kuhl, drag 5.40 Herman Knaak, drag 7.80 Will Luebbers, drag 5.40 Miller Hasselbalch Co., repairs 34.89 Walter Nissen, drag 6.00 Ernest Pittach, drag 2.40 Wm. Sterner, oper and repairing tractor 59.00 W. F. Machine Works, repairs 60.15 COUNTY HIGHWAY NO. 2 J. D. Adams Co., repairs 14.27 H. H. Bichimeier, drag 11.90 Hy. Hinrichsen, oper grader 24.00 Miller Hasselbalch Co., repairs 206.07 H. H. Martin, maintaining 5.25 Clarence Meisner, drag 6.00 COUNTY HIGHWAY NO. 3 L. C. Beyer, hauling gravel and plank 35.00 Mitchel Haas, drag 2.45 Miller Hasselbalch Co., repairs 32.49 Herman Vonderhoe, maintaining 10.50 ROAD DIST. NO. 2 Buckendahl Estate, supplies .65 ROAD DIST. NO. 7 G. H. Bockelman, roadwork 6.00 Anton Benson, roadwork 23.40 Robert Hamer, hauling plank 3.00 Elmer Cohrs, roadwork 2.50