Click image to open full size in new tab

Article Text

LOCAL MARKETS

Butter, and Ess Co.) candled colored Leghorn colored (up to lbs.) Stags lbs. Roosters Ducks 10c Butter

Fruits and Vegetables. Quota Co. 88 Arkansas Blacks. 138 Rome Beauty fancy, bushels bushels Flemish extra fancy 2.75 Beauty, fancy. 110-120-135s extra Oranges. 126 Oranges, bushels Oranges. special Cranberries. Rhubarb. Canadian. 100 Tomatoes. Fla crate Cabbage. per 100 Brown Beauty 100 lbs. 100 round sweet. per bushel Onions. pounds Parsley dozen Lettuce dozen dozen

