Article Text

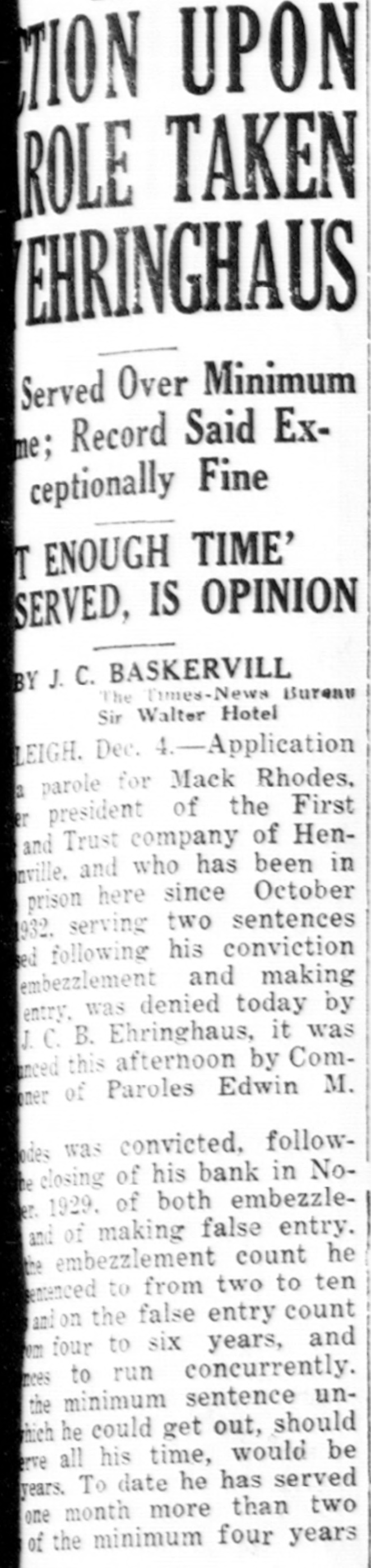

TION UPON ROLE TAKEN EHRINGHAUS Served Over Minimum me; Record Said Exceptionally Fine T ENOUGH TIME' SERVED, IS OPINION BY J. C. BASKERVILL The Times-News Bureau Sir Walter Hotel LEIGH. Dec. 4.-Application a parole for Mack Rhodes, er president of the First and Trust company of Hennville. and who has been in prison here since October 1932, serving two sentences ed following his conviction embezzlement and making entry. was denied today by J.C. B. Ehringhaus, it was funced this afternoon by ComOner of Paroles Edwin M. odes was convicted. followhe closing of his bank in Noer. 1929. of both embezzleand of making false entry. the embezzlement count he sentenced to from two to ten andon the false entry count om four to six years, and nces to run concurrently. the minimum sentence unhich he could get out, should erve all his time, would be years. To date he has served one month more than two of the minimum four years