Click image to open full size in new tab

Article Text

# Trust Company Case

trust company that part of the securities giv-

en by it in exchange which was retained by

the insurance company, and has never come

into his hands. All that is required of him is

to do equity by returning those which have

come into his possession from the insur-

ance commissioner.

The fact that the amount of the securities

deposited by the insurance company in trust

for the benefit of policy holders exceeded

the minimum deposit required by statute is

not material. The excess was as fully bound

by the trust as the balance.

General Laws 1881, chapter 123 (General

Statutes 1894, sections 3,331 and seq.) au-

thorizes the business of insurance against

losses resulting from the insolvency of those

to whom goods are sold on credit.

The court had jurisdiction of the state

auditor as respects the control and disposi-

tion of this trust fund for the benefit of

policy holders, in which the state, as such,

has no interest. Former decisions as to

the control of the courts over the official acts

of executive officers of the state government,

distinguished.

Order affirmed on appeal of the trust com-

pany.

Order reversed on appeal of state auditor.

-Mitchell, J.

Eagle Roller Mill Company, respondent, vs.

G. C. Dillman et al., defendants, Hugh

McBain et al., appellants.

Action against the sureties on a bond given

by an agent to buy grain conditioned that he

would, on demand, deliver or account for all

grain purchased by him for his principal, and

pay over all moneys in his hands belonging to

him, the breach alleged being that he had

failed on demand to deliver or account for the

grain purchased by him or to pay over the

money in his hands furnished him by the

principal for the purpose of buying grain.

Held, that the fact that the principal, in the

conduct of the business, used, and furnished

for use of his agent, scales which had not

been tested and sealed as required by Gen.

St. 1894, sec. 2205, constituted no defense in

favor of the sureties.

The illegal act alleged (the use of unsealed

scales in weighing the grain) constituted no

link in the plaintiff's chain of title to the

grain or the money, or any part of his cause

of action. Neither was the plaintiff dependent

upon it for the purpose of establishing his

claim. Order affirmed.

-Mitchell, J.

A. W. Bradley and H. H. Hanford, co-part-

ners as Bradley & Hanford, appellants, vs.

Gilbert C. Thorne, receiver, etc., Intervenor,

respondent.

The "disclosure" of the garnishee is com-

petent in favor of a "claimant," and against

the plaintiff for the purpose of showing what

property had been impounded by the gar-

nishee proceedings, and thus identify it as

the same property to which the claimant is

asserting a right. Judgment affirmed.

-Mitchell, J.

J. C. Easton, appellant, vs. Edward P. Childs

et al., respondents.

Under Gen. St. 1894, sec. 5204, the filing of

the return of the sheriff is not a jurisdictional

prerequisite to the publication of the sum-

mons; overruling Corson vs. Shoemaker, 55

Minn., 386.

Under the statute the office of a return of

the sheriff that the defendant cannot be found

is not to authorize the publication, but to

support it after it is made, being prima facie

evidence that the case was one where service

by publication was authorized, to wit, where

the defendant could not be found in the state.

Order reversed.

-Mitchell, J.

Oluf Stendal, as administrator, etc., respond-

ent, vs. Allen P. Boyd, appellant.

In action for damages resulting from acts

of another, alleged to have been negligent,

the complaint is not demurrable as not stat-

ing a cause of action, unless the particular

acts alleged are such that they could not be

negligent under any evidence admissible un-

der the allegations of the pleading; follow-

ing Rolseth vs. Smith, 38 Minn., 14. Order

affirmed.

--Mitchell, J.

First National Bank of Waverly, Iowa, ap-

pellant, vs, W. D. Forsyth et al., respon-

dents.

An overdue and unpaid installment of in-

terest (known to the indorsee at the time of

purchase) dishonors negotiable paper and ren-

ders it subject, in the hands of the purchaser,

to existing defenses between the original

parties, the same as an overdue and unpaid

installment of principal; following First Na-

tional Bank vs. Scott County 14 Minn., 77.

Order affirmed.

-Mitchell, J.

State ex rel. Surety Trust Company, peti-

tioner, vs. Probate Court of Rock County,

Minn., et al., respondents.

Pursuant to the order directing the issu-

ing of a writ of certiorari to the probate

court a citation was served upon the opposite

party in interest to show cause why the action

of that court should not be reversed.

