Article Text

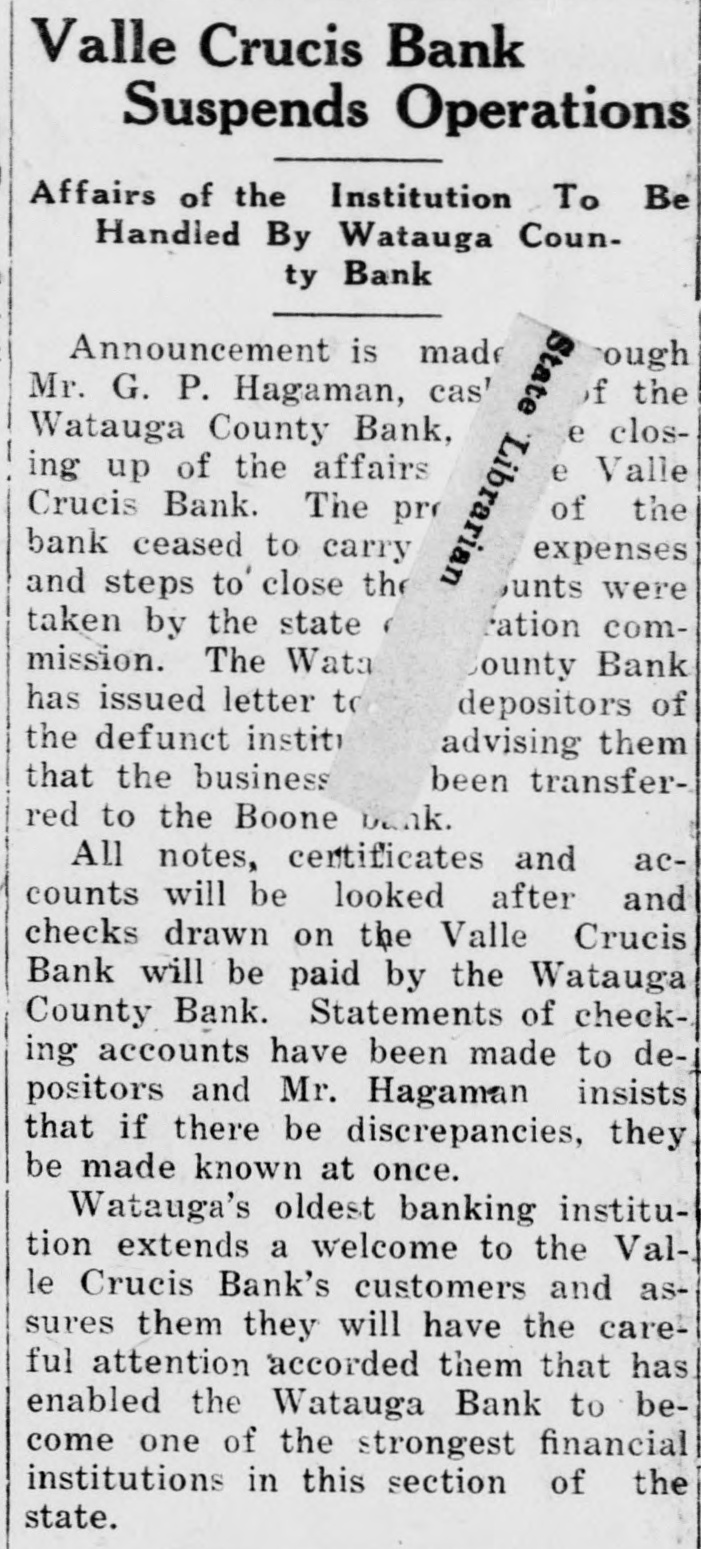

Valle Crucis Bank Suspends Operations Affairs of the Institution To Be Handled By Watauga County Bank Announcement is made rough f the Mr. G. P. Hagaman, cas' e closWatauga County Bank, e Valle ing up of the affairs of the Crucis Bank. The prr bank ceased to carry expenses unts were and steps to' close the , ation comtaken by the state mission. The Wata County Bank has issued letter to depositors of the defunct institi advising them that the business been transferred to the Boone bank. All notes, certificates and accounts will be looked after and checks drawn on the Valle Crucis Bank will be paid by the Watauga County Bank. Statements of checking accounts have been made to depositors and Mr. Hagaman insists that if there be discrepancies, they be made known at once. Watauga's oldest banking institution extends a welcome to the Valle Crucis Bank's customers and assures them they will have the careful attention accorded them that has enabled the Watauga Bank to become one of the strongest financial institutions in this section of the state.