Article Text

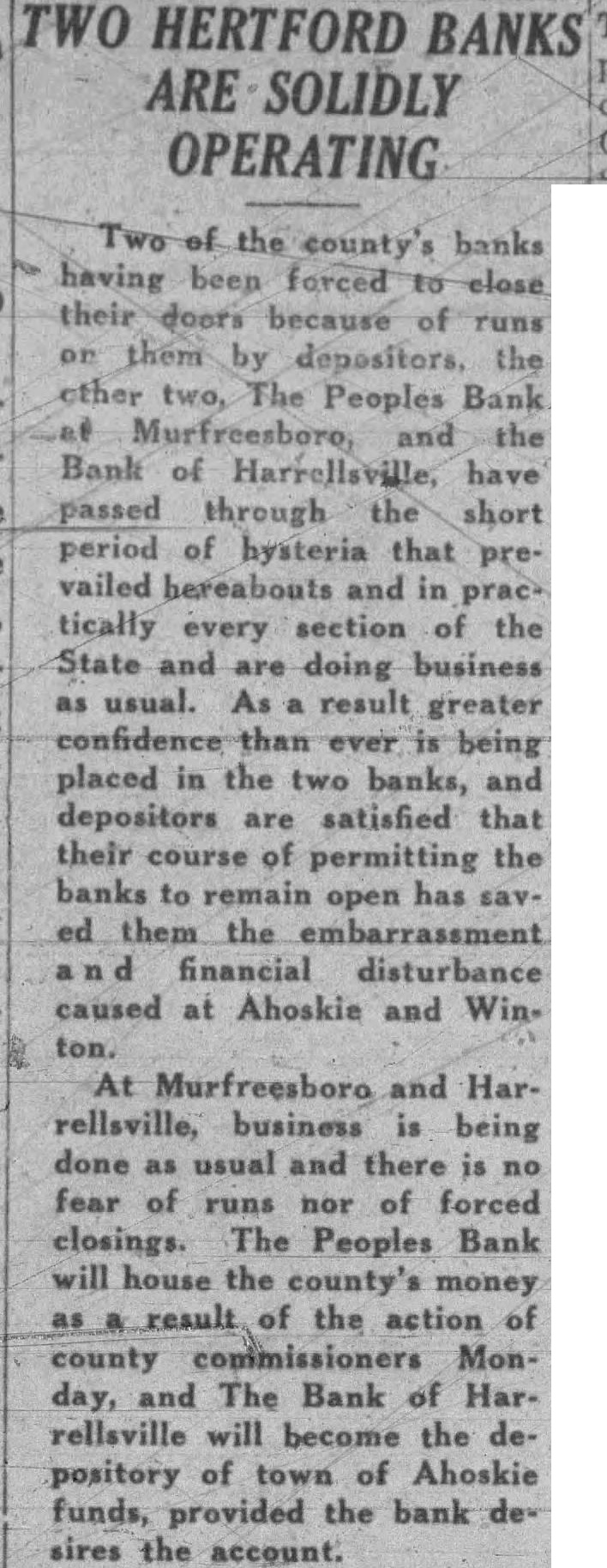

TWO HERTFORD BANKS ARE SOLIDLY OPERATING the county's banks having been forced close because them by depositors, the other two, The Peoples Bank Murfreesboro, the Bank of Harrellsville, have passed through the short period of hysteria that prevailed bereabouts and in practically every section of the and are doing business usual. As result greater ever is being placed in the two banks, and depositors satisfied that their course of permitting the banks to remain open has sav ed them the financial disturbance caused at Ahoskie and Winton. Murfreesboro and Harrellsville, business being done usual and there is fear of runs nor of forced closings. The Peoples Bank will house the county's money result of the action of county commissioners Monday, and The Bank of Harrellsville will become the depository of town of Ahoskie funds, provided the bank desires the account.