The relator prevailed.

Held that he was entitled to costs and dis-

bursements against the opposite party in in-

terest, although the writ was directed only

to the probate court.

-Mitchell, J.

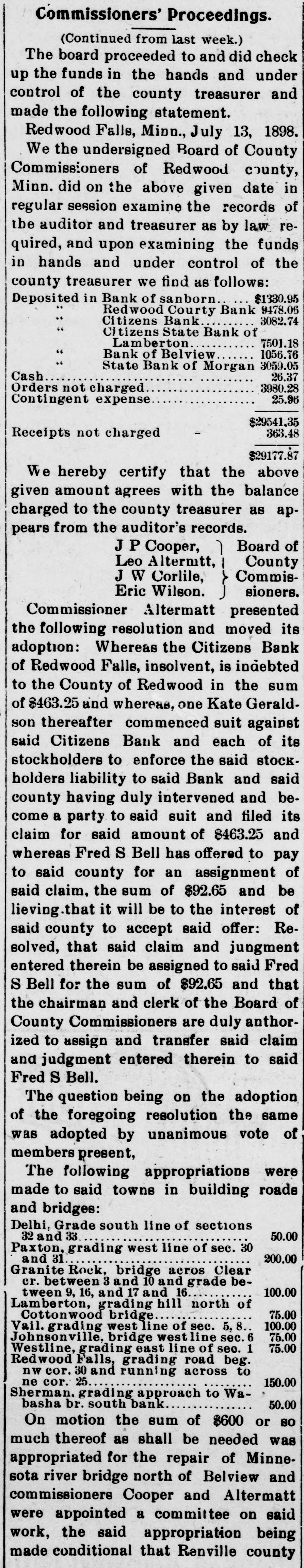

The Board of County Commissioners of the

County of Redwood, appellant, vs. The

Citizens' Bank of Redwood Falls, defendant.

W. T. Donaldson et al., respondents.

A bank which had been depository of coun-

ty funds for one term about to expire and

which was indebted to the county for money

deposited with it during that term, was desig-

nated depository for a second term and gave

to the county a bond with sureties conditioned

that it would pay on demand all funds "which

shall be deposited in said bank pursuant to

said designation."

The account between the bank and the

county was kept in the form of an open cur-

rent account. During the second term, from

time to time, deposits were made to the

credit of the county and payments made gen-

erally to the county on its checks, the amount

of these payments during the second term

exceeding the amount of the deposits during

the same time but leaving a balance still

due the county when the bank failed during

the second term.

Held that the sureties were only liable for

money deposited during the second term for

which their bond was given.

But that the relation between the bank and

the county was that of debtor and creditor

and that the money deposited with the bank

became its property and all payments made

by it to the county were made with its own

funds; and having been paid generally on a

single continuous account the law will ap-

propriate them according to the general rule,

viz: the first item on the credit side to

discharge or reduce the first item on the debit

side; that the sureties have no right to have

the payments first applied to discharge the

debits created by deposits made during the

second term.

The case distinguished from those on of-

ficial bonds where the officer was merely

the custodian of public funds, which remained

the property of the public, and where he

used the public funds which came into his

custody during one term to discharge his

liability on account of an embezzlement com-

mitted by him during a previous term. Or-

der reversed.

-Mitchell, J.

Hans Olson, respondent, vs. The State Bank

et al., defendants. Willis H. Manley et al.,

appellants.

Held, following Dunn vs. State Bank, 59

Minn., 221:

First-That where the stockholders of a

banking corporation voted to increase its

stock (having authority to do so under the

articles of association) and part of such

stock was purchased by its president, who

was also city treasurer, and paid for with

city funds unlawfully used by him for that

purpose, and the stock then sold by him to

third parties, the stock was not ultra vires

and void, but at most only voidable.

Second-In view of the lapse of time after

the stock was issued before the bank failed;

the want of diligence on part of the holders

in not sooner discovering the insolvency of

the bank, the large amount of corporate in-

debtedness, still outstanding, which has been

incurred since the stock was issued, the hold-

ers of the stock have no right to rescind as

against creditors whose rights have become

vested by the insolvency of the bank. Order

affirmed.

-Mitchell, J.

# Griswold Will Contest