Article Text

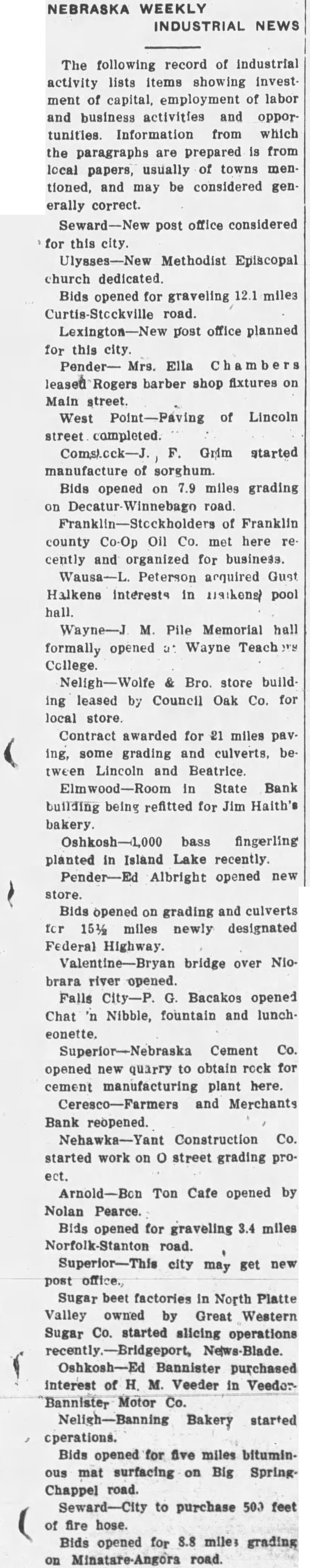

NEBRASKA WEEKLY INDUSTRIAL NEWS The following record of Industrial activity lists items showing invest ment of capital, employment of labor and business activities and oppor tunities. Information from which the paragraphs are prepared is from local papers, usually of towns mentioned, and may be considered generally correct. office considered for this city. Methodist Episcopal church dedicated. Bids opened for graveling miles road. post office planned for city. Mrs. Ella Rogers barber shop fixtures on Main street. West of Lincoln street completed. Grim started manufacture of sorghum. Bids opened on 7.9 miles grading on road. of Franklin county Co-Op Oil Co. met here recently and organized for business. Wausa-L. Peterson acquired Gust Halkens interests in mathens pool hall. Wayne-J M. Pile Memorial hall formally opened Wayne College. & Bro. store building leased by Council Oak Co. for local store. Contract awarded for 21 miles paving, some grading and culverts, between Lincoln and Beatrice. Elmwood-Room in State Bank building being refitted for Jim Haith's bakery. Oshkosh-1,000 bass fingerling planted in Island Lake recently. Albright opened new store. Bids opened on grading and culverts for 15½ miles newly designated Federal Highway. bridge over Niobrara river opened. Falls Bacakos opened Chat Nibble, fountain and lunch- Cement Co. opened quarry to obtain rock for cement manufacturing plant here. Ceresco-Farmers and Merchants Bank reopened. Construction Co. started on street grading ect. Ton Cafe opened by Nolan Pearce. Bids opened for graveling 3.4 miles Norfolk-Stanton road. city get new may post Sugar beet factories in North Platte Valley owned by Great Western Sugar started slicing operations Bannister purchased interest of H. Veeder in VeederBannister Motor Co. Bakery started cperations. Bids opened for five miles bituminous mat surfacing on Big Chappel road. to purchase feet of fire hose. Bids opened for 8.8 mile; grading road.