Click image to open full size in new tab

Article Text

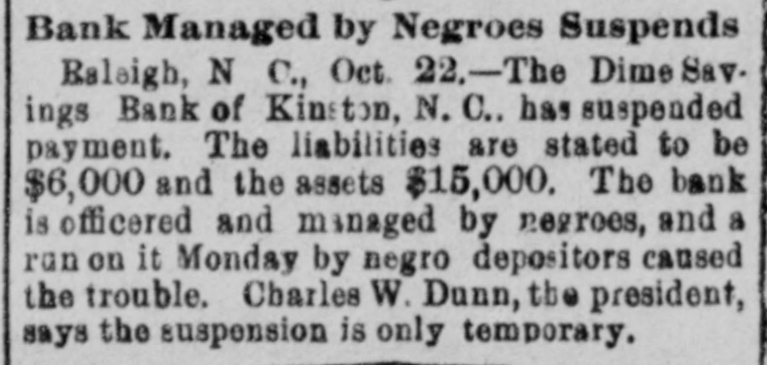

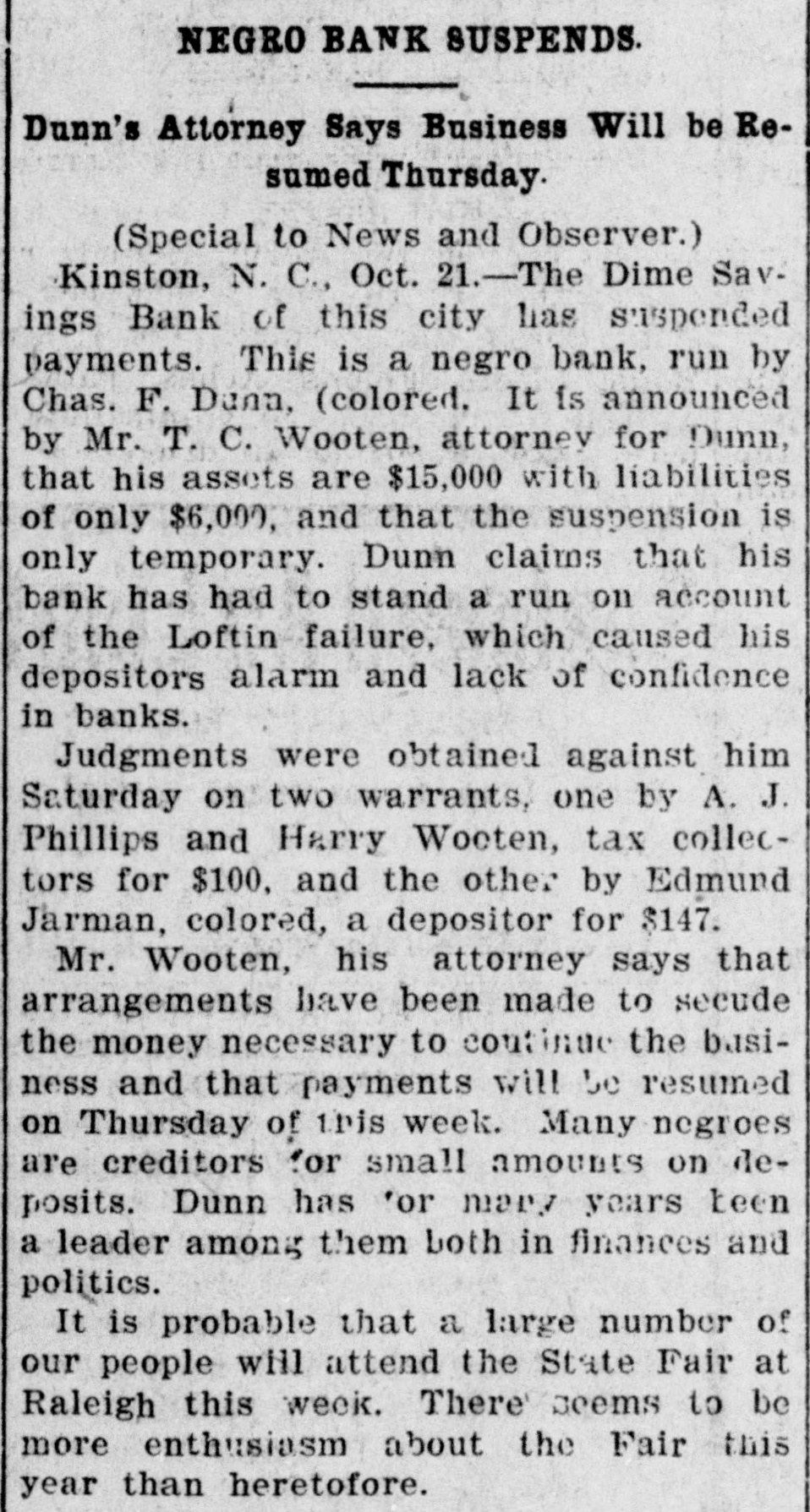

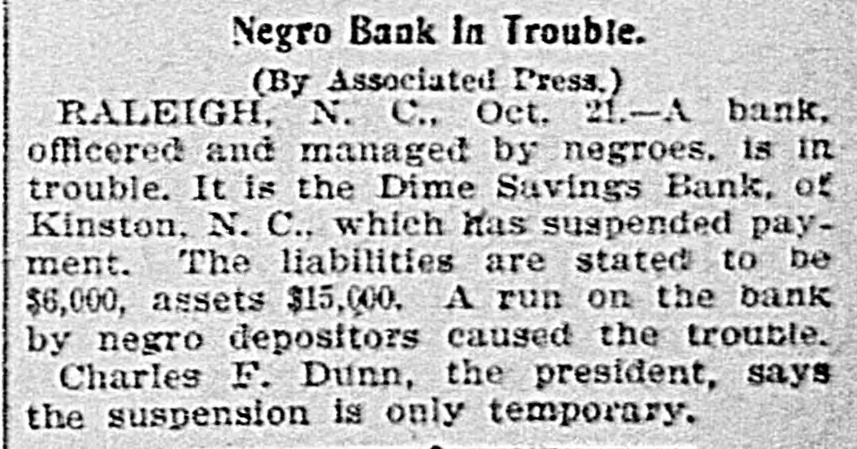

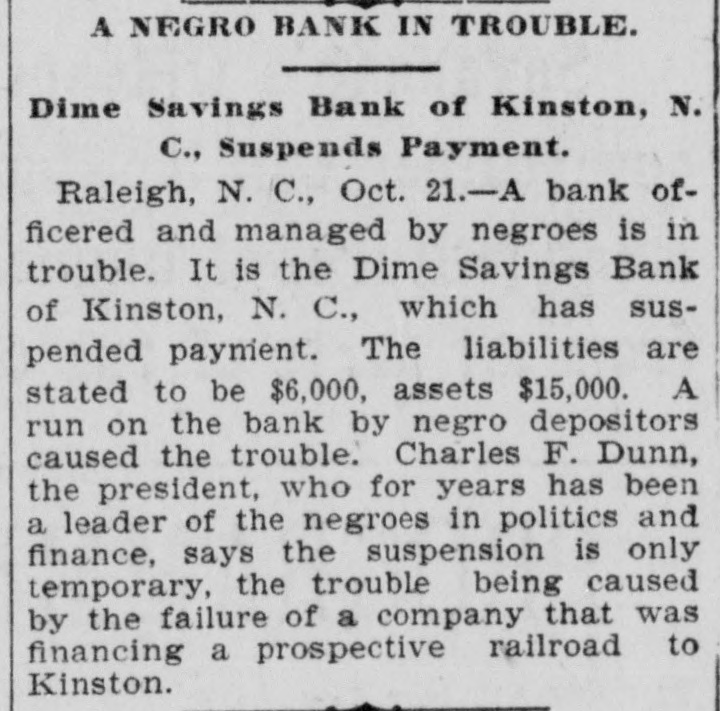

ANDERSON, S. C., WEDNESDAY, NOVEMBER 6, 1901. - The United States naval board GENERAL NEWS. FROM THE NATION'S CAPITAI of construction has recommended the construction of forty naval vessels of - Mrs. Roosevelt is a good houseall classes in addition to the four warFrom Our Own Correspondent. keeper and says she can dress well on ships authorized by last congress. $300 a year. - A party of native soldiers under WASHINGTON, D. C., Nov. 4, 1901. - Arrests for drunkenness in 129 the Britith flag were sent to quell a The Schley case is ended except f oities in the United States are said to riot in the back country of Africa and the arguments of the opposing couns aggregate. during the last fiscal they were killed and roasted by the and the decision of the Court. Whet year. natives who ate them up with great er the lacter will acquit Schley on a - In the year ending June 30, relish. counts or will criticise certain of h 1901, there was paid to railway emactions on the ground that they we - Rev. John Spurgeon, the father ployes in the United States $577,264,errors of judgment cannot be tol of the famous Charles Spurgeon, now 841 in wages. these being questions on which on dead, recently celebrated his 91st experts can pass. Whatever the Cou - A dispatch from Manila says may decide as to this, it is certain th birthday by laying the foundation that, notwithstanding the ports of the inquiry has shown conclusive stone of South Norwood church in Samar are closed, supplies still reach that the battle of Santiago was won Eugland. the insurgents. the Brooklyn and the Oregon excl sively and not by the American fle - On the race course at Morris - TIe government's grant of 34,000 For the past three years the officers Park last Wednesday one jockey and square miles to the Union Pacific the ships which were not in the tig three horses were killed. One horse Railway Co., is the largest ever made have held the center of the stage wh fell and broke his neck the first race, to any railroad company. those who were have kept silent; t and in the fifth race a jockey and two result has been an altogether false co - It is said that Cuban merchants horses were killed. ception of the battle; whether t are starting a campaign and circulatNavy Department has