Article Text

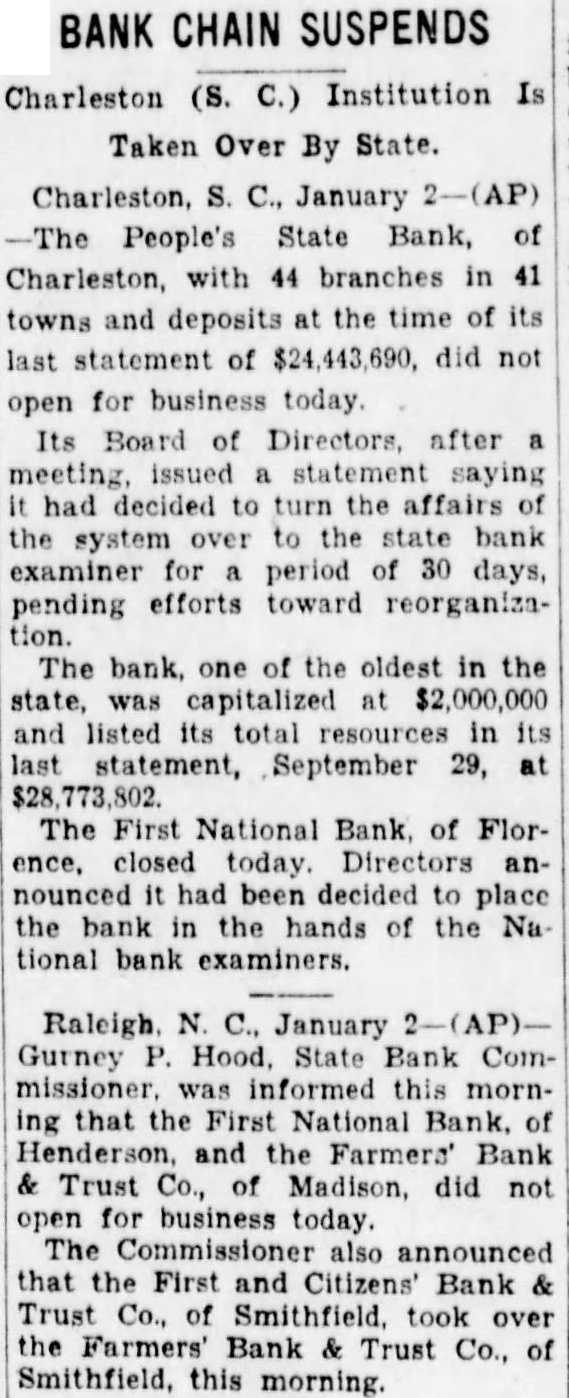

BANK CHAIN SUSPENDS Charleston (S. C.) Institution Is Taken Over By State. Charleston, S. C., January -(AP) People's State Bank, of Charleston, with 44 branches in 41 towns and deposits at the time of its last statement of $24,443,690, did not open for business today Its Board of Directors after it had decided to turn the affairs the system over to the state bank examiner for period of 30 days, pending efforts toward reorganizaThe bank, of the oldest in the state, was capitalized at $2,000,000 and listed its total in its last statement, September 29, at $28,773,802. The First National Bank. of Florence. closed today. Directors announced had been decided to place the bank in the hands of the Na tional bank examiners. Raleigh N. C., January Gurney Hood. State Bank Commissioner was informed this morning that the First National Bank. of and the Farmers' Bank & Trust Co., of Madison, did not open for business today. The Commissioner also announced that the First and Citizens' Bank & Trust Co., of Smithfield took over the Farmers' Bank Trust Co., of Smithfield, this morning.