Article Text

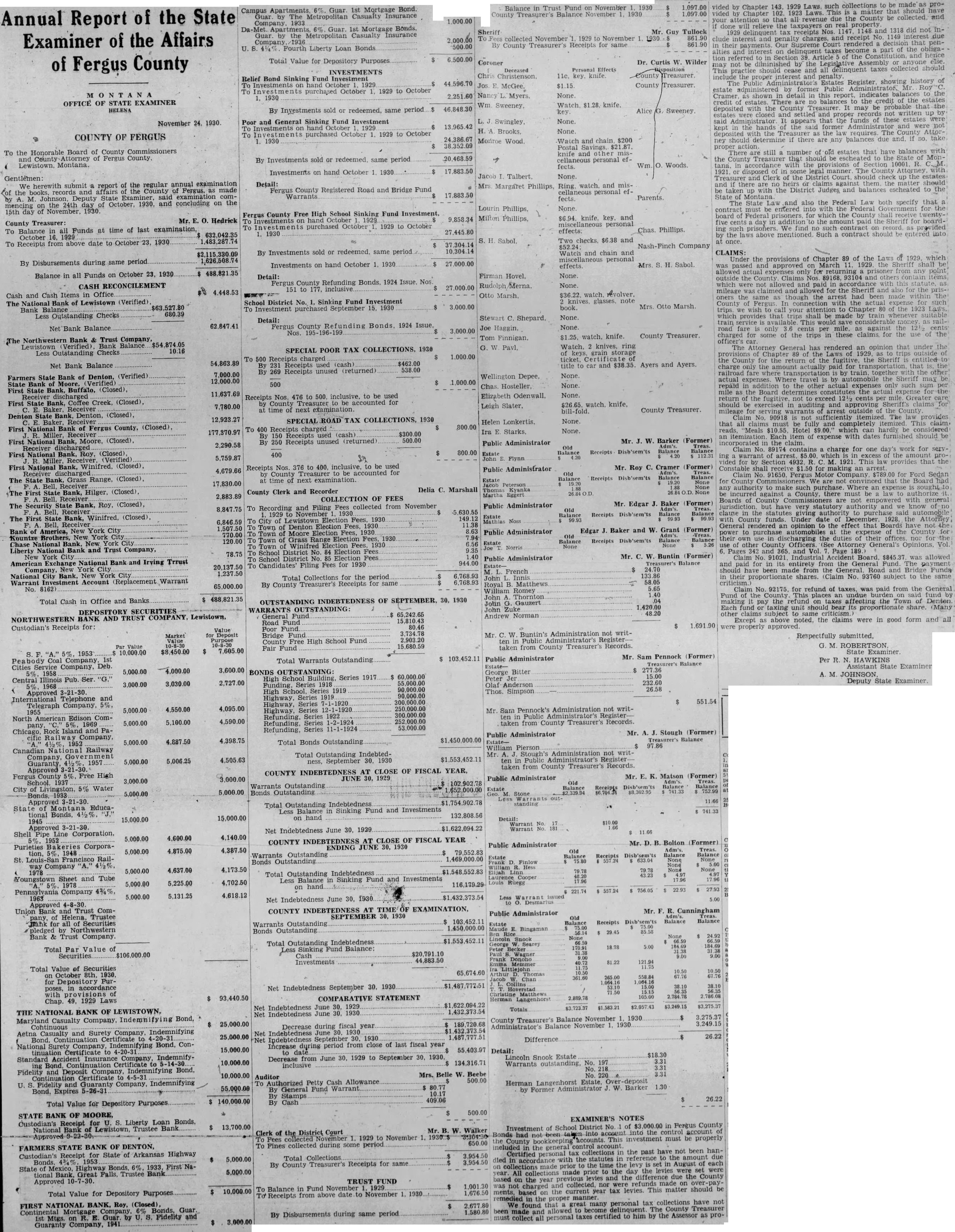

Annual Report of the State Examiner of the Affairs of Fergus County OFFICE OF STATE EXAMINER HELENA November 24, 1930. COUNTY OF FERGUS To the Honorable Board of County Commissioners County Attorney of Fergus County, Lewistown, Montana. herewith submit a report of the regular annual Fergus. examination made of and affairs County of the books, said examination comJohnson, State by mencing on the 24th Deputy day of October, 1930, and concluding on the 15th day of November, 1930. Mr. E. Hedrick County Treasurer: To Balance in all Funds at time of last examination, 632,042.35 October 16, 1929 1,483,287.74 To Receipts from above date to October 23, 1930 By Disbursements during same period Balance in all Funds on October 23, 1930 CASH RECONCILEMENT Cash and Cash Items in Office The National Bank of Lewistown (Verified) $63,527.80 Bank Balance 680.39 Less Outstanding Checks Net Bank Balance The Northwestern Bank & Trust Company, Lewistown (Verified) Bank Balance $54,874.05 10.16 Less Outstanding Checks Net Bank Balance $2,115,330.09 1,626,508.74 Investments on hand October 1, 1930 488,821.35 4,448.53 54,863.89 7,000.00 12,000.00 11,637.69 Farmers State Bank of Denton, (Verified) State Bank Moore. Verified) First State Bank, Buffalo, (Closed), Receiver First State Bank, Coffee Creek, (Closed), 7,780.00 C. E. Receiver Denton State Bank, Denton, (Closed), 12,923.27 First of Fergus County, (Closed), 177,370.97 R. First National Bank, Moore, (Closed). 2,290.58 Receiver First National Bank, Roy, (Closed) 5,759.87 First National Bank, Winifred. (Closed), 4,679.66 Receiver The State Grass Range, (Closed), 17,830.00 Bell, Receiver The First State Bank, Hilger, (Closed), 2,883.89 Bell, The Security State Bank, Roy. (Closed), 8,847.75 Receiver The First State Bank, Winifred, (Closed), 6,846.59 A. Bell, 1,507.50 Bank of America, New York City 770.00 Kountze Brothers, New York City 120.00 Chase National Bank, New York City Liberty National Bank and Trust Company, 78.75 New York American Exchange National Bank and Irving Trrust 20,137.50 Company, New York City 1,237.50 National City Bank, New York Warrant Investment Account (Replacement Warrant 65,000.00 No. 8162) 488,821.35 Total Cash in Office and Banks Campus Apartments. 6%. Guar 1st Mortgage Bond. Guar by The Metropolitan Casualty Insurance Company. 1933 Da-Met. Apartments, 6% Guar. 1st Mortgage Bonds, Guar by the Metropolitan Casualty Insurance Company 1936 U. S. 4%, Fourth Liberty Loan Bonds Total Value for Depository Purposes 1,000.00 2,000.00 500.00 6,500.00 INVESTMENTS Relief Bond Sinking Fund Investment 44,596.70 To Investments on hand October 1929 To purchased October 1, 1929 to October 2,251.60 1, 1930 sold same period 46,848.30 By Investments or redeemed, Poor and General Sinking Fund Investment 13,965.42 To Investments on hand 1929 To purchased October 1. 1929 to October 24,386.67 1930 38,352.09 By Investments sold or redeemed. same period Investments on hand October 1. 1930 $ 17,883.50 By Investments sold or redeemed, same period Jacob Talbert. Detail: Mrs Margaret Phillips, Fergus County Registered Road and Bridge Fund Warrants $ 17,883.50 Lourin Phillips, Fergus County Free High School Sinking Fund Investment, 9,858.34 Milton Phillips, Investments hand October 1929 To To purchased October 1929 to October 27,445.80 1, 1930 S. Sabol. 