Article Text

Send 10 cents for Sample Copy Correct English Publishing Co. Evanston, Illinois AGENTS Wanted Everywhere

SHERIFF'S SALE In the District Court of the Nineteenth Judicial District of the State of Montana, in and for the County ADDIS 01 H. DOWNING, Plaintiff, VS. WILLIAM OLIVER, HATTIE B OLIVER, his wife, COUNTY OF LACIER, and FRANK X. LINDER, To be sold at Sheriff's Sale on the 20th day of March, 1926 at 2:00 o'clock M. at the front door of the Court House at the City of Cut Bank, County of Glacier, State Montana, the following premises sit uate in the county of Glacier, State of Montana, particularly described as follows, to-wit: The northwest quarter (NW4) of Section twenty-five (25) township thirty-three (33) North of Range Five (5) W. Montana Meridian, containing one hundred sixty acres according to the Government survey thereof, together with all and singular the tenements and hereditaments thereunto belonging or in anywise ap. pertaining and the rents, issues and profits thereof, and all rights of homestead exemption, and all other rights and interests therein Dated this 19th day of February, 1926.

R. J. CROFF, By H. G. Ewing, Under Sheriff. First publication February 26th, 1926.

NOTICE OF SALE In the District Court of the Nineteenth Judicial District of the State of Montana, in and for the County ANNE Glacier. L. HENDRICKSON, Plaintiff, versus GILBERT E. CLELAND, 80 known as E. Cleland, MARGARET CLELAND, THE GREAT FALLS NATIONAL BANK of Great Falls, Montana, corporation, FRANK G. NEUMUTH and MRS. FRANK G. NEUMUTH, Defendants. To be sold at Sheriff's Sale at the front door of the court house in Cut Bank, Montana, on the 20th day of March, 1926 at the hour of two clock, P. M., the following described real The property. East half of the Northeast quarter (E2NE4), the Southwest quarter of the Northeast quarter (SW4NE4). the Northwest quarter of the Southeast quarter (NW4SE4), Section Thirty (30). Township thirty five (35) North of Range Five (5) West, Montana Meridian containing one hundred sixty (160) acres, together with all and singular the tenements and hereditaments thereunto belonging, or in anywise appertaining and the rents, issues and profits theerof, and all rights of homestead exemption, and all other rights and interests R. J. CROFF, Sheriff By H.G. Ewing, Under Sheriff Dated at Cut Bank, Montana, this 19th day of February, 1926. First publication February 26th, 1926

NOTICE OF SALE In the District Court of the Nineteenth Judicial District of the State of Montana, in and for the County LOUISE of Glacier. J. FORBES, Plaintiff, VS GILBERT CLELAND. also known as G. E. Cleland, MAR GARET CLELAND, THE GREAT FALLS NATIONAL BANK OF GREAT FALLS, MONTANA, a corporation, Defendants. To be sold at Sheriff's Sale at the front door of the court house in Cut Bank, Montana, on the 20th day of March, 1926 at the hour of two clock D. m., the following described real South property. half of the Southeast quarter (S2SE4). Section Thirty (30) Township Thirty-five (35), North of Range Five (5) West, containing eighty acres according to the Government survey thereof, together with all and singular the tenements and hereditaments thereunto belonging, or in anywise appertaining. and the rents, issues and profits thereof, and all rights of homestead exemption. R. J. CROFF.

By H. G. Ewing, Under Sheriff. Dated at Cut Bank, Montana, this 19th day of February, 1926. First publication February 26, 1926.

