Article Text

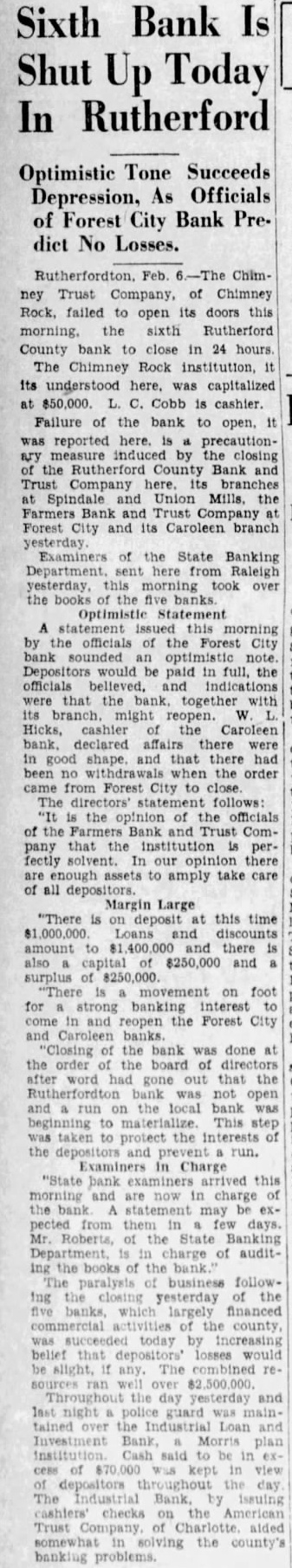

Sixth Bank Is Shut Up Today In Rutherford Optimistic Tone Succeeds Depression, As Officials of Forest City Bank Prediet No Losses. ney Trust Company, of Chimney Rock, failed to open its doors this morning, the sixth Rutherford County bank to close in 24 hours The Chimney Rock institution, it its understood here. was capitalized at $50,000. L. C. Cobb is cashier. Failure of the bank to open, It was reported here. is precautionary measure induced by the closing of the Rutherford County Bank and Trust Company here. its branches at Spindale and Union Mills. the Farmers Bank and Trust Company at Forest City and its Caroleen branch yesterday Examiners of the State Banking Department. sent here from Raleigh yesterday, this morning took over the books of the five banks. Optimistic Statement A statement issued this morning by the officials of the Forest City bank sounded an optimistic note. Depositors would be paid in full, the officials believed. and indications were that the bank, together with its branch. might reopen. W. Hicks, cashier the Caroleen bank. declared affairs there were in good shape, and that there had been no withdrawals when the order came from Forest City to close The directors' statement follows: "It is the opinion of the officials of the Farmers Bank and Trust Company that the institution is perfectly solvent. In our opinion there are enough assets to amply take care of all depositors. Margin Large "There is on deposit at this time $1,000,000 Loans and discounts amount to $1,400,000 and there is also capital of $250,000 and a surplus of $250,000. "There is movement on foot for strong banking interest to come in and reopen the Forest City and Caroleen banks "Closing of the bank was done at the order of the board of directors after word had gone out that the Rutherfordton bank was not open and run on the local bank was beginning to materialize This step was taken to protect the interests of the depositors and prevent run. Examiners in Charge "State bank examiners arrived this morning and are now in charge of the bank statement may be expected from them in few days. Mr. Roberts, of the State Banking Department, is in charge of auditing the books of the bank. The paralysis of business following the closing yesterday of the five banks, which largely financed commercial activities of the county, was succeeded today by increasing belief that depositors' losses would be alight. any. The combined resources ran well over 82 500 Throughout the day yesterday and last night police guard was maintained over the Industrial Loan and Investment Bank, Morris plan institution. Cash said to be in excess of $70,000 was kept in view of depositors throughout the day The Industrial Bank. by issuing cashiers' checks on the American Trust Company of Charlotte aided somewhat in solving the county's banking problems.