37,304.14 10,304.14 $ 27,000.00 Detail: Firman Hovel, Fergus County Refunding Bonds. 1924 Issue, Nos Rudolph 27,000.00 151 to 177, inclusive Otto Marsh, School District No. 1, Sinking Fund Investment 3,000.00 To Investment purchased September 15. 1930 Detail: Fergus County Refunding Bonds, 1924 Issue $ 3,000.00 Nos. 500 SPECIAL POOR TAX COLLECTIONS, 1930 $ 1,000.00 To 500 Receipts charged $462.00 By 231 Receipts used (cash) 538.00 By 269 Receipts unused (returned) 1,000.00 Receipts Nos. 476 to 500. inclusive, to be used County Treasurer to be accounted for at time of next examination. SPECIAL ROAD TAX COLLECTIONS, 1930 $ To 400 Receipts charged 150 Receipts used (cash) $300.00 500.00 By 250 Receipts unused (returned) 400 Receipts Nos 376 to 400. inclusive. to be used by County to be accounted for at time of next examination. County Clerk and Recorder 800.00 Helen Lonkertis. Ira Starks, Public Administrator $ 800.00 Estate John Flynn Public Administrator Estate Jacob Peterson Delia C. Marshall Thomas Kyanka Martha Eggert To Recording and Filing Fees collected from November 1930 5,630.55 1929 November 149.12 To City of Lewistown Election Fees. 1930 11.38 To Town of Denton Election Fees, 1930 8.63 Town of Moore Election Fees, 1930 Town of Grass Range Election Fees, 1930 6.56 Town of Winifred Fees, 1930 9.35 To School District No. 84 Election 1.40 To School District No. 85 Election Fees 944.00 To Candidates' Filing Fees for 1930 Total Collections for the period 6,768.93 6,768.93 By County Treasurer's Receipts for same Balance in Trust Fund on November 1930 County Treasurer's Balance November 1930 Sheriff Mr. Guy Tullock To collected November 1929 to November 1. 1930 861.90 By County Treasurer's Receipts for same 861.90 Stewart C. Shepard. Joe Haggin. Tom Finnigan. G. Pavl, Wellington Depee, Elizabeth Odenwall. Leigh Slater. Alice County Treasurer. Total Bonds Outstanding EXAMINER'S NOTES Investment of School District No. of the in Fergus County of taken into into Bonds County had bookkeeping accounts. This investment must be properly included control account Certified in the personal general tax collections in the past have not been handled in accordance with the statutes the due on made prior to the time the day levy the set levies in August of each were made prior the based year. All on collections the year previous levies and the refunds difference made due on the County was nor charged This matter should be the current tax levies. ments, based in the proper collections have not great many personal We found that The County Treasurer been allowed to become must made collect all personal taxes certified to him by the Assessor as pro- vided by Chapter 143. 