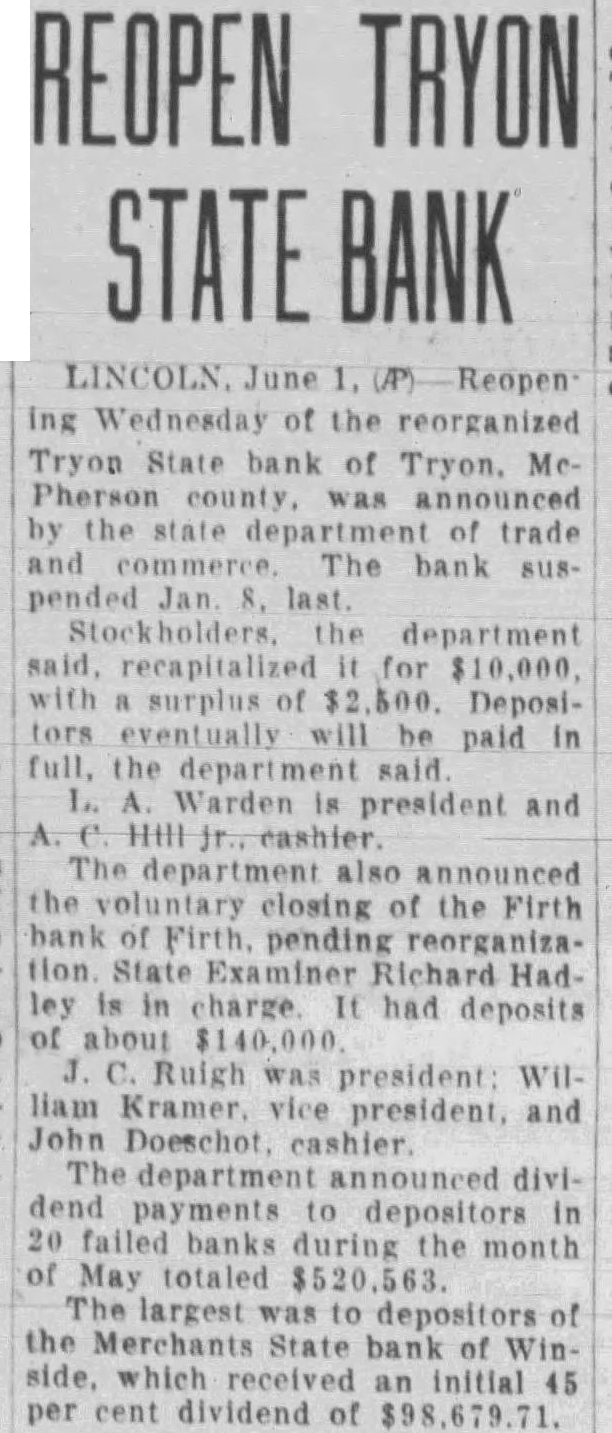

Article Text

REOPEN TRYON STATE BANK LINCOLN. June Reopen ing Wednesday of the reorganized Tryon State bank of Tryon. MePherson announced by the state of trade and The bank sus pended the department said, recapitalized for surplus of $00. Depositors eventually will be paid in full, the department said L. Warden is president and The department also announced the closing of the Firth bank pending reorganiza tion State Richard Had ley charge It had deposits of about Ruigh was president: William Kramer vice president. and John Doeschot department announced dividend payments to depositors 20 failed banks during the month of May totaled The largest was to depositors of the Merchants State bank Winside, which received an initial 45 per cent dividend of