Article Text

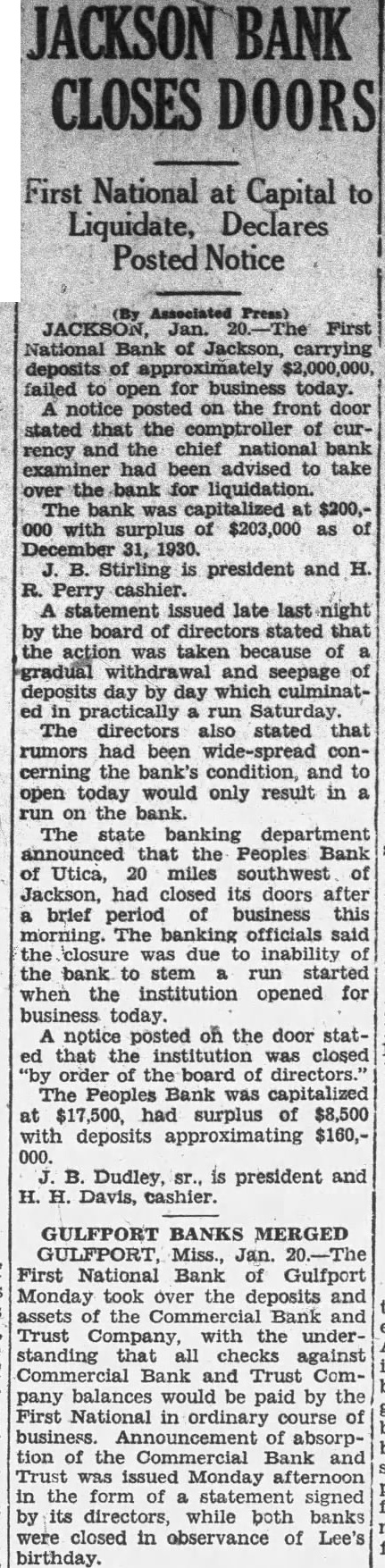

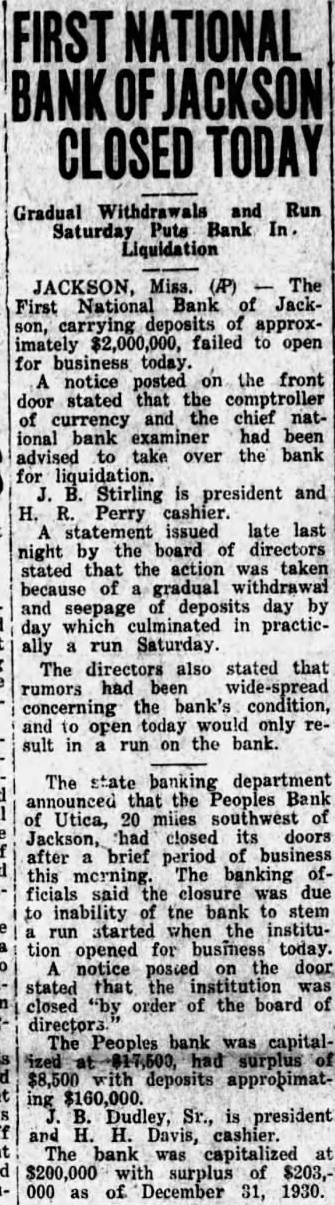

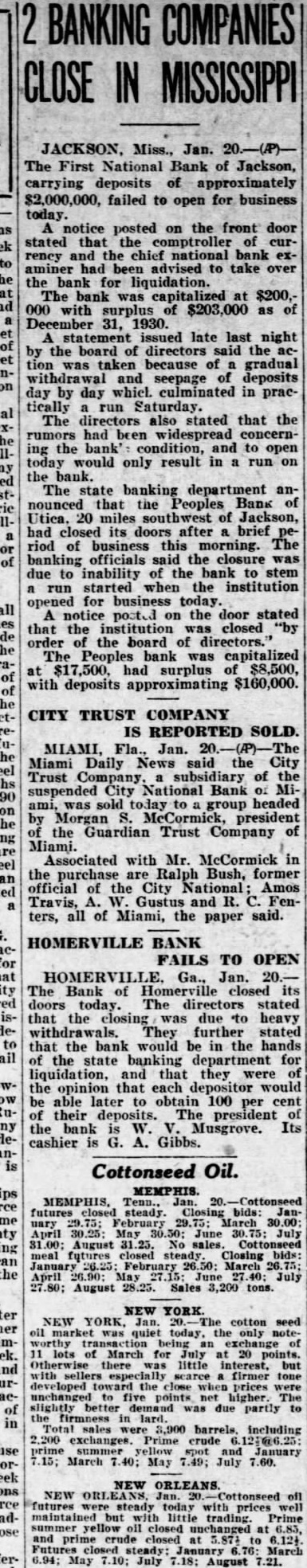

JACKSON BANK First National at Capital to Liquidate, Declares Press) Jan. First National Bank of Jackson, deposits of failed to open for today. notice posted on the front door stated that the comptroller currency and chief national bank examiner had been advised to take the bank for liquidation. The bank was capitalized $200,with surplus of $203,000 December 31, 1930. Stirling president and Perry cashier. statement issued late by the board of directors stated that the action was taken because of gradual withdrawal and seepage deposits day by day which in practically Saturday. The directors stated that rumors had been wide-spread concerning the bank's condition, and to open today would only result in run on the bank. The state banking department announced that the Peoples Bank Utica, 20 miles southwest of Jackson, had closed its doors after brief period of business this morning. The banking officials said the closure was due inability the bank stem started when institution opened for business today. notice posted on the door statthat the institution was closed order the board of directors. The Peoples was capitalized $17,500, had surplus of $8,500 with deposits approximating $160,Dudley, is president and Davis, cashier. GULFPORT BANKS MERGED First National Bank of Gulfport Monday took over the deposits and assets of the Bank and Trust Company, with the understanding that all checks against Bank and Trust Company balances would be paid by the First National in ordinary course of business. of absorption the Commercial Bank and Trust Monday afternoon form of statement signed by its directors, while both banks were closed in observance of Lee's birthday.