1929 Laws, such collections to be made as pro1,097.00 vided by Chapter 1923 Laws. is matter that should have 1,097.00 your attention that all revenue due the County be collected, and the on real done 1929 will delinquent relieve tax taxpayers receipts Nos. 1148 and 1318 did not include interest and charges. and receipt No. 1149 due in their payments. Supreme Court rendered that penalties and interest on taxes become part of the obligation in 39. Article the and hence Dr. Curtis W. Wilder not be diminished by the Assembly or else This should cease all delinquent taxes collected should include the and The Public interest Estates Register, showing history Roy of Treasurer. former Public Administrator estate by balances to the shown in detail this report, indicates credit of are no balances to the credit the that estates the with the County Treasurer may be deposited records not written up by estates closed and settled and proper estates were said It that the funds appears kept hands the said former Administrator and were Attor- not the the law requires. The County ney should determine if there are any balances due and, if so, take proper There are still number of old estates that have balances Mon- with should be escheated to the State of the Treasurer that O. Woods. tana, in accordance with the provisions of Section 10001. R. The with 1921. disposed of in some legal manner County and Clerk of the District Court should check up the estates and there are no heirs or claims against them. the matter should be taken up with the District Judges and balances escheated to the State of Montana The State Law and also the Federal Law both specify that contract must be entered into with the Federal Government for the board of Federal prisoners, for which the County twentyfive cents day in addition to the amount paid Sheriff for boarding such prisoñers. We find no such contract on record. provided by the laws above mentioned. Such a contract should be entered into at once. CLAIMS: Under the provisions of Chapter 89 of the Laws of 1929. which March 11, 1929 the Sheriff shall be was passed and approved on allowed for from any point outside the Claims Nos. 93104 and items which not and in accordance with this as paid claimed and for the Sheriff also for the mileage the arrest had been made the oners the same as though connection expense for such County Fergus trips. wish your attention to Chapter 80 the 1923 Laws, which that shall be made by train whenever suitable train service available would money. as vailroad fare is only 3.6 cents mile. against the cents per charged for some of the trips in these claims for use of the officer's The General has rendered an opinion that under the of Chapter 89 of the Laws trips outside of the County for the of the fugitive. the Sheriff is entitled to charge amount paid for that the only the actually railroad fare where by train, together with the other actual expenses. Where travel is by automobile the Sheriff may be repaid in addition to the other actual expenses such sum per mile as the Board determines constitutes the actual expense the return of the fugitive, to exceed 12½ cents per mile Greater care should be exercised auditing and approving Sheriff's claims for mileage for serving warrants arrest outside the County Claim No. 90918 sufficiently itemized The law provides that all claims must be fully and completely itemized. This claim. reads, Meals Hotel which hardly considered an itemization. Each item of expense with dates furnished should be