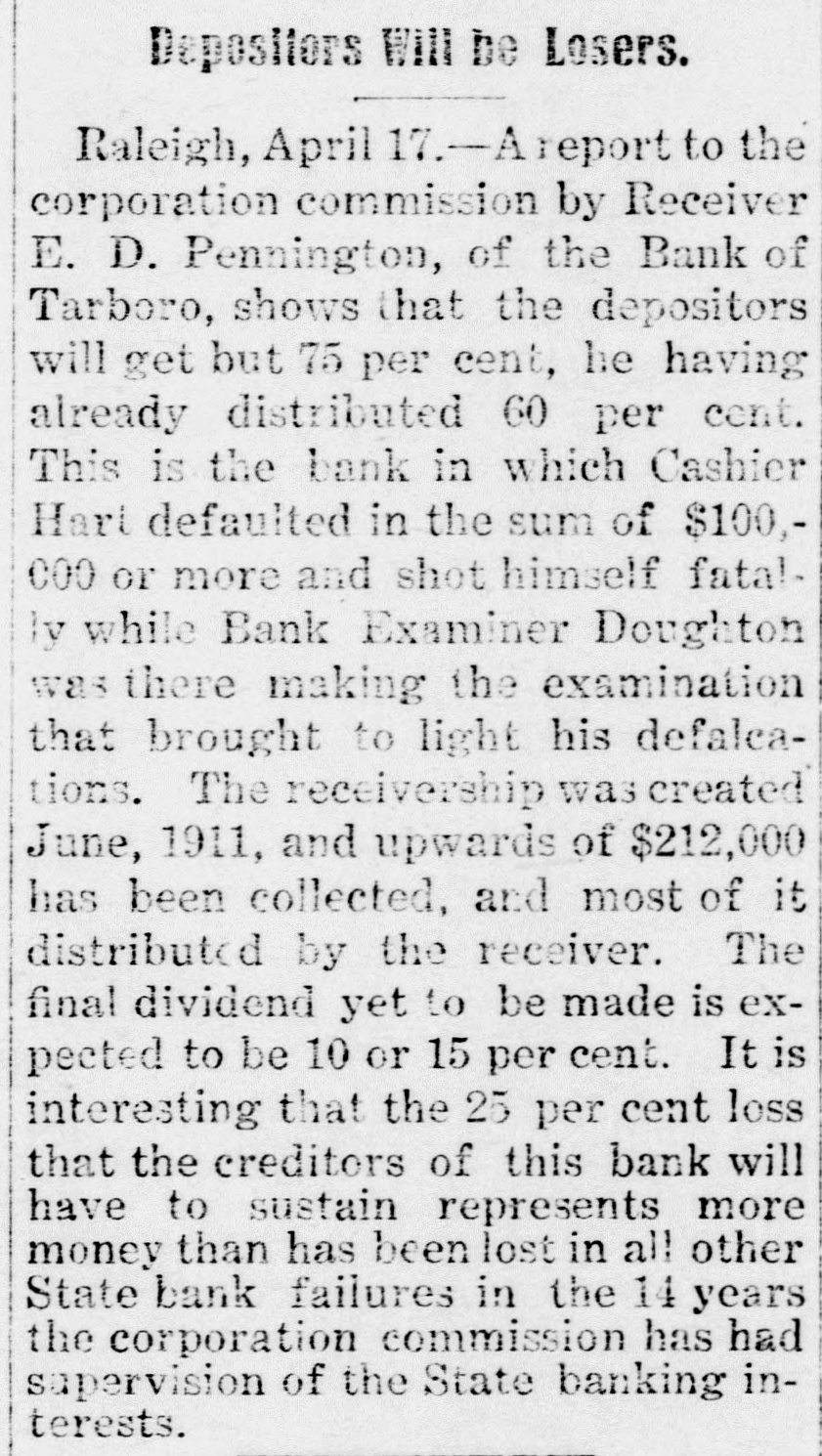

Article Text

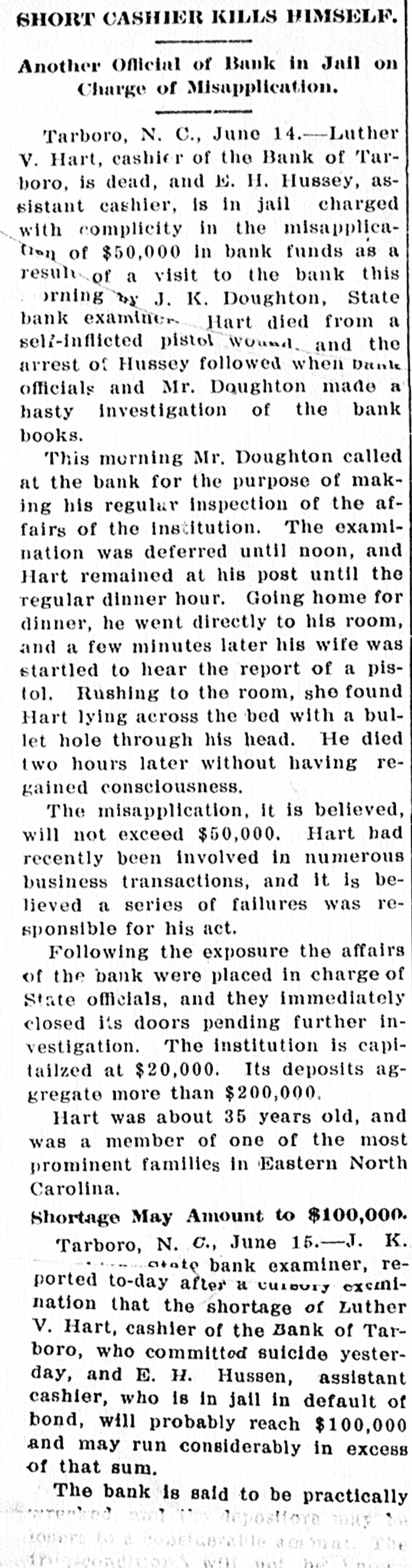

SHORT CASHIER KILLS HIMSELF. Another Official of Bank in Jail on Charge of Misapplication. Tarboro, N. C., June 14.-Luther V. Hart, cashier of the Bank of Tarboro, is dead, and E. H. Hussey, assistant cashier, is in jail charged with complicity in the misapplica(101) of $50,000 in bank funds as a result of a visit to the bank this orning by J. K. Doughton, State bank examiner Hart died from a self-inflicted pistol Wound and the arrest of Hussey followed when Dank officials and Mr. Doughton made a hasty investigation of the bank books. This morning Mr. Doughton called at the bank for the purpose of making his regular inspection of the affairs of the institution. The examination was deferred until noon, and Hart remained at his post until the regular dinner hour. Going home for dinner, he went directly to his room, and a few minutes later his wife was startled to hear the report of a pistol. Rushing to the room, she found Hart lying across the bed with a bullet hole through his head. He died two hours later without having regained consciousness. The misapplication, it is believed, will not exceed $50,000. Hart had recently been involved in numerous business transactions, and it is believed a series of failures was responsible for his act. Following the exposure the affairs of the bank were placed in charge of State officials, and they immediately closed its doors pending further investigation. The institution is capitailzed at $20,000. Its deposits aggregate more than $200,000. Hart was about 35 years old, and was a member of one of the most prominent families in Eastern North Carolina. Shortage May Amount to $100,000. Tarboro, N. C., June 15.-J. K. atate bank examiner, reported to-day after a Cursury exemination that the shortage of Luther V. Hart, cashier of the Bank of Tarboro, who committed suicide yesterday, and E. H. Hussen, assistant cashier, who is in jail in default of bond, will probably reach $100,000 and may run considerably in excess of that sum. The bank is said to be practically NO will