Click image to open full size in new tab

Article Text

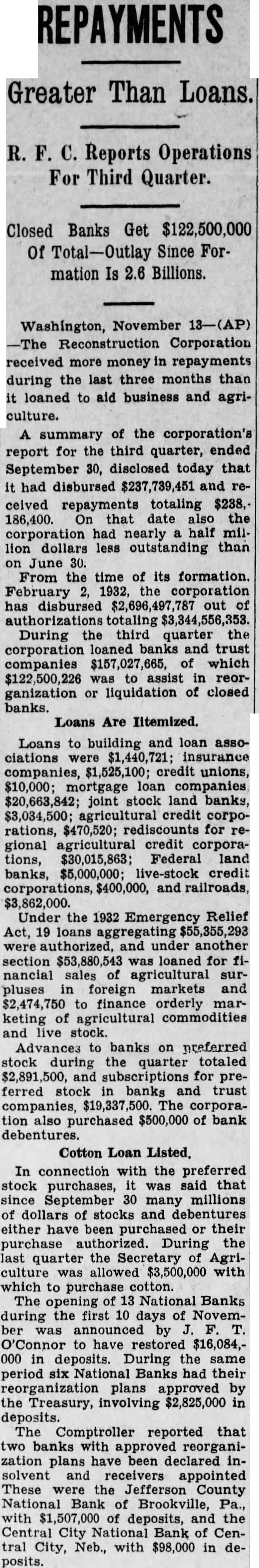

REPAYMENTS

Greater Than Loans.

R. Reports Operations For Third Quarter.

Closed Banks Get $122,500,000 Of Since Formation 2.6 Billions.

Washington, November Reconstruction Corporation received more money repayments during the last three months than loaned to aid business and agriculture. summary of the corporation's report for the third quarter, ended September 30, disclosed today that it had disbursed and recelved repayments totaling $238, 186,400. that corporation had nearly half million dollars less outstanding than on June 30. From the time of its formation. 1932, the corporation has disbursed out authorizations totaling During third quarter corporation loaned banks and trust companies which assist reorganization or of closed banks.

Loans Are Iltemized.

Loans to building and loan associations insurance unions, $10,000; loan $20,663,842; joint stock land banks, credit corporations, $470,520; rediscounts for gional agricultural credit corporations, $30,015,863; Federal land banks, $5,000,000; credit corporations, $400,000, and railroads, Under the 1932 Emergency Relief Act, 19 loans aggregating under another section $53,880,543 loaned for nancial sales agricultural surpluses foreign markets and finance orderly marketing of agricultural commodities and stock. Advances banks on preferred stock during quarter totaled and subscriptions for preferred stock banks and trust companies, $19,337,500. The corporaalso purchased $500,000 of bank debentures.

Cotton Loan Listed.

In connection with the preferred stock purchases, was that since September 30 many millions dollars stocks and debentures either have been their purchase During the quarter Secretary Agriculture allowed $3,500,000 with which purchase cotton. The opening National Banks during first 10 days of Novemwas announced O'Connor have restored $16,084,in deposits. During same period six National Banks had their reorganization plans approved the Treasury, involving $2,825,000 in deposits. Comptroller reported that two banks reorganization plans been declared insolvent and appointed These the County Brookville, with deposits, and the City Bank of Central City, Neb., with $98,000 in deposits.