incorporated the claim Claim No contains charge for one day's work for serving arrest which the provided for Section 4932 M. 1921 This law provides that the Constable for making an arrest Claim No. 91650. Fergus Motor Company $789 00 for Ford Sedan for County We not convinced that the Board had any authority to make such purchase Where an expense sought incurred against there must be law authorize it Boards of County are not with but have statutory and we know of very clause in the statutes giving authority to said with funds. Under date of the Attorney General rendered an opinion to the effect that Boards not the power purchase automobiles the expense of the County for their own the duties of their offices nor for the use of other Officers. Attorney General's Opinions, Vol. 342 365 and Vol. Page 189. Claim No. 91021, Industrial Accident Board. $845.37 was allowed and paid for in its entirety from Fund. The payment should been from the Road and Funds in their proportionate shares. (Claim No. 93760 subject to the same criticism.) Claim No. 92175. for refund of taxes, was paid from the General Fund the County. This places an undue burden said fund by making pay the refund on taxes affecting the Town Denton. Each fund taxing unit should bear its proportionate share. (Many other claims subject to same criticism.) Except above noted, the claims were in good form and all were properly approved. Respectfully submitted. G. M. ROBERTSON. State Examiner. Per R. N. HAWKINS Assistant State Examiner. A. M. JOHNSON Deputy State Examiner. DEPOSITORY SECURITIES NORTHWESTERN BANK AND TRUST COMPANY, Lewistown, Custodian's Receipts for: Value Market for Deposit Value $8,450.00 $ 7,605.00 "A." 1953 10,000.00 Coal Company, 1st Cities Service Company, Deb. 4,000.00 3,600.00 5,000.00 1958 Central Illinois Pub. Ser. "G," 3,030.00 2,727.00 3,000.00 1968 Approved 3-21-30. International Telephone and Telegraph Company, 5%, 4,550.00 4,095.00 5,000.00 North American Edison Com5,100.00 4,590.00 5,000.00 pany, 5%. 1969 Chicago, Rock Island and Pacific Company, 4,887.50 4,398.75 5,000.00 1952 Canadian National Railway Company, 5,006.25 4,505.63 5,000.00 Guaranty 1957 Approved 3-21-30. Fergus County 5%, Free High 3,000.00 1937 3,000.00 City of Livingston, 5% Water 5,000.00 5,000.00 1933 Approved 3-21-30 of Montana Educational Bonds, 15,000.00 15,000.00 1945 Approved 3-21-30. Shell Pipe Line Corporation, 4,600.00 4,140.00 5,000.00 1952 Purieties Bakeries Corpora4,875.00 4,387.50 5,000.00 tion, 5%, 1948 St. Louis-San Francisco RailCompany "A," 4½, 4,637.00 4,173.50 5,000.00 1978 Youngstown Sheet and Tube 5,225.00 4,702.50 5,000.00 1978 5,131.25 4,618.12 5,000.00 1963 Approved 4-8-30. Union Bank Trust Company, of Trustee Bank for all of Securities pledged by Northwestern Bank & Trust Company. Total Par Value of Securities $106,000.00 Total Value of Securities on October 8th, 1930, for Depository Purposes, in accordance with visions of $ 93,440.50 Chap. 49, 1929 Laws THE NATIONAL BANK OF LEWISTOWN. Maryland Casualty Company, Bond, 25,000.00 Continuous Aetna Casualty and Surety Company, Indemnifying 25,000.00 Bond. Continuation Certificate National Surety Company, Indemnifying Bond, Con15,000.00 