Article Text

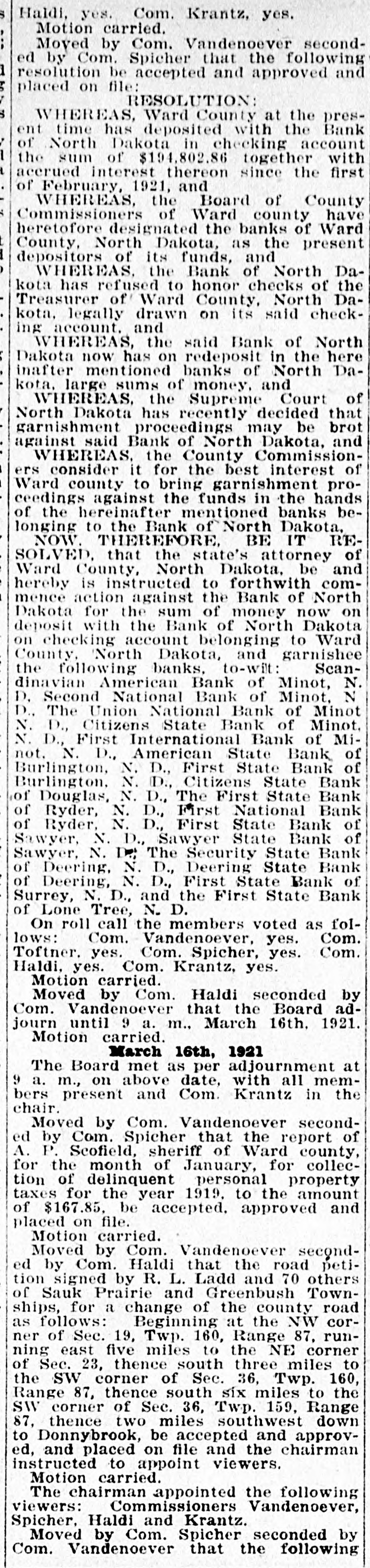

Hald, yes. com Motion carried. Moved by Com. Vandenoever seconded by Com. Spicher that the following resolution be accepted and approved and placed on file: RESOLUTION: WHEREAS, Ward County at the present time has deposited with the Bank of North Dakota in checking account the sum of $194,802.86 together with accrued interest thereon since the first of February, 1921, and WHEREAS, the Board of County Commissioners of Ward county have heretofore designated the banks of Ward County, North Dakota, as the present depositors of its funds, and WHEREAS, the Bank of North Dakota has refused to honor checks of the Treasurer of Ward County, North Dakota. legally drawn on its said checking account. and WHEREAS, the said Bank of North Dakota now has on redeposit in the here inafter mentioned banks of North Dakota, large sums of money, and WHEREAS, the Supreme Court of North Dakota has recently decided that garnishment proceedings may be brot against said Bank of North Dakota, and WHEREAS, the County Commissioners consider it for the best interest of Ward county to bring garnishment proceedings against the funds in the hands of the hereinafter mentioned banks belonging to the Bank of North Dakota. NOW. THEREFORE, BE IT RESOLVED. that the state's attorney of Ward County, North Dakota, be and hereby is instructed to forthwith commence action against the Bank of North Dakota for the sum of money now on deposit with the Bank of North Dakota on checking account belonging to Ward County, North Dakota, and garnishee the following banks. to-wilt: Scandinavian American Bank of Minot, N. D. Second National Bank of Minot. N D., The Union National Bank of Minot N. D., Citizens State Bank of Minot. N. D., First International Bank of Minot. N. D., American State Bank of Burlington, N. D., First State Bank of Burlington, N. D., Citizens State Bank of Douglas, N. D., The First State Bank of Ryder, N. D., First National Bank of Ryder, N. D., First State Bank of Sawyer, N. D., Sawyer State Bank of Sawyer, N. D. The Security State Bank of Deering, N. D., Deering State Bank of Deering, N. D., First State Bank of Surrey, N. D., and the First State Bank of Lone Tree, N. D. On roll call the members voted as follows: Com. Vandenoever, yes. Com. Toftner. yes. Com. Spicher, yes. Com. Haldi, yes. Com. Krantz, yes. Motion carried. Moved by Com. Haldi seconded by Com. Vandenoever that the Board adjourn until 9 a. m., March 16th. 1921. Motion carried. March 16th, 1921 The Board met as per adjournment at 9 a. m., on above date, with all members present and Com. Krantz in the chair. Moved by Com. Vandenoever seconded by Com. Spicher that the report of A. P. Scofield, sheriff of Ward county, for the month of January, for collection of delinquent personal property taxes for the year 1919. to the amount of $167.85. be accepted. approved and placed on file. Motion carried. Moved by Com. Vandenoever seconded by Com. Haldi that the road petition signed by R. L. Ladd and 70 others of Sauk Prairie and Greenbush Townships, for a change of the county road as follows: Beginning at the NW corner of Sec. 19, Twp. 160, Range 87, running east five miles to the NE corner of Sec. 23, thence south three miles to the SW corner of Sec. 36, Twp. 160, Range 87, thence south six miles to the SW corner of Sec. 36, Twp. 159, Range 87, thence two miles southwest down to Donnybrook, be accepted and approved, and placed on file and the chairman instructed to appoint viewers. Motion carried. The chairman appointed the following viewers: Commissioners Vandenoever, Spicher, Haldi and Krantz. Moved by Com. Spicher seconded by Com. Vandenoever that the following