Click image to open full size in new tab

Article Text

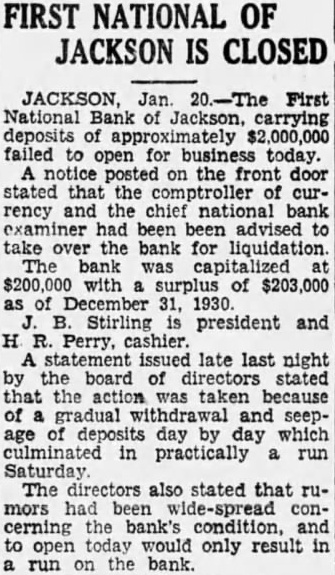

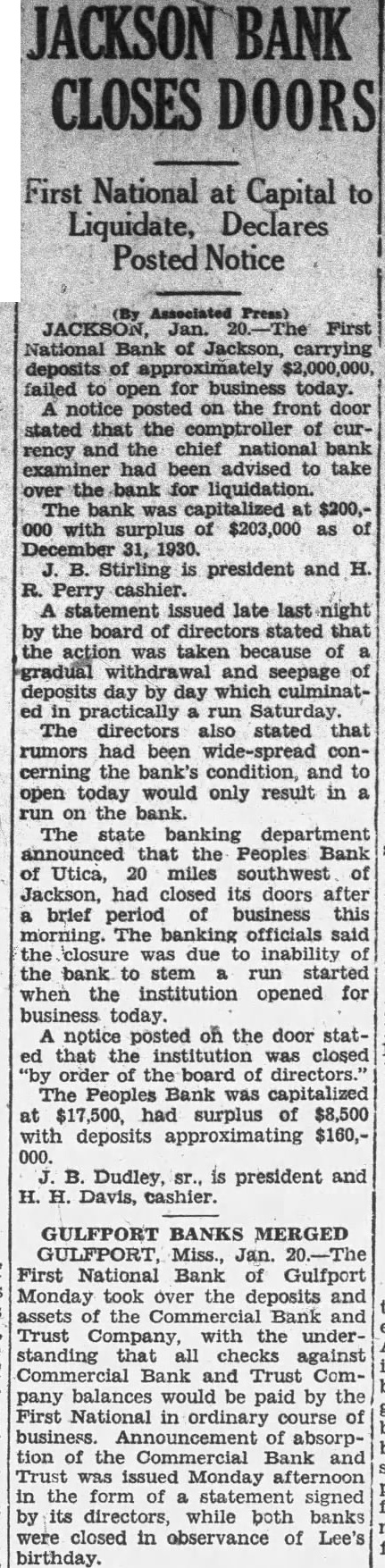

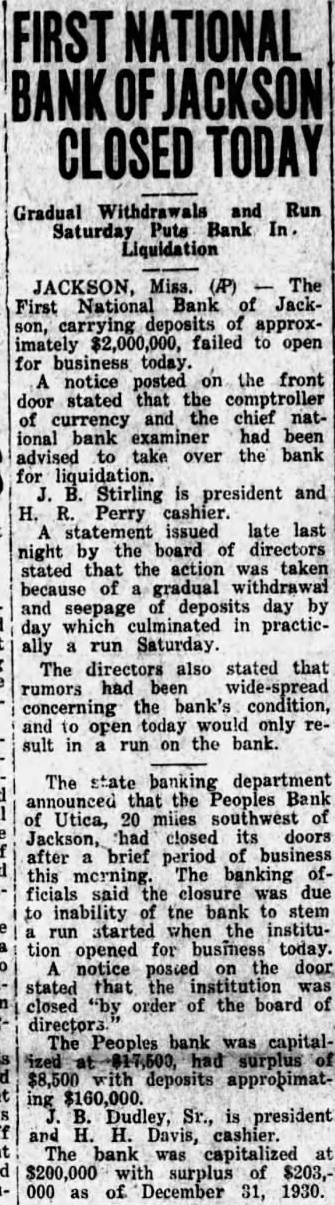

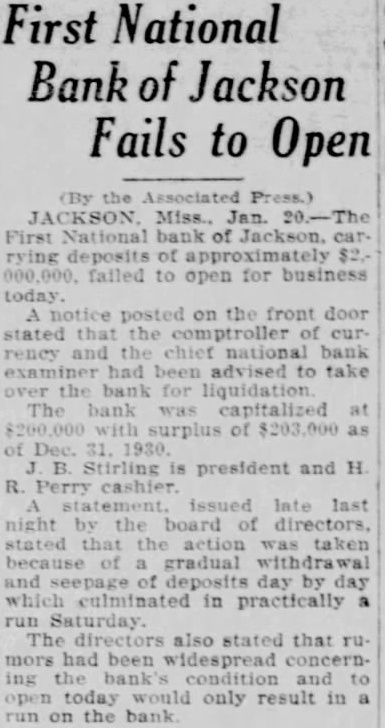

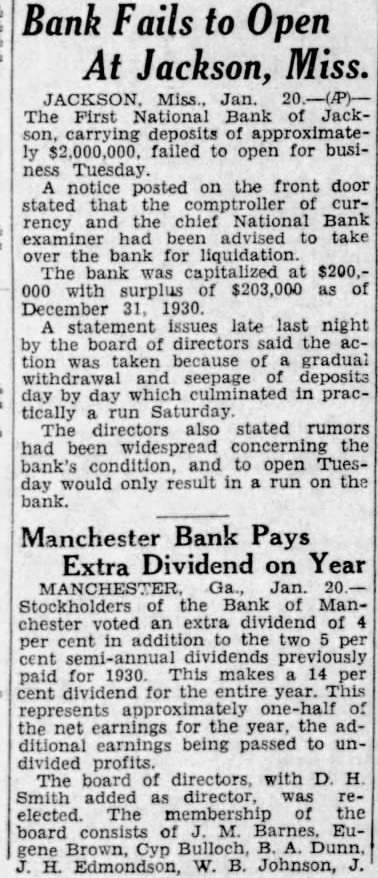

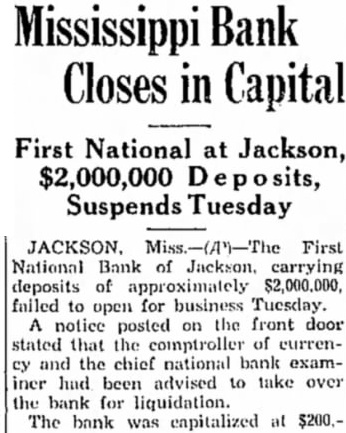

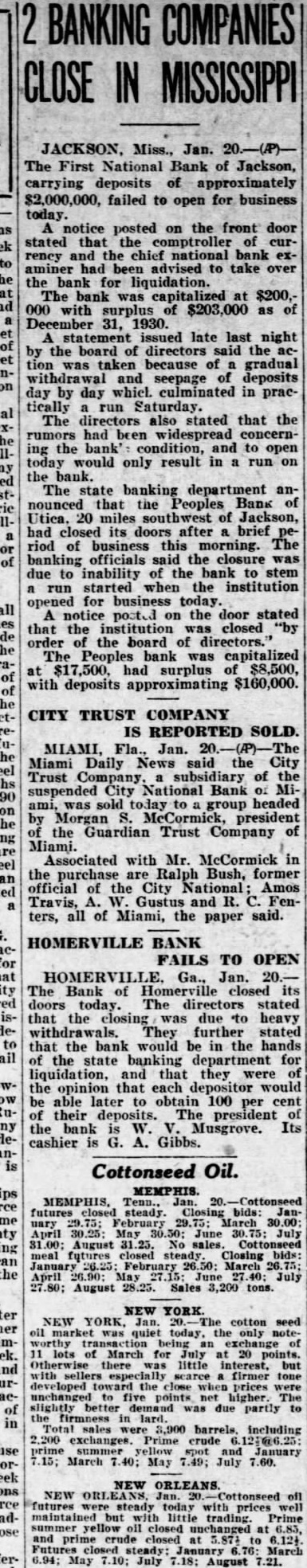

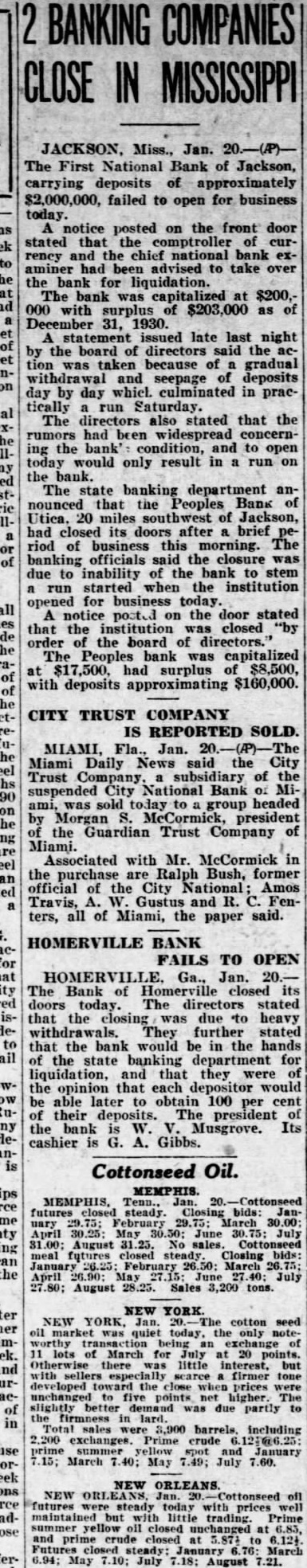

BANKING COMPANIES CLOSE IN MISSISSIPPI

JACKSON, Miss., Jan. The First National Bank of Jackson, carrying deposits of approximately $2,000,000, failed to open for business today. notice posted on the front door stated that the of currency and the chief national bank examiner had advised to take over the for The $200,000 surplus of $203,000 as of December 31, 1930. A statement issued late last night by the board of directors said the tion was taken because of gradual withdrawal