Certificate to 4-20-31 Standard Accident Insurance Company. Indemnify10,000.00 ing Bond, Continuation Certificate Fidelity and Deposit Company, Indemnifying Bond, 10,000.00 Certificate 4-5-31 U. S. Fidelity and Guaranty Company, Indemnifying 55,000.00 Bond, Expires 5-26-31 140,000.00 Total Value for Depository Purposes STATE BANK OF MOORE, Custodian's Receipt for S. Liberty Loan Bonds, $ 13,700.00 National Bank of Lewistown, Trustee Bank Approved FARMERS STATE BANK OF DENTON. Custodian's Receipt for State of Arkansas Highway 5,000.00 1953 State Mexico, Highway Bonds, 6%, 1933, First Na5,000.00 tional Bank. Great Falls, Trustee Bank Approved 10-7-30. 10,000.00 Total Value for Depository Purposes FIRST NATIONAL BANK, Roy, (Closed) Continental Mortgage Company. 6% Bonds, Guar R. E. Guar. by U. S. Fidelity and Mtgs. on 3,000.00 Guaranty Company, 1941 Coroner Deceased Personal Effects Chris Christenson. 11c. key, knife. County Jos. McGee. $1.15. County Nancy L. Myers, None Wm Sweeney, key. L. Swingley, None. H. Brooks, None. Monroe Wood. Watch and chain $200 Postal Savings, knife and other cellaneous personal efWm fects. None. Ring. watch. and miscellaneous personal effects. None. miscellaneous personal effects: Chas. Phillips. Two checks, and $52.24 Company Watch and chain and miscellaneous personal effects. Mrs. S. H. Sabol. None None. watch. revolver. knives. glasses. note Mrs. Otto Marsh. book. None. None. watch, knife. Watch. knives. ring keys, grain storage ticket, Certificate title to car and $38.35. Ayers and Ayers. None. None. None. watch. knife, bill-fold. County Treasurer. None None. Mr. J. W. Barker Adm's Treas. Old Balance Receipts Disb'sem'ts Balance Mr. Roy C. Cramer Former) Treas. Old Receipts Disb'sem'ts Balance Balance Balance None None None Mr. Edgar J. Baker (Former) Public Administrator Old Treas. Receipts Disb'sem'ts Balance Balance Estate Balance Mathias Noss Edgar J. Baker and W. Grant (Former) Public Administrator Old Treas. Receipts Disb'sem'ts Balance Balance Estate Balance None None Norris Mr. C. W. Buntin (Former) Public Administrator Treasurer's Balance 24.70 French 133.86 John Innis 58.05 Royal B. Matthews 5.65 William Romey 1.40 John Thornton John Gauzert 1,420.00 John Zuke 48.20 Andrew Norman $ 1,691.90 Mr. C. W Buntin's Administration not writin Public Registertaken from County Treasurer's Records. Mr. Sam Pennock (Former) Public Administrator Treasurer's Balance Estate277.36 George Bitter 15.00 Peter 232.60 Olaf Anderson 26.58 Thos. Simpson $ 551.54 OUTSTANDING INDEBTEDNESS OF SEPTEMBER, 30. 1930 WARRANTS OUTSTANDING: 65,242.65 General Fund 15,810.43 Road Fund 80.46 Poor Fund 3,734.78 Bridge Fund 2,903.20 County Free High School Fund 15,680.59 Fair Fund $ Total Warrants Outstanding BONDS OUTSTANDING: Series 1917 60,000.00 High School 55,000.00 Funding. Series 1918 90,000.00 High School. Series 1919 90,000.00 Highway, Series 300,000.00 Highway, Series 7-1-1920 250,000.00 Mr. Sam Pennock's Administration not writHighway, Series 12-1-1920 300,000.00 ten Public Administrator's RegisterRefunding, Series 1922 Refunding. Series 1-2-1924 252,000.00 taken from County Treasurer's Records. 