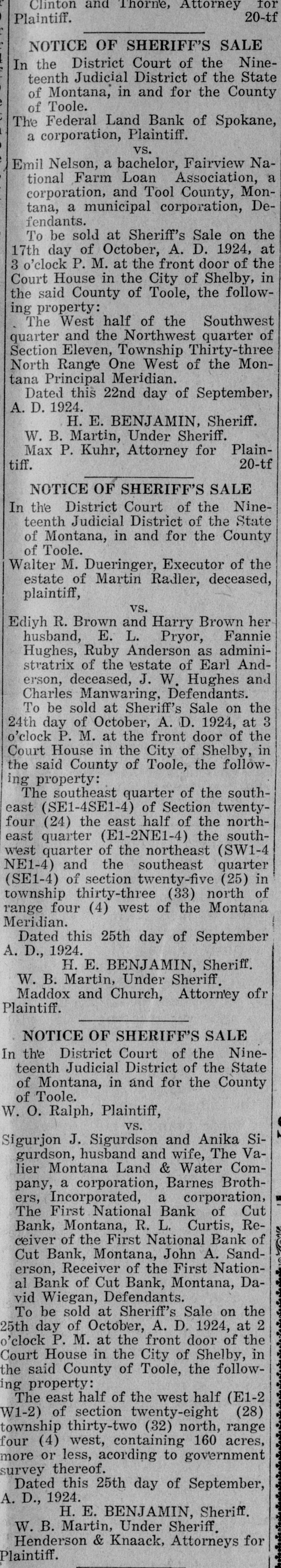

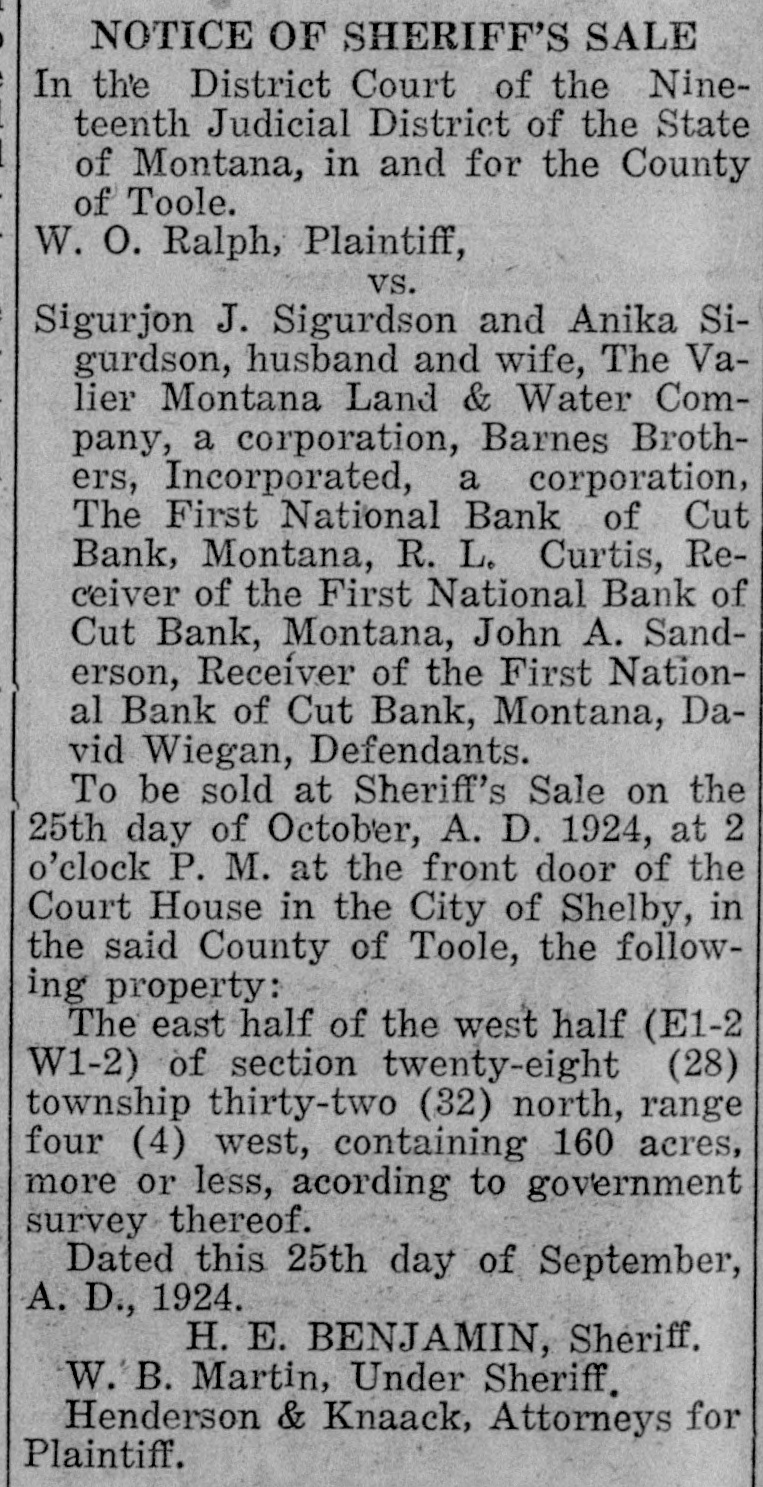

SHERIFF'S SALE In the District Court of the Nineteenth Judicial District of the State of Montana, in and for the County Glacier. WILLIAM of F. RIECKHOFF. Plaintiff, versus SALLIE ALLISON, ALFRED E. ALLISON, W. M. WAYMAN. Receiver of the First National Bank of Cut Bank. NORTHERN MONTANA ASSOCIATION OF CREDIT MEN, a corporation, Defendants. To be sold at Sheriff's Sale at the front door of the Court House at the City of Cut Bank, Glacier County, Montana, on Saturday, the 20th day of March, A. D., 1926 at o'clock P M., of said day, all the right, title and interest of the above named defendants in and to the following real to-wit: property, The Southeast quarter of Secton Thirteen (13) and the north half of the quarter, and the north half of the south half of the northeast quarter of Section Twenty-four (24) Township Thirty-four (34) North of Range Seven (7) and the southeast quarter of the southeast quarter of Section Three (3) Township Thirty-three (33) North, Range M. M. six Dated West at Cut Bank, Montana, this 19th day of February R. 1926. J. CROFF. Sheriff of Glacier County, Montana By H. G. Ewing, Under Sheriff (First publication February 26, 1926.)

SHERIFF'S SALE In the District Court of the Nineteenth Judicial District of the State of Montana, in and for the County WILLIAM of Glacier. F. RIECKHOFF Plaintiff. versus WILLIAM E. HAGERTY PEARL W. HAGERTY PORTLAND CATTLE LOAN COMPANY of Portland, Oregon, corporation. MARTIN JACOBSON, MARTIN J. DANIEL WHETSTONE and JOHN F. LINDHE as Trustees of Northland Petroleum Consolidated, a common law trust, and SALINA defendants. KELLY, To be sold at Sheriff's Sale at the front door of the Court