Article Text

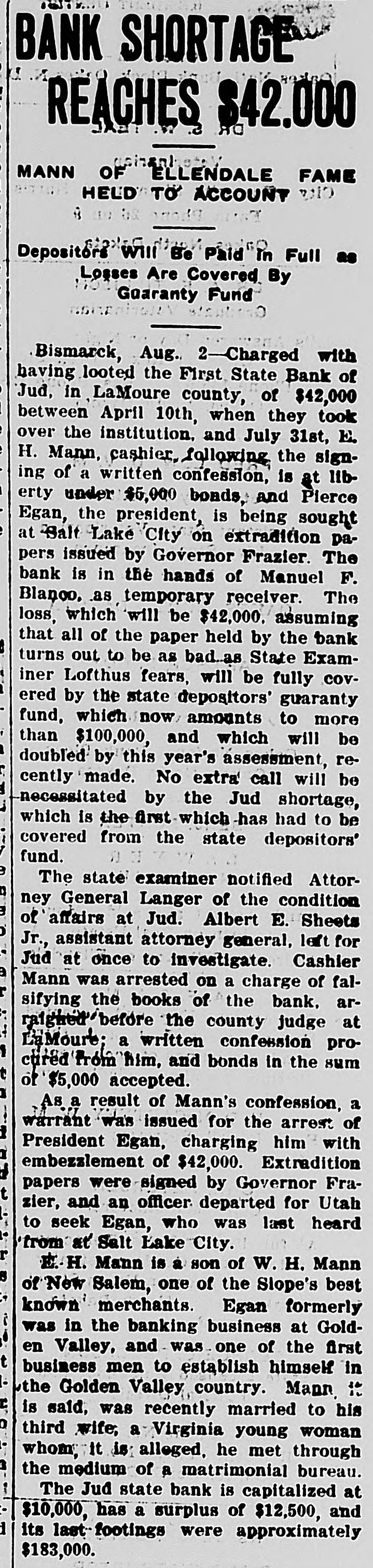

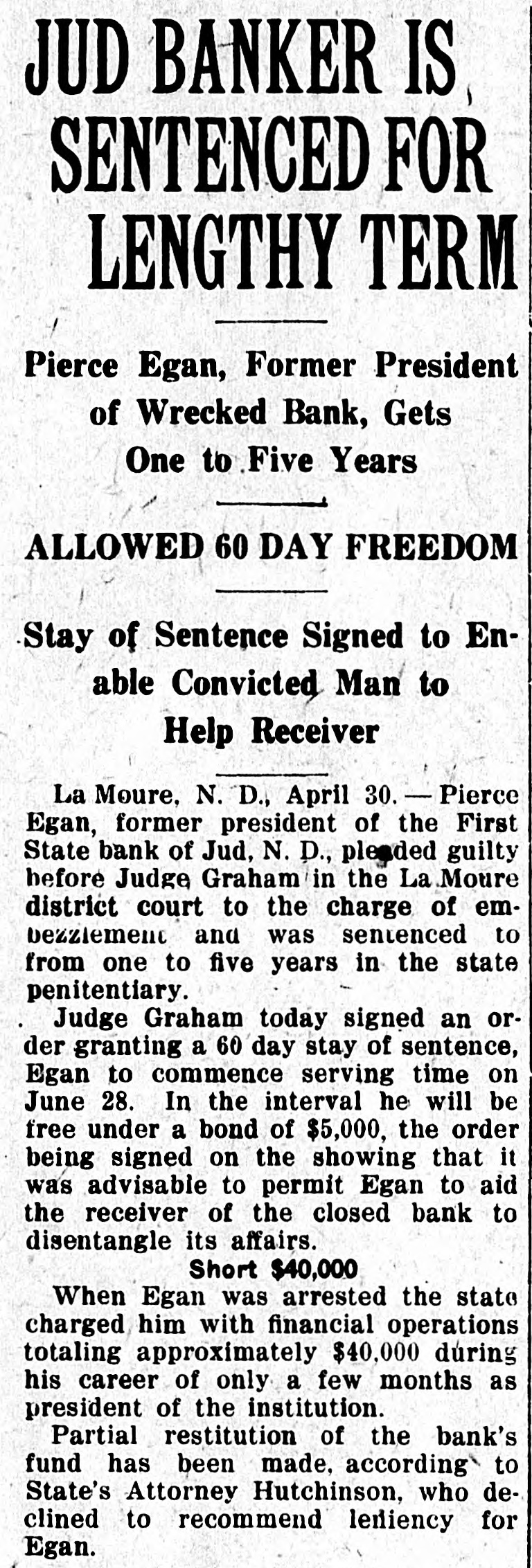

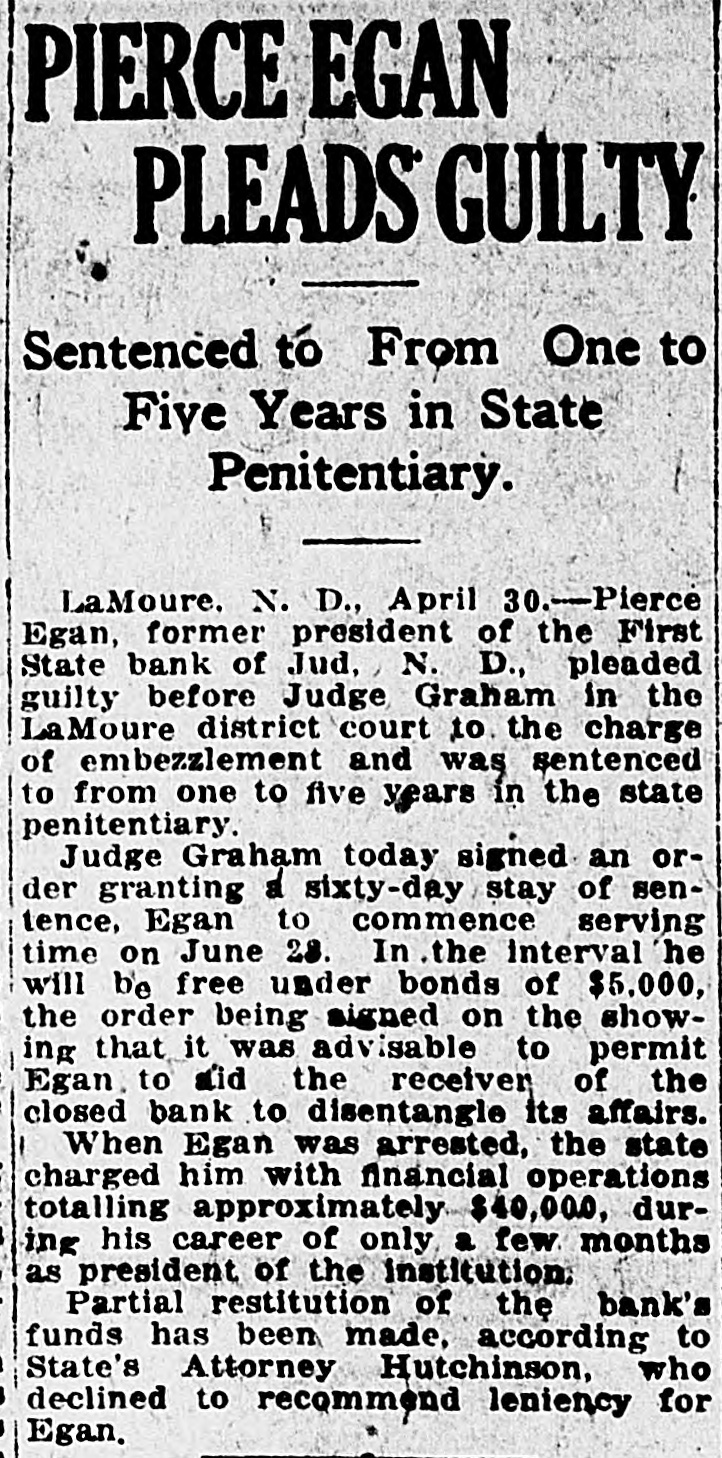

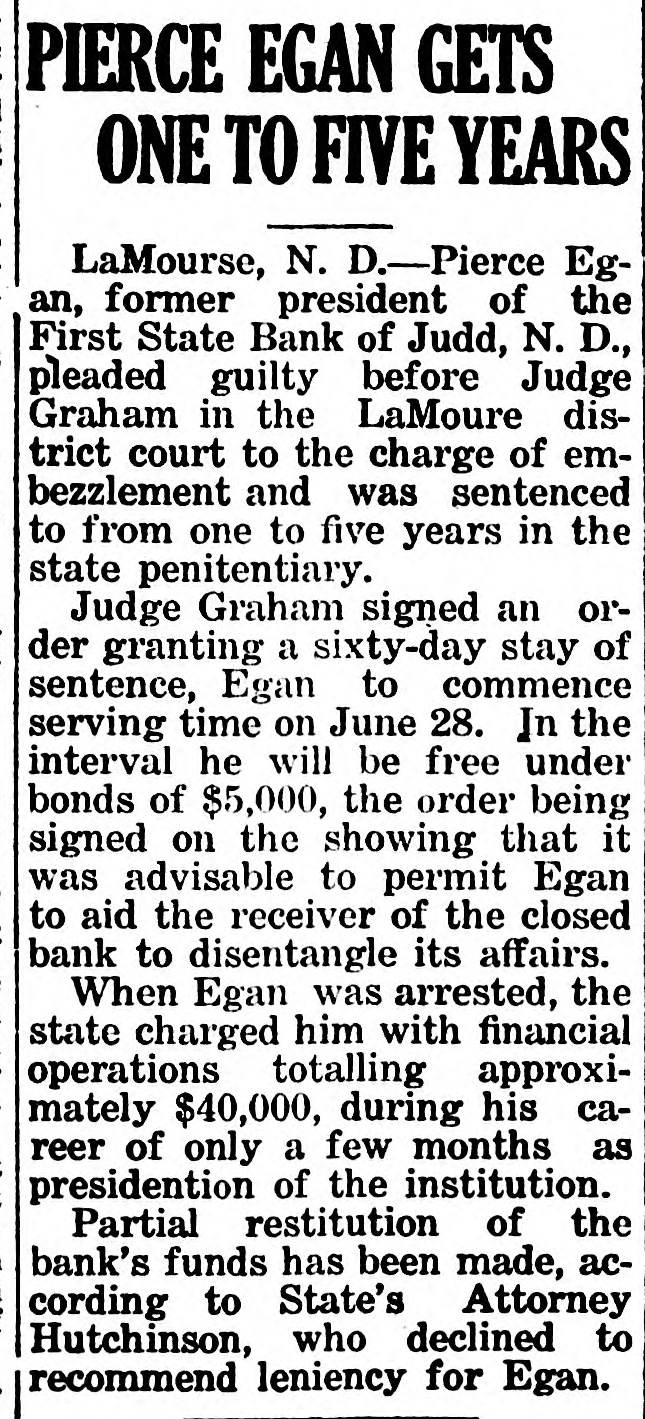

BANK SHORTAGE REACHES $42.000 MANN OF ELLENDALE FAME HELD TO ACCOUNT will Depositors Will Be Paid in Full Losses Are Covered By Gaaranty Fund Bismarck, Aug. 2-Charged with having looted the First State Bank of Jud, in LaMoure county, of $42,000 between April 10th, when they took over the institution. and July 31st, E. H. Mann, cashier, following the signing of a written confession, is at llberty under $5,000 bonds, and Pierce Egan, the president, is being sought at Salt Lake City on extradition papers issued by Governor Frazier. The bank is in the hands of Manuel F. Blanco, as temporary receiver. The loss. which