Article Text

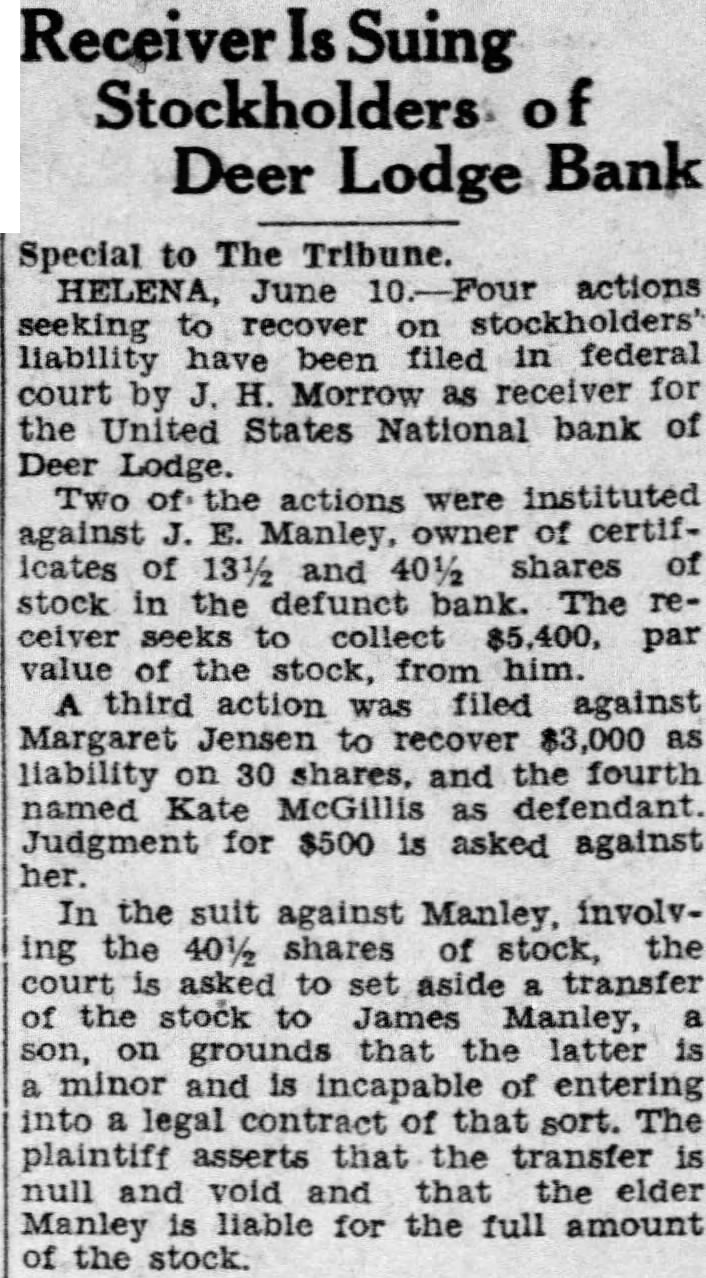

Receiver Is Suing Stockholders of Deer Lodge Bank Special to The Tribune. HELENA, June Four actions seeking to recover on stockholders' liability have been filed in federal court by J. H. Morrow as receiver for the United States National bank of Deer Lodge. Two of the actions were instituted against J. E. Manley, owner of certificates of 13½ and 401/2 shares of stock in the defunct bank. The receiver seeks to collect $5,400, par value of the stock, from him. A third action was filed against Margaret Jensen to recover $3,000 as liability on 30 shares, and the fourth named Kate McGillis as defendant. Judgment for $500 is asked against her. In the suit against Manley, involving the 401/2 shares of stock, the court is asked to set aside transfer of the stock to James Manley, son, on grounds that the latter is minor and is incapable of entering into legal of that sort. The plaintiff asserts that the transfer is null and void and that the elder Manley liable for the full amount of the stock.