53,000.00 Refunding, Series 11-1-1924 Mr. A. J. Stough (Former) Public Administrator $1,450,000.00 Treasurer's Balance EstateWilliam Pierson Total Outstanding Indebted- Mr. A. Stough's Administration not writ$1,553,452.11 ten in Public Administrator's Registerness, September 30, 1930 taken from County Treasurer's Records. COUNTY INDEBTEDNESS AT CLOSE OF FISCAL YEAR, Mr. E. K. Matson (Former) JUNE 30, 1929 Public Administrator Old Adm's. Treas. 102.902.78 Warrants Outstanding Disb'sem'ts Balance Estate Balance 1,652,000.00 Bonds Outstanding Stone $2,339.94 Less out11.66 $1,754,902.78 standing Total Outstanding Indebtedness Less Balance in Sinking Fund and Investments 741.33 132,808.56 on hand Detail: Warrant $1,622,094.22 Warrant Net Indebtedness June 30, 1929 11.66 COUNTY INDEBTEDNESS AT CLOSE OF FISCAL YEAR Mr. Bolton (Former) Public Administrator ENDING JUNE 30, 1930 Treas. Old $ 79,552.83 Warrants Outstanding Disb'sem'ts Balance Balance Balance Receipts Estate 1,469,000.00 633.04 None None Bonds Outstanding Frank D. Finlow $ William Hess None None $1,548,552.83 Elijah Total Outstanding Indebtedness 43.23 Laurence Cooper Less Balance in Sinking Fund and Investments 17.96 17.96 17.96 Louis Ruegg 116,179.29 hand on 22.93 27.93 221.74 $1,432,373.54 Less Warrant issued Indebtedness June 30, 1930 5.00 Net Desmarius COUNTY INDEBTEDNESS AT TIME EXAMINATION, Mr. F. R. Cunningham Public Administrator SEPTEMBER 30, 1930 Adm's. Treas. Old 103,452.11 Receipts Disb'sem'ts Balance Balance Warrants Outstanding Estate Balance 1,450,000.00 Maude E. Bingaman Bonds Outstanding 56.14 85.58 Rice None $ Lincoln Snook None $1,553,452.11 66.59 Total Outstanding Indebtedness George Searey 18.78 5.00 184.69 Sinking Fund Balance: Becker 170.91 $20,791.10 Cash 9.00 9.00 44,883.50 Frank Donoho Investments 81.22 121.94 Emma Memmer 65,674.60 Thomas Arthur 361.60 265.00 67.76 Chan Collins $1,487,777.51 15.00 Net Indebtedness September 30. 1930 Hoverstad 71.50 Christine Matthews 105.00 2,784.78 2,786.08 COMPARATIVE STATEMENT Herman 2,889.78 Langenhorst $1,622,094.22 $3,249.15 $3,275.37 Net Indebtedness June 30. 1929 $3,723.37 $1,583.21 $2,057.43 Totals 1,432,373.54 Net Indebtedness June 30, 1930 $ 3,275.37 County Treasurer's Balance November 1930 189,720.68 3,249.15 Decrease during fiscal year Administrator's Balance November 1, 1930 Net Indebtedness June 1930 1,487,777.51 26.22 Indebtedness September 30, 1930. Difference Increase during period from close of last fiscal year 55,403.97 Detail: date $18.30 30, 1929 to September 30, Lincoln Snook Estate Decrease from June 3.31 134,316.71 Warrants outstanding, No. 197 inclusive 218 3.31 No. Belle W. Beebe 3.31 Mrs. No. Auditor 500.00 To Authorized Petty Cash Allowance Herman Langenhorst Estate, Over-deposit By General Fund Warrant by Former Administrator J. W. Barker 1.30 10.17 By Stamps 409.06 26.22 By Cash $ 500.00 Mr. B. W. Walker Clerk of the District Court November 1929 November 1, To Fees 650.00 To Fines collected during some period 3,954.50 Total Collections 3,954.50 By County Treasurer's Receipts for same TRUST FUND 1,001.30 To Balance in Fund November 1929 1,676.50 To Receipts from above date to November 1. 1930 2,677.80 1,580.80 By Disbursements during same period