House at the City of Cut Bank. Glacier County, Montana, on Saturday, the 20th day of March, A. D 1926 at o'clock M of said day. all the right, title and interest of the above named defendants in and to the following real property, to-wit: Lots Eight (8) Nine (9) and Ten (10) and the southeast quarter of the northwest quarter and the southwest quarter, all in Section Three (3) Township Thirty-four (34) North. M. Range West, M. Six Dated (6) at Cut Bank, Montana, this

Sheriff's Sale In the District Court of the Nineteenth Judicial District of the State of Montuna, in and for the County J. of Glacier Rigler. as Receiver of Commercial National Bank of Great Falls, corporation, Plaintiff, versus Thomas Harwood. Maude A. Harwcod, E. V. Day, as Receiver of Ft "mers State Bank of Cut Bank, D. Frank Stufdt, Alfred Klein and Edward Murphy, Defendants. To be sold at Sheriff's Sale at the Front Door of the Court House at the City of Cut Bank, Glacier County, Montana, on Saturday, the 27th day of March, D., 1926 at 2:00 o'clock m., of said day, all the right, title and interest of the above named defendants in and to the following real property, to-wit: The southwest quarter, and the west half of the southeast quarter, and the west half of the east half of the southeast quarter of Section Thirty-four (34) township thirty-seven (37) North all in Range Six (6) West of the Montana Meridian, containing 280 acres, together with all and singular the tenements, hereditaments, appurtenances, easements, water. and all other rights belonging or in anywise appertaining Dated thereto. at Cut Bank, Montana, this 24th day of February 1926 R. J. CROFF, Sheriff of Glacier County, Montana. By H. G. Ewing. Under Sheriff. First publication March 5th, 1926.