Article Text

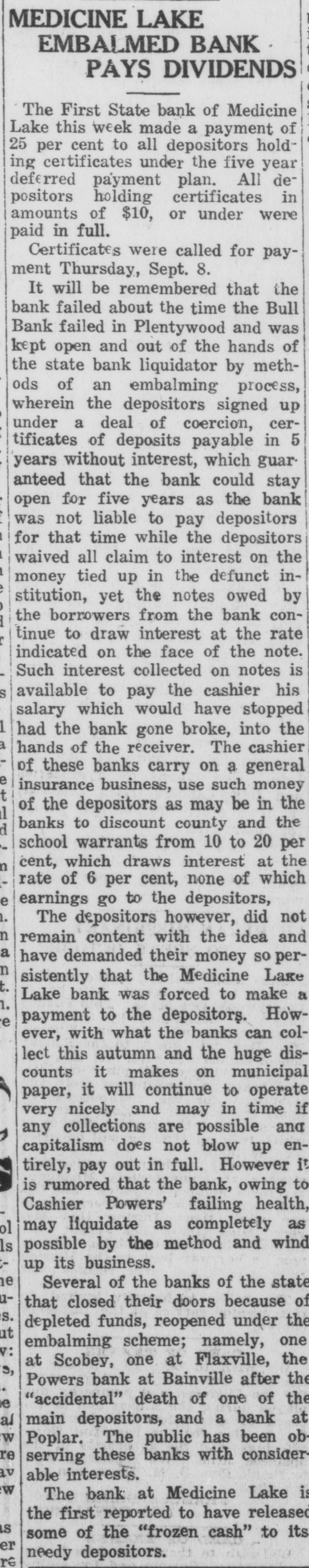

MEDICINE LAKE EMBALMED BANK PAYS DIVIDENDS The First State bank of Medicine Lake this week made a payment of 25 per cent to all depositors holding certificates under the five year deferred payment plan. All depositors holding certificates in amounts of $10, or under were paid in full. Certificates were called for payment Thursday, Sept. 8. It will be remembered that the bank failed about the time the Bull Bank failed in Plentywood and was kept open and out of the hands of the state bank liquidator by methods of an embalming process, wherein the depositors signed up under a deal of coercion, certificates of deposits payable in 5 years without interest, which guar anteed that the bank could stay open for five years as the bank was not liable to pay depositors for that time while the depositors waived all claim to interest on the money tied up in the defunct institution, yet the notes owed by the borrowers from the bank continue to draw interest at the rate indicated on the face of the note. Such interest collected on notes is S available to pay the cashier his salary which would have stopped had the bank gone broke, into the hands of the receiver. The cashier of these banks carry on a general e insurance business, use such money of the depositors as may be in the d school warrants from 10 to 20 per cent, which draws interest at the UNITED banks to discount county and the C rate of 6 per cent, none of which e earnings go to the depositors, The depositors however, did not n remain content with the idea and a have demanded their money SO pern sistently that the Medicine Lake Lake bank was forced to make a 1. payment to the depositors. Ho'we ever, with what the banks can collect this autumn and the huge discounts it makes on municipal paper, it will continue to operate very nicely and may in time if any collections are possible and capitalism does not blow up entirely, pay out in full. However it is rumored that the bank, owing to Cashier Powers' failing health, may liquidate as completely as ol Is possible by the method and wind up its business. e Several of the banks of the state -1 that closed their doors because of S. depleted funds, reopened under the ut embalming scheme; namely, one v: at Scobey, one at Flaxville, the 9, Powers bank at Bainville after the "accidental" death of one of the al main depositors, and a bank at W Poplar. The public has been ob re serving these banks with considerav able interests. W The bank at Medicine Lake is the first reported to have released is some of the "frozen cash" to its er needy depositors. re