Article Text

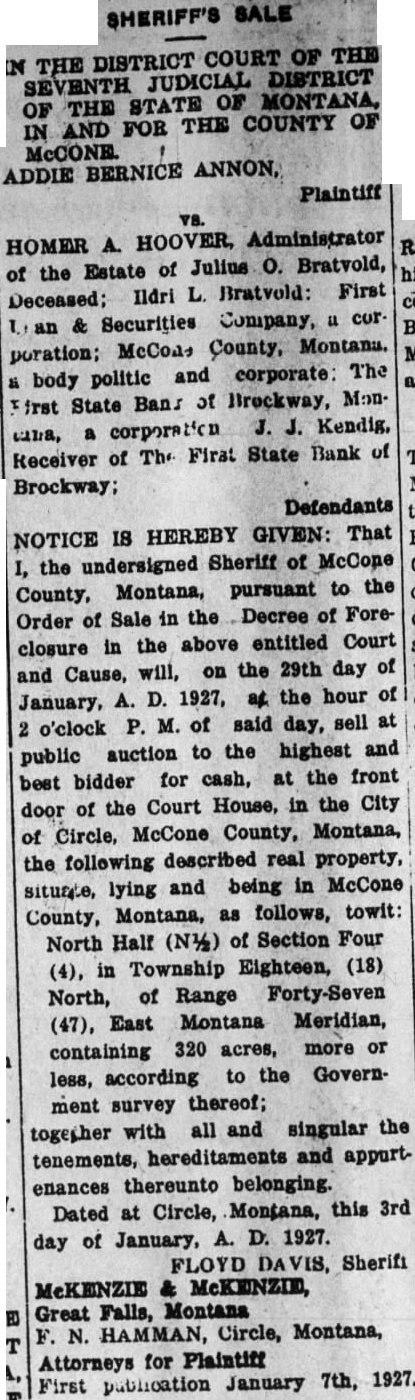

SHERIFF'S SALE IN THE DISTRICT COURT OF THE SEVENTH JUDICIAL DISTRICT OF THE STATE OF MONTANA, IN AND FOR THE COUNTY OF McCONE. ADDIE BERNICE ANNON, Plaintiff HOMER A. HOOVER, Administrator of the Estate of Julius O. Bratvold, Deceased; Ildri L. Bratvold: First an & Securities Company, " cor & body politic and corporate: The First State Bans of Brockway, Moncalla, a corporation J. J. Kendig, Receiver of The First State Bank of Defendants NOTICE IS HEREBY GIVEN: That I, the undersigned Sheriff of McCone County, Montana, pursuant to the Order of Sale in the Decree of Foreclosure in the above entitled Court and Cause, will, on the 29th day of January, A. D. 1927, at the hour of 2 o'clock P. M. of said day, sell at public auction to the highest and best bidder for cash, at the front door of the Court House, in the City of Circle, McCone County, Montana, the following described real property, situate, lying and being in McCone County, Montana, as follows, towit: North Half (N½) of Section Four (4), in Township Eighteen, (18) North, of Range Forty-Seven (47), East Montana Meridian, containing 320 acres, more or less, according to the Government survey thereof; together with all and singular the tenements, hereditaments and appurtenances thereunto belonging. Dated at Circle, Montana, this 3rd day of January, A. D. 1927. FLOYD DAVIS, Sherifi MeKENZIE & McKENZIE, Great Falls, Montana F. N. HAMMAN, Circle, Montana, Attorneys for Plaintiff First publication January 7th, 1927.