fostered tl - A twelve-year old boy in Moning petitions asking that Cuba be anmisconception for its own purpos nexed to the United States. tana kidnapped a child and demands does not matter. The actual facts o a ransom of $1,600, threatening to ram tained by cross examination and 1 - Milton H. Mory, cashier of the boiling down process show that 1 pieces of glass into the child's eyes National bank of Boyertown, Pa., h 18 Maria Teresa alone was destroyed and cut his hands off unless the dedisappeared with a large amount of the fleet; the other three vess mand is complied with. securities, and the institution has escaped and started to run. This T closed its doors. the upshot of Sampson's plan. TI - The governor of Indiana conSchley's plan came into operation a tinues to refuse to honor the requisi- The American Agriculturist esunder it, he and Oregon chased do tion of the Governor of Kentucky for timates the commercial crop of apples and destroyed the other three vess former Governor Taylor, who is charthis year at 23,000,000 barrels, against This is now an established fact and ged with complicity in the assassinaerrors of judgment, if any be found 48,000,000 last year and 70,000,000 in tion of Governor Goebel. the Court, can obscure it. 1896. President Roosevelt has explais - Caleb Powers has again been - Two female nurses in the insane his action in inviting Booker Washi convicted of being accessory to the asylum at Dunning, Ill., have been ton to dinner to several perso murder of Governor Goebel at Georgefriends, not as an explanation charged with causing the death of town, Ky. His sentence was fixed merely casually, in conversation. two patients by withholding food from says that he had no idea of the st at life imprisonment His attorneys thèm. of criticism that his action would p gave notice of an appeal. - Rev. B. A. Cherry, of Lebanon, voke; in fact, the subject never - A tramp was arrested in New curred to him as one calling for a c Tenn., has been deposed from the ment at all. This was by no means York city a few days ago who had ministry for setting fire to buildings first time on which he had eaten with in order to get insurance. Insanity is $2,000 in his pockets, all of which he negro. On the plains, in the mo said he made begging, and wasn't in suspected. tains, in his home and the Govern right good luck either. for some years - President Roosevelt has decided mansion in New York, he had as he made as much as $7,000. others to dine