Article Text

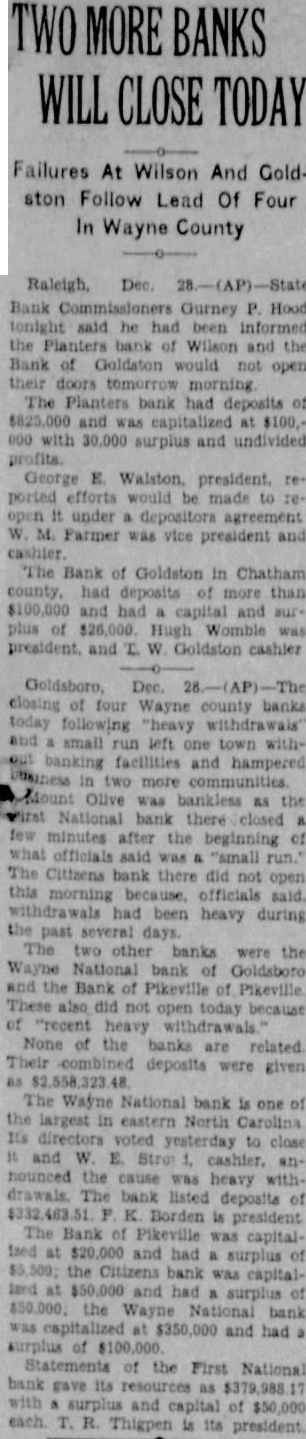

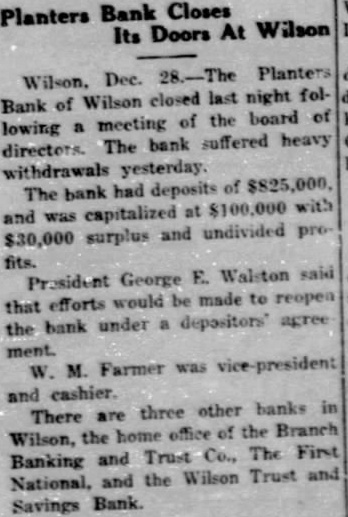

TWO MORE BANKS WILL CLOSE TODAY Failures At Wilson And Goldston Follow Lead Of Four In Wayne County Dec. Bank Commissioners Gurney P. Hood tonight said he had been informed the Planters bank of Wilson and the Bank of Goldston would not open their doors tomorrow morning The Planters bank had deposits of $825,000 and was capitalized $100,000 with 30,000 surplus and undivided George E. Walston president, ported efforts would be made to reopen it under depositors agreement W. M. Farmer was vice president and The Bank of Goldston in Chatham had deposits of more than $100,000 and had capital and surplus of $26,000. Hugh Womble was president. and T. W. Goldston cashier Dec. closing of four Wayne county banks today following "heavy withdrawals and small left one town withrun banking facilities and hampered jusiness in two more communities Mount Olive was bankless as the First National bank there closed a few minutes after the of beginning what officials was "small run.' The Citizens bank there did not open withdrawals had been heavy during the past several The other banks were the Wayne National bank of Goldsboro and the Bank of Pikeville of Pikeville These also not open today because of "recent heavy withdrawals. None of the banks are related Their deposits were given as The Wayne is of National bank one the largest in eastern North Carolina Its directors yesterday to close and W. E. announced the cause was heavy withThe bank listed deposits of K. Borden is president The Bank of was capitalat $20,000 and had surplus of the Citizens bank was capitalland at and had surplus of the Wayne National bank was $350,000 and had surplus of Statements of the First National bank gave its as with and capital of $50,000 each. T. Thigpen is its president