Article Text

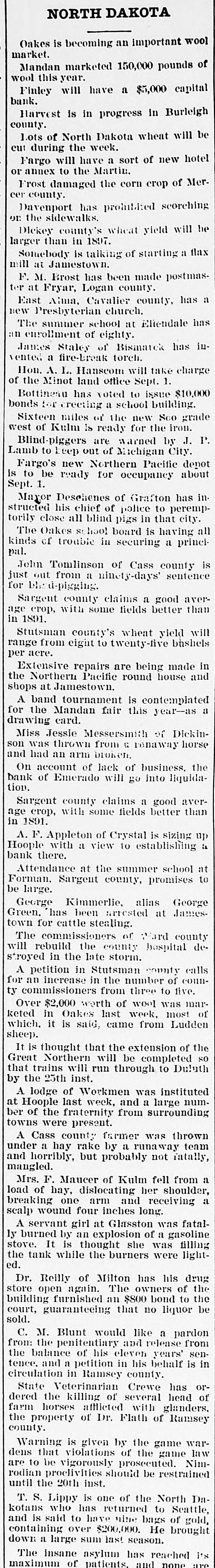

NORTH DAKOTA Oakes is becoming an important wool market. Mandan marketed 150,000 pounds of wool this year. Finley will have a $5,000 capital bank. Harvest is in progress in Burleigh county. Lots of North Dakota wheat will be cut during the week. Fargo will have a sort of new hotel or annex to the Martin. Frost damaged the corn crop of Mercounty. Davenport has promitited scorching or the sidewalks. Dickey county's wheat yield will be larger than in 1897. Somebody is talking of starting a flax mill at Jamestown. F. M. Brost has been made postmaster at Fryar, Logan county. East Alma, Cavalier county, has a new Presbyterian church. The summer school at Eliendale has an enrollment of eighty. James Staley of Bismatck has invented a fire-break torch. Hon. A. L. Hanscom will take charge of the Minot land office Sept. 1. Bottinenu has voted to issue $10,000 bonds for creeting a school building. Sixteen miles of the new Sco grade west of Kulm is ready for the iron. Blind-piggers are warned by J. P. Lamb to keep out of Michigan City. Fargo's new Northern Pacific denot is to be ready for occupancy about Sept. 1. Mayor Deschenes of Grafton has instructed his chief of police to peremptorily close all blind pigs in that city. The Oakes school board is having all kinds of trouble in securing a principal. John Tomlinson of Cass county is just out from a ninety-days' sentence for bhe d-pigging. Sargent county claims a good average crop, with some fields better than in 1891. Stutsman county's wheat yield will range from eight to twenty-five bhshels per acre. Extensive repairs are being made in the Northern Pacific round house and shops at Jamestown. A band tournament is contemplated for the Mandan fair this year-as a drawing card. Miss Jessie Messersmith of Dickinson was thrown from G renaway horse and had an arm broken. On account of lack of business, the bank of Emerado will go into liquidation. Sargent county claims a good average crop, with some fields better than in 1891. A. F. Appleton of Crystal is sizing up Hoople with a view to establishing is bank there. Attendance at the summer school at Forman. Sargent county, promises to be large. George Kimmerlie, alias George Green, has been arrested at Jamestown for cattle stealing. The commissioners of ;Yard county will rebuild the county hospital destroyed in the late storm. A petition in Stutsman county calls for an increase in the number of county commissioners from three worth of wool Oakes last of keted Over in $2,000 week, was to most live. marwhich, it is said, came from Ludden sheep. It is thought that the extension of the will be will run Dubuth that Great trains Northern through completed to SO by the 25th inst. A lodge of Workmen was at last week, and a Hoople of the large instituted number fraternity from surrounding were county farmer was towns under A Cass hay present. thrown a rake by a but probably not and mangled. horribly, runaway ratally, team Mrs. F. Maucer of Kulm fell from a her one arm and load breaking of hay, dislocating receiving shoulder, a scalp wound four inches long. servant girl at Glasston was ly by an explosion of a A burned It is gasoline fatalthought she was while the burners were ed. stove. the tank filling lightDr. Reilly of Milton has his open again. The owners store building of drug the furnished an $800 bond to the sold. court, guaranteeing that no liquor be C. M. Blunt would like a pardon penitentiary and release of his eleven from: tence, the balance the and years' from sena petition in his behalf is in in Crewe killing of several of circulation dered State the Veterinarian Ramsey county. head has orfarm horses afflicted with glanders, the property of Dr. Flath of Ramsey county. Warning is given by the game wardens that violations of the game law are to be vigorously should be 20th rodian until the proclivities inst. prosecuted. restrained Nimis one of the North who has returned to and kotans T. S. is said Lippy Seattle, Dato have nine bags of gold, containing over $200,000. He a large sum last asylum has down The insane season. reached brought none maximum of patients, and its