and seepage of deposits day by which culminated in practically run The also stated that the rumors had ing the bank condition, and to open today would only result in run on the bank. The state banking department announced that the Peoples Bank of Utica. 20 miles southwest of had closed its doors after brief riod of business this The banking officials said the closure was due inability of the to stem a started the institution opened for business notice posted on the door stated that the institution closed "by order the board of directors. Peoples bank was at $17,500. had surplus of $8,500, with deposits approximating $160,000.

CITY TRUST COMPANY IS REPORTED SOLD. MIAMI, Fla. Jan. Miami Daily News the City Trust of the suspended City Bank or Miami, was sold today group headed Morgan S. president the Guardian Trust Company of Miami. Associated with Mr. McCormick in the purchase Bush, former official of the City National: Amos Travis, and R. C. Fenters, all of Miami, the paper said.

HOMERVILLE BANK FAILS TO OPEN

HOMERVILLE Ga., Jan. The Bank of its doors today. The directors stated that the closing was to heavy withdrawals. They further stated that the bank would be in the hands of the state banking department for liquidation, and that they the opinion that able later to obtain 100 per cent of their The president the bank W. Musgrove. Its cashier G. A. Gibbs.

Cottonseed Oil.

MEMPHIS. MEMPHIS, Tenn., -Cottonseed bids: February June August futures 27.80; August tons.

NEW YORK NEW YORK cotton seed exchange lots March for little but firmer the when prices were five was due firmness in including 2,200 exchanges. January March May 7.49;

NEW ORLEANS. NEW with little trading. yellow and prime closed at 6.94; May July August 7.21.