Article Text

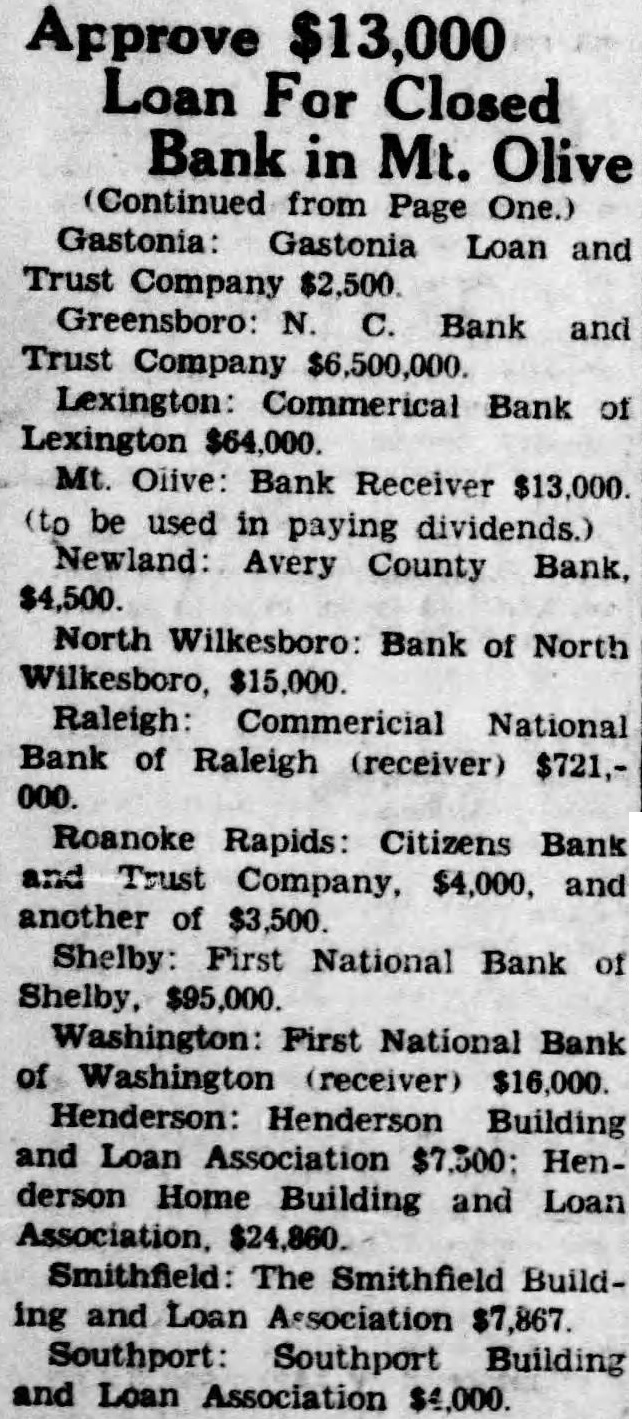

Approve $13,000 Loan For Closed Bank in Mt. Olive (Continued from Page One.) Gastonia: Gastonia Loan and Trust Company $2,500 Greensboro: Bank and Trust Company $6,500,000. Lexington: Commerical Bank Lexington $64,000. Mt. Bank Receiver (to be used in paying dividends.) Newland: Avery County Bank, $4,500. North Wilkesboro: Bank of North Commericial National Bank of Raleigh (receiver) $721,000. Roanoke Rapids: Citizens Bank and Trust Company, $4,000, and another of $3,500 Shelby: First National Bank of Shelby, $95,000. Washington: First National Bank of Washington (receiver) $16,000. Henderson: Henderson Building and Loan Association $7,500: Henderson Home Building and Loan Smithfield: The Smithfield Building and Loan Association Southport Southport Building and Loan Association