Click image to open full size in new tab

Article Text

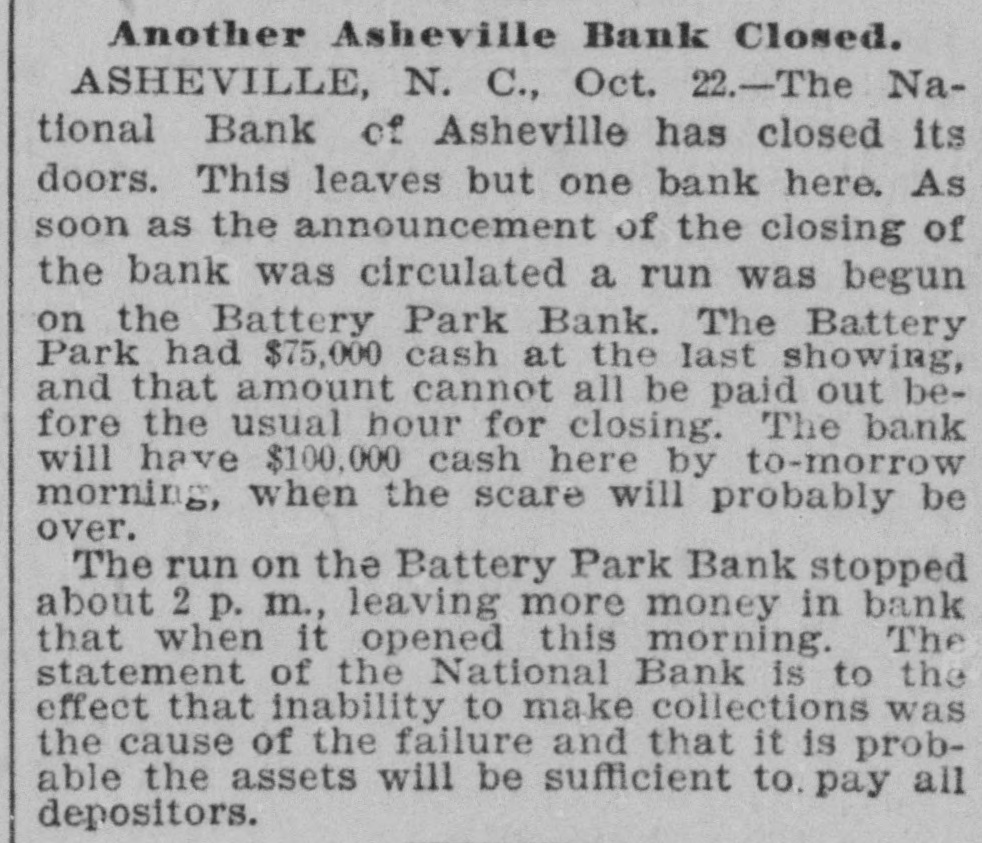

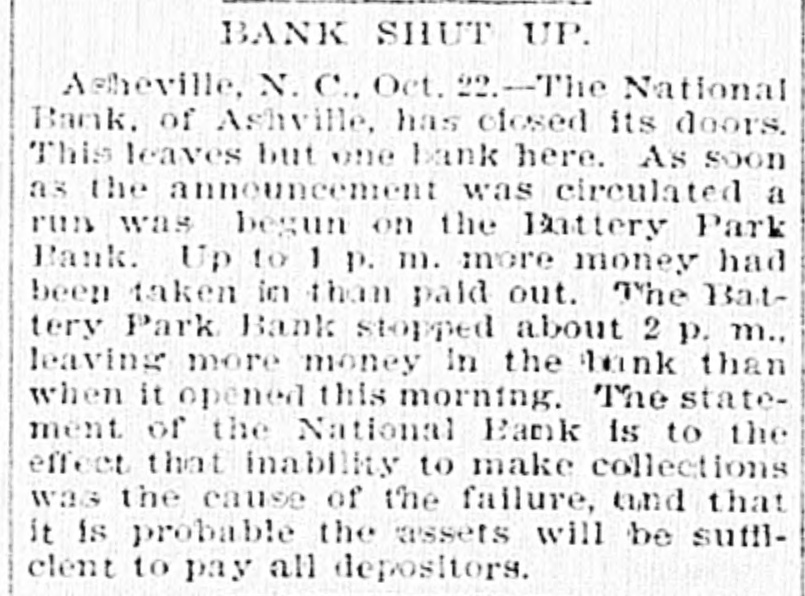

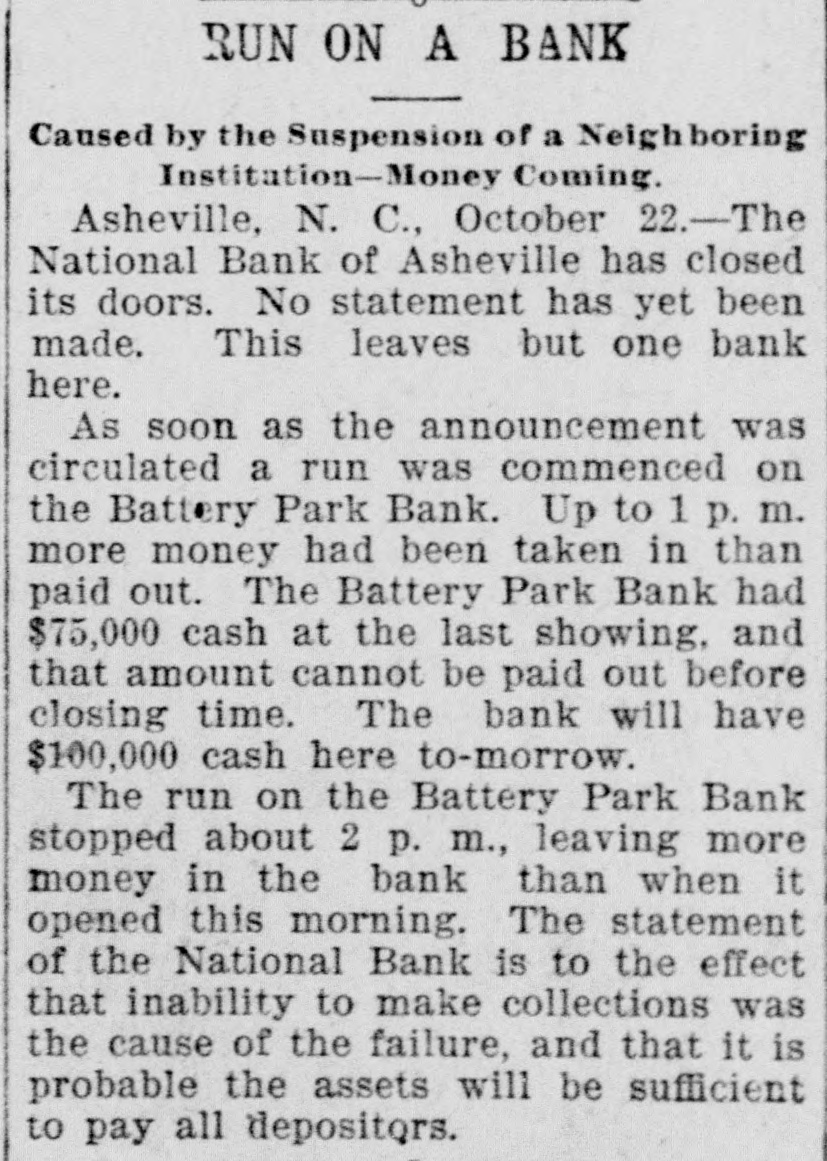

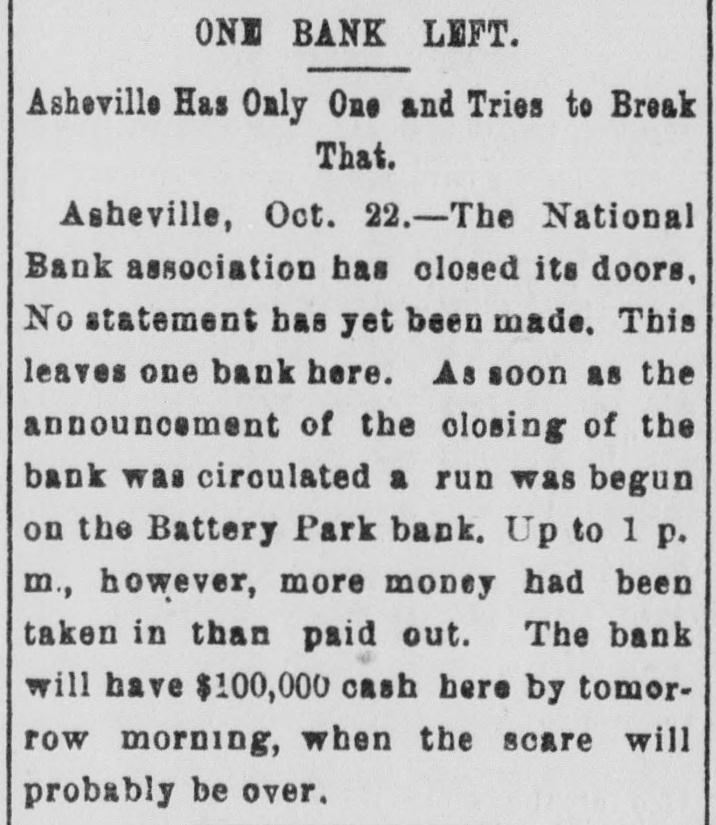

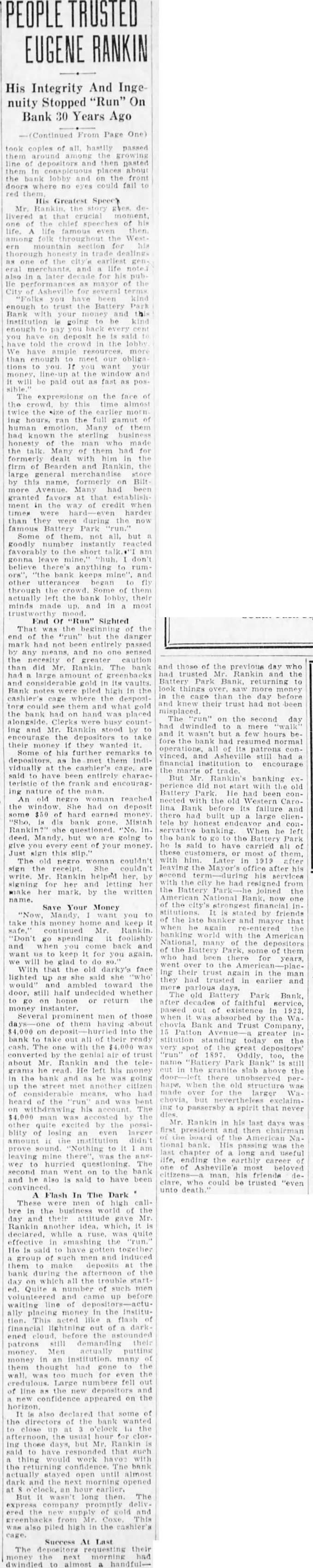

CONDENSED DISPATCHES. Emperor William is visiting Emperor Nicholas and the Grand Duke of Hesse at Darmstadt. The survey of the Pribilof islands by the coast and geodetic survey will be completed this season. Admiral Worden's body was laid to rest at Pawling, N. Y., Thursday. The casket was wrapped in flags. The National Bank of Ashville, N. C., closed its doors Friday, and a run at once commenced on the Battery Park bank. Ex-Congressman Charles W. Woodman, of Chicago, was taken to the detention hospital Friday, suffering from paresis, W. G. Hitchcock & Co., of New York, one of the largest dealers in silk, have assigned. Their liabilities will exceed a million dollars. The Ute Indians are pouring over the line from Utah to Colorado in great numbers to kill deer, and the settlers threaten to drive them out. One of the boats of the British ship Hallamshire and other wreckage has been picked up on the coast of Newfoundland, and it is supposed the Hallamshire is lost. The Turkish government has granted permission to the Thessalians who fled from Thessaly after the invasion of the Turkish troops to return to their homes. Gov. Pingree's visit to Venezuela turns out to have been for the purpose of investigating the new gold fields of the Guarico region, and obtaining control of several asphalt mines. The pool sellers at Louisville have been