Article Text

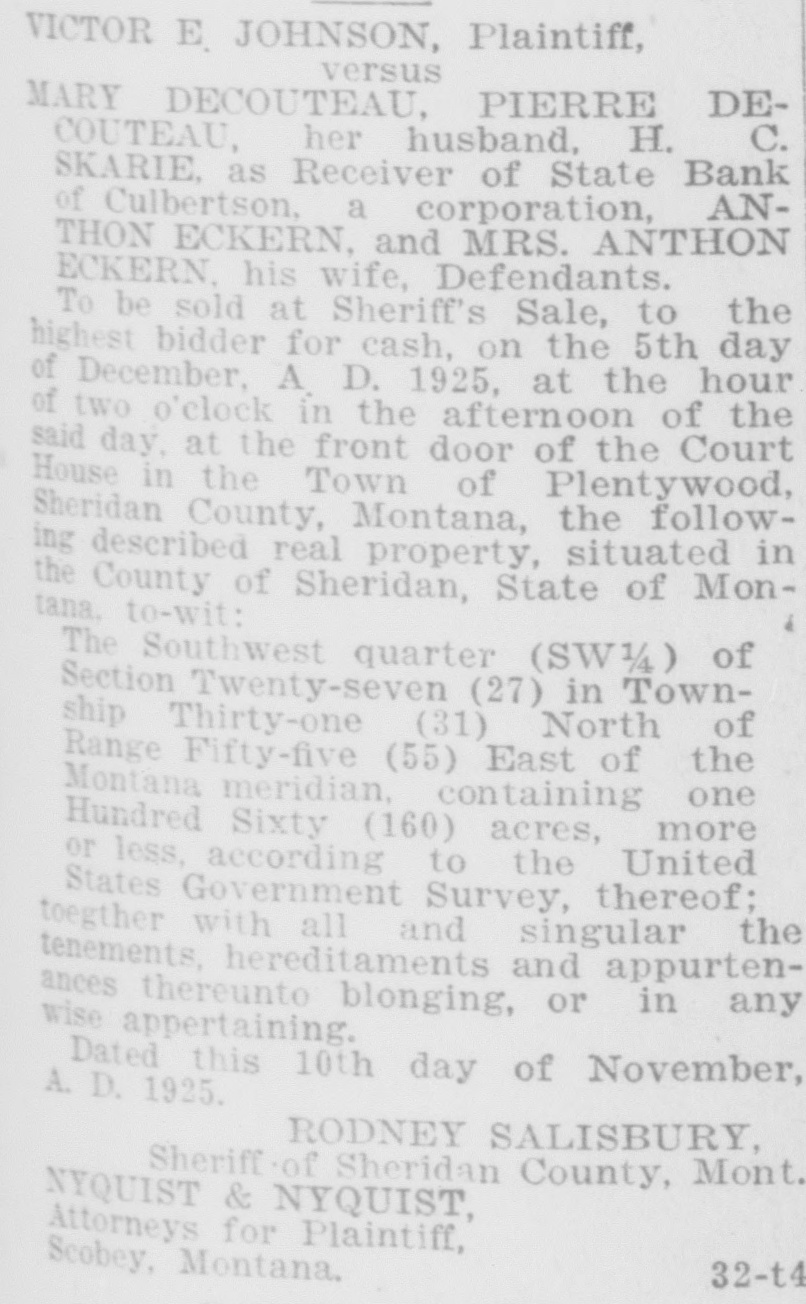

CLOSES SECOND TIME WITHIN TWO YEARS Culbertson, Jan. -Owing to a NORTHRUP PLEADS constant withdrawal of funds during the fall and winter the State Bank of Culbertson did not open its doors GUILTY TO THEFT on Monday, January 14th. A representative of the State Banking Department is making a thorough exMedicine Lake Man Appears Before amination and plans for reorganizaJudge Comer and Receives Senttion or liquidation will be carried out ence of From 3 to 6 Years. as soon as the examination is completed. John Northrup, who was placed in This is the second time within the jail some time ago on the charge of past two year that the above bank being implicated in the stealing of has closed its doors. automobiles at Medicine Lake, plead On the day following the closing guilty before Judge Camer last Wedof the State Bank. the Citizens State nesday and was sentenced to three to Bank did not open for business and six years in the state penitentiary at as a result, Culbertson is left without Deer Lodge. banking facilities. Business proceeds Due to the efforts of Sheriff Salisas usual but business is very much bury the auto thieves of Sheridan inconvenienced by the sudden stopcounty are being apprehended one page of the general flow of currency. by one and it is reported that there Owing to a heavy run on the bank, will be more arrests follow, until the the Citizens State Bank of Culbertson gang of auto thieves which have been was forced to close its doors on Januoperating in this county for the past ary 16, 1924. year have been cleaned up. The representative of the State Banking Department will take charge and the affairs of the bank gone OVJ.J. CARROL HOME er thoroughly and such plans for reorganization or liquidation to the depositors will be arranged on the comBURNS FRIDAY pletion of his report. Culbertson has been hard hit by this sudden failure of the two banks Five Room House of C. C. Carrol, of the town and many people are Situated 11 Miles Southwest of wondering how they are going to Plentywood Completely Destroyed meet their obligations for the rest of By Fire-Loss Estimated at About the winter. Business has received a $2,000.00. hard blow as a great amount of the cash money of the town was carried Last Friday morning, while Mr. in the banks and is new tied up or Carrols was doing chores in the barn, sunk in those institutions. None of his house, located on the farm, 11 the depositors are able to see the miles southwest of Plentywood caught great Republican cry of four years fire from what is supposed to have ago, "Back to Normalcy." been an over-heated stove and burned