Article Text

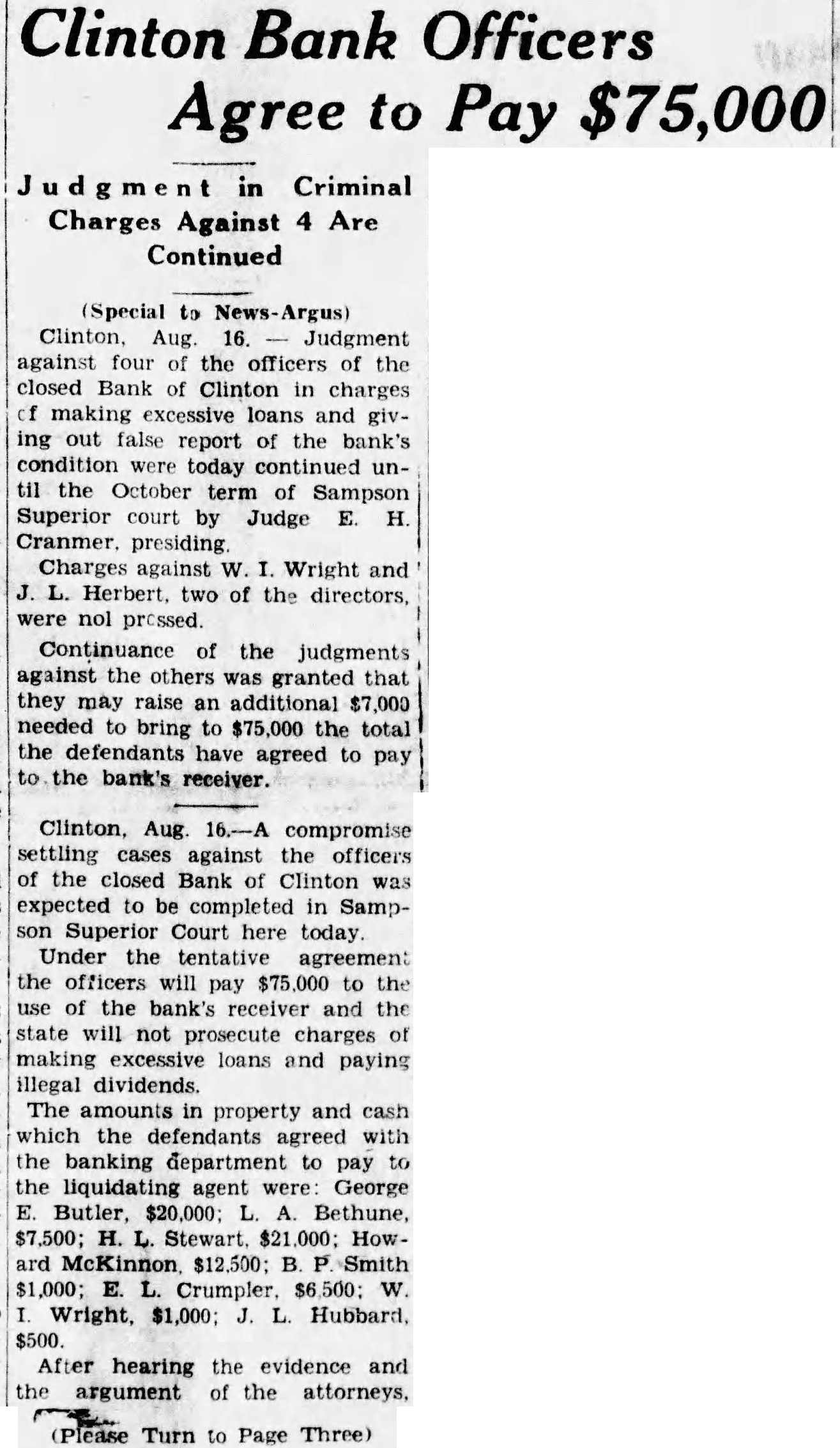

Clinton Bank Officers Agree to Pay in Criminal Charges Against Continued (Special to Aug. 16. Judgment against four of the officers of the closed Bank of Clinton in charges making excessive loans and giving out report of the bank's condition were today continued until the October term of Sampson Superior court by Judge H. Cranmer. Charges against Wright and Herbert. two of the directors, nol prossed. Continuance of the judgments against the others was granted that they may raise an additional needed to bring to $75,000 the total the defendants have agreed to pay the bank's receiver. Aug. compromise settling cases against the officers of the closed Bank of Clinton was expected to be completed in Sampson Superior Court here today. Under the tentative agreement the officers will pay to the use of the bank's receiver and the state will not prosecute charges of making excessive loans and paying illegal dividends. The amounts in property and cash which the defendants agreed with the banking department to pay to the liquidating agent were: George Butler, $20,000; Bethune, $7,500; H. L. Howard $12,500; B. Smith $1,000; E. Crumpler, W. $500. After hearing the evidence and the argument the Turn to Page Three)