victimized by manipulated reports of the State Central stakes at Latonia, O., the Turf Exchange losing $2,700 and the Newmarket $3,000. At Rosendale, N. Y., on Friday, the premature explosion of a blast in Snyder's cement quarry killed Arnold Johnson instantly and inflicted probably fatal injuries on three others. Citizens of Neosho county, Kan., have petitioned Judge Stillwell to break up what they claim is a gigantic trust alleged to have been formed by the merchants and coal dealers of the state, in violation of the anti-trust law. Mrs. Todd, of New London. Mo., who killed her daughter, Hettle Bethel in an Insane fit of jealousy, has been convicted of second-degree murder at her fourth trial, and the penalty was fixed at two years in the penitentiary. The German government will ask the reichstag to largely increase both the army and navy estimate. Emperor Willfam has struck many names of officers off the active list. his policy being to put young men in charge. William W. Broadwell, a young society man and board of trade operator in Chicago, is accused of appropriating money intrusted to him for wheat buying, and was routed out of a bath room in his father's home by an officer. The Robbers' Roost gang of outlaws in Wayne county. Utah, which is composed of forty or fifty desperadoes and has long terrorized Central and Southern Utah ha just made a raid and driven off a band of horses to its mountain rendezvous. The Illinois River Improvement Association, with its object to further the project of a deep waterway from Chicago to the Mississippi river, is holding a convention at Beardstown. III. It hopes