Article Text

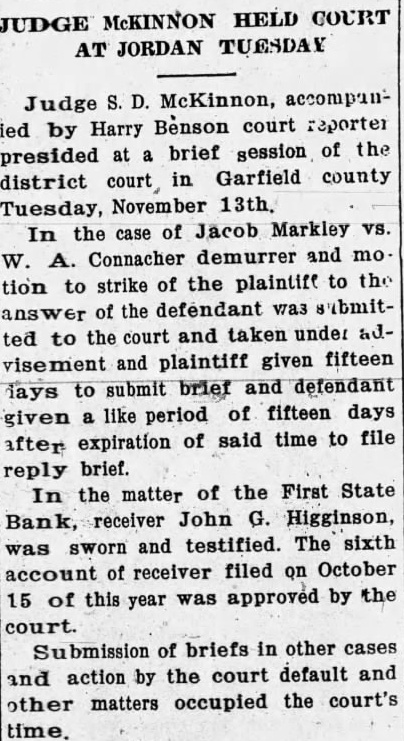

JUDGE McKINNON HELD COURT AT JORDAN TUESDAY Judge S. D. McKinnon, accompanled by Harry Benson court reporter presided at a brief gession of the district court in Garfield county Tuesday, November 13th. In the case of Jacob Markley vs. W. A. Connacher demurrer and motion to strike of the plaintiff to the answer of the defendant was submitted to the court and taken under advisement and plaintiff given fifteen lays to submit brief and defendant given a like period of fifteen days after expiration of said time to file reply brief. In the matter of the First State Bank, receiver John G. Higginson, was sworn and testified. The sixth account of receiver filed on October 15 of this year was approved by the court. Submission of briefs in other cases and action by the court default and other matters occupied the court's time.