with him in a matte to appoint a Democrat to fill the vacourse way, not caring as to the c cancy on the bench in North Caro- Ismail Hudjo, said to have been of his guest's skin so long as other line caused by the death of Judge the oldest man in the world. died at he was all right. So on this occas Thomas Fuller. Khuti. Albania. It is said that he he wanted to talk to Professor Wa was 160 years old. His faculties were ington and invited him as the eas - Negroes are on the warpath about way of bringing about a quiet t unimpaired, and he had all his teeth Selma, Ala. There were twenty homiHe had no idea of raising the negr when he died. He leaves 200 decides in that vicinity in two weeks, all a race, or of making an issue be scendants. being negroes that were engaged in the country or anything of the k - A bank officered and managed by the deadly work. At the same time, Mr. Rooseve careful to state that if he had kn negroes is in trouble. It is the Dime - A bread war is on in Cincinnati. all that the invitation would b Savings Bank, of Kingston, N. C.. and a 15 ounce loaf for a cent is near forth, he should nevertheless have which has suspended payment. The at hand. Itis claimed that there is a vited Professor Washington. Th liabilities are stated to be about $6,000 profit for the large bakers at a cent the explanation, whether it cond assets $15,000. A run on the bank and a half a loaf. or aggravates the original offense, question for the consideration of by negro depositors caused the trouble. - The postmaster general in his South. annual report makes some suggestions - A negro was hung in FayetteThe failure of the last Republ for 3 radical change in the matter of ville on Saturday for sault, but it Congress to reduce taxes to a safe gree has again forced Secretary G subletting mail contracts and many seems that there was some question of to go into the market and offer to changes for the service. his guilt. He protested his innocence United States bonds before they - The balance of trade in favor of on the gallows and the priest who acdue at a heavy premium. This the United States as shown in a re. companied declared him an innocent involve a gift to the bond holder man as the trap fell. It was the most cent statment of the treasury departthe country of many million dolla dramatic execution ever witnessed in the aggregate, a bum which sh ment was $339,270,546 for the nine never have been taken from the p North Carolina. months ending September 30.