Article Text

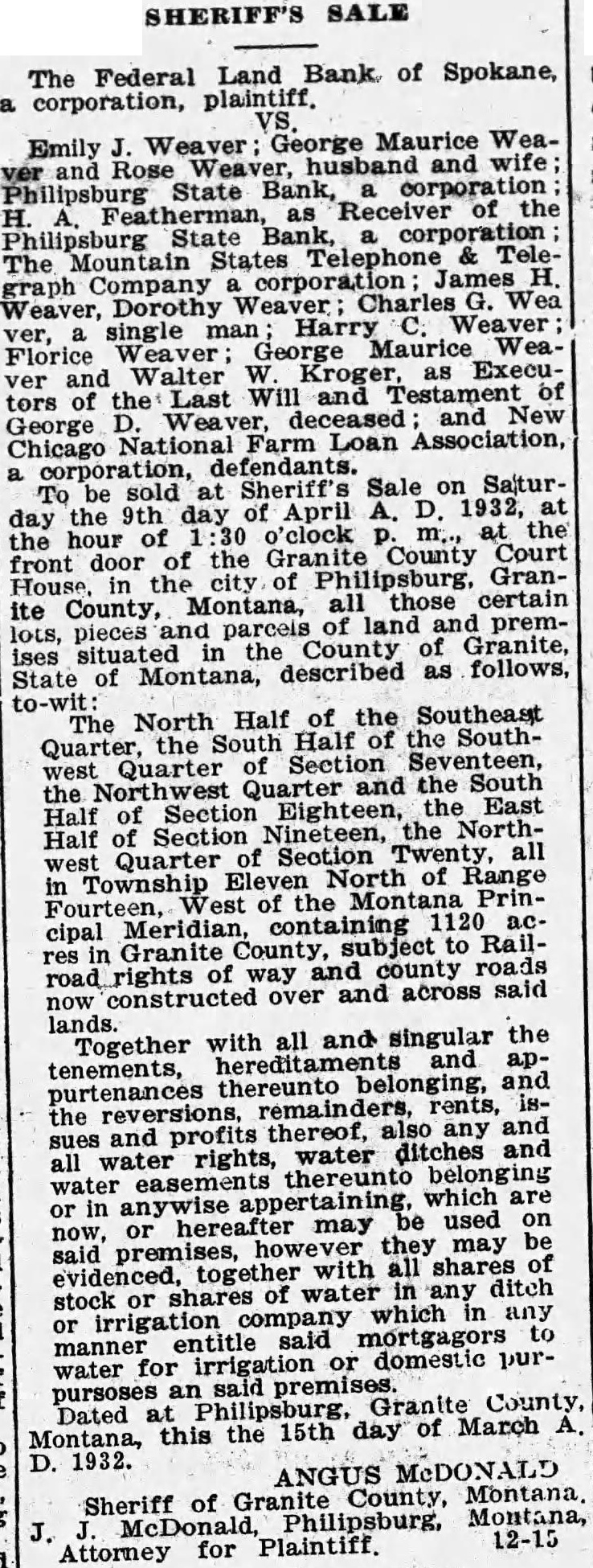

SHERIFF'S SALE The Federal Land Bank of Spokane, a corporation, plaintiff. Emily Weaver George Maurice Weaver and Rose Weaver, husband and wife Philipsburg State Bank, corporation as Receiver of the Philipsburg State Bank, corporation The Mountain States Telephone & Telegraph Company corporation James H Weaver, Dorothy Weaver Charles G. Wea ver, single man Harry Weaver Florice Weaver George Maurice Weaand Walter Kroger, as Executors the Last Will and Testament of George Weaver, deceased and New Chicago National Farm Loan Association, corporation, To be sold at Sheriff's Sale on Saturday the 9th day of April A. D. 1932, at the hour of o'clock P. at the front door of the Granite County Court House the city of Philipsburg. Granite County, Montana, all those certain lots, pieces and parcels of land and premises situated in the County of Granite, State of Montana, described as follows, to-wit The North Half of the Southeast Quarter, the South Half of the Southwest Quarter of Section Seventeen, the Northwest and the South Half of Section Eighteen, the East Half of Section Nineteen, the Northwest Quarter of Section Twenty, all in Township Eleven North of Range Fourteen, est of the Montana Principal Meridian containing 1120 ac res Granite County, subject to Railroad rights of way and county roads now constructed over and across said lands. Together with all and singular the tenements, hereditaments appurtenances thereunto belonging, and the reversions, remainder rents, sues and profits thereof, also any and all water rights, water ditches and water easements thereunto belonging or in anywise appertaining, which are now, or hereafter may be used on said they may be with all shares of stock or shares of water in any ditch or irrigation company which in any manner entitle said mortgagors to water for or domestic purpursoses an said premises. Dated at Philipsburg, Granite County Montana, this the 15th day of March A, D. 1932. ANGUS McDONALD Sheriff of County, Montana Philipsburg, Montana, J. 12-15 Attorney for Plaintiff