to influence congress and get an $8,000,000 appropriation. A fight in which John Cooney was shot in the leg and several men were smashed over the head with clubs and canes took place on North Clark street. Chicago, Wednesday night between the followers of City Collector Joseph C. Martin and the county civil service commissioner, James A. Quinn. The charges brought against Grand Master Powell and Grand Secretary Perham, of the Order of Railway Telegraphers, for the violation of the anti-alien contract labor law, have fallen through. because of the failure of the Federal grand jury, to which they had been held, to return true bills against them. At the fifty-first anniversary of the charter of Princeton university. to be held today, the subject of arbitration will be discussed by Grover Cleveland, the Earl of Aberdeen, governor general of Canada: President D. C. Gilman, of Johns Hopkins, and Provost C. C. Harrison, of the University of Pennsylvania. One hundred masked and armed men attempted to enter the county jail at Liberty, Mo. shortly after midnight Wednes. day for the purpose of lynening William Foley and Frank Wade, murderers, held awaiting trial. The sheriff assembled a few deputies and with a show of arms compelled the mob to disperse. Melville C. Brown. ex-congressman and now attorney for the Goulds in their fight against Mary Angell, Jay Gould's pretended wife has been sued by Margaret E. Cody at Denver for 000 damages alleged to have been caused by the publica tion of an article attributing to Mrs. Cody certain statements about Mrs. Angell and her actions. The body of William J Lvons an em-