Click image to open full size in new tab

Article Text

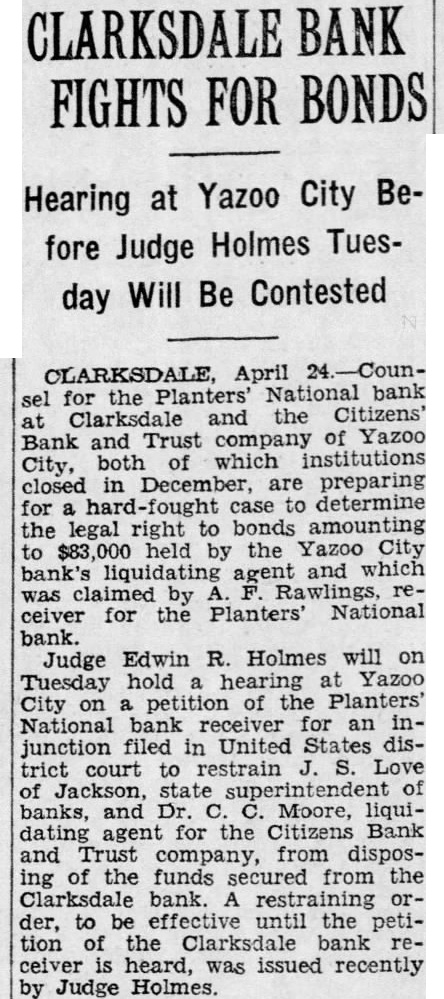

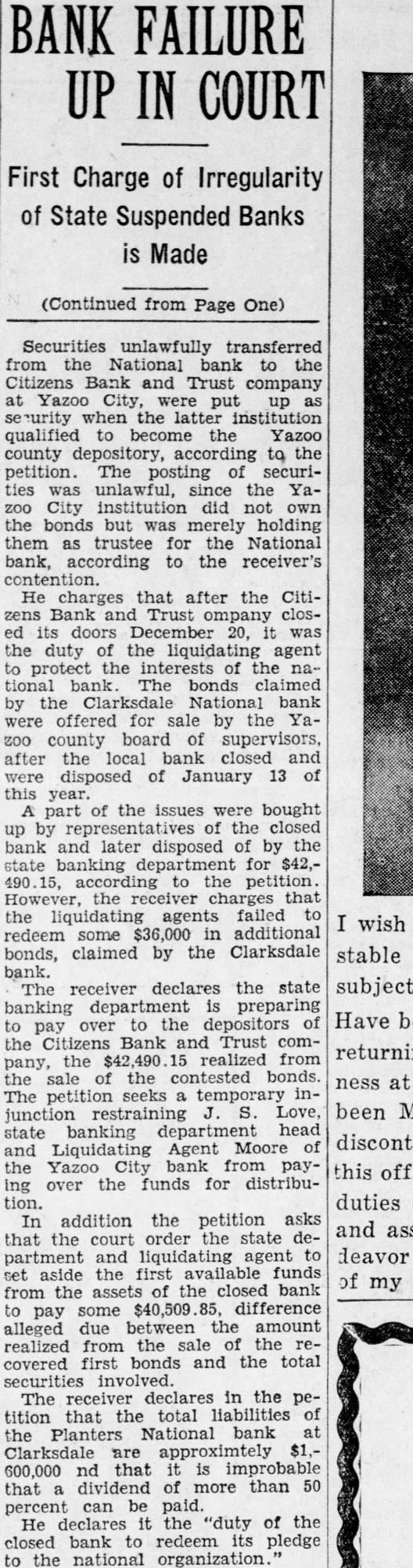

BANK FAILURE UP IN COURT

First Charge of Irregularity of State Suspended Banks is Made

(Continued from Page One)

Securities unlawfully transferred from the National bank to the Citizens Bank and Trust company at Yazoo City, were put up as security when the latter institution qualified to become the Yazoo county depository, according to the petition. The posting of securities was unlawful, since the YaZOO City institution did not own the bonds but was merely holding them as trustee for the National bank, according to the receiver's contention. He charges that after the Citizens Bank and Trust ompany closed its doors December 20, it was the duty of the liquidating agent to protect the interests of the national bank. The bonds claimed by the Clarksdale National bank were offered for sale by the YaZOO county board of supervisors, after the local bank closed and were disposed of January 13 of this year. A part of the issues were bought up by representatives of the closed bank and later disposed of by the state banking department for $42,490 15, according to the petition. However, the receiver charges that the liquidating agents failed to redeem some $36,000 in additional bonds, claimed by the Clarksdale bank. The receiver declares the state banking department is preparing to pay over to the depositors of the Citizens Bank and Trust company, the $42,490.15 realized from the sale of the contested bonds. The petition seeks a temporary injunction restraining J. S. Love, state banking department head and Liquidating Agent Moore of the Yazoo City bank from paying over the funds for distribution. In addition the petition asks that the court order the state department and liquidating agent to set aside the first available funds from the assets of the closed bank to pay some $40,509 85, difference alleged due between the amount realized from the sale of the recovered first bonds and the total securities involved. The receiver declares in the petition that the total liabilities of the Planters National bank at Clarksdale are approximtely $1,600,000 nd that it is improbable that a dividend of more than 50 percent can be paid. He declares it the "duty of the closed bank to redeem its pledge to the national organization."