will be $42,000. assuming that all of the paper held by the bank turns out to be as bad as State Examiner Lofthus fears, will be fully covered by the state depositors' guaranty fund, which now amounts to more than $100,000, and which will be doubled by this year's assessment, recently made. No extra call will be necessitated by the Jud shortage, which is the first which has had to be covered from the state depositors' fund. The state examiner notified Attorney General Langer of the condition of affairs at Jud. Albert E. Sheets Jr., assistant attorney general, left for Jud at once to investigate. Cashier Mann was arrested on a charge of falsifying the books of the bank, arraighted before the county judge at LaMoure a written confession procured from him, and bonds in the sum of $5,000 accepted. As a result of Mann's confession, a warrant was issued for the arrest of President Egan, charging him with embezzlement of $42,000. Extradition papers were signed by Governor Frazier, and an officer departed for Utah to seek Egan, who was last heard from at Salt Lake City. E. H. Mann is a son of W. H. Mann of New Salem, one of the Slope's best known merchants. Egan formerly was in the banking business at Golden Valley, and was one of the first business men to establish himself in the Golden Valley country. Mann it is said, was recently married to his 0 third wife, a Virginia young woman whom it is alleged. he met through the medium of a matrimonial bureau. The Jud state bank is capitalized at $10,000, has a surplus of $12,500, and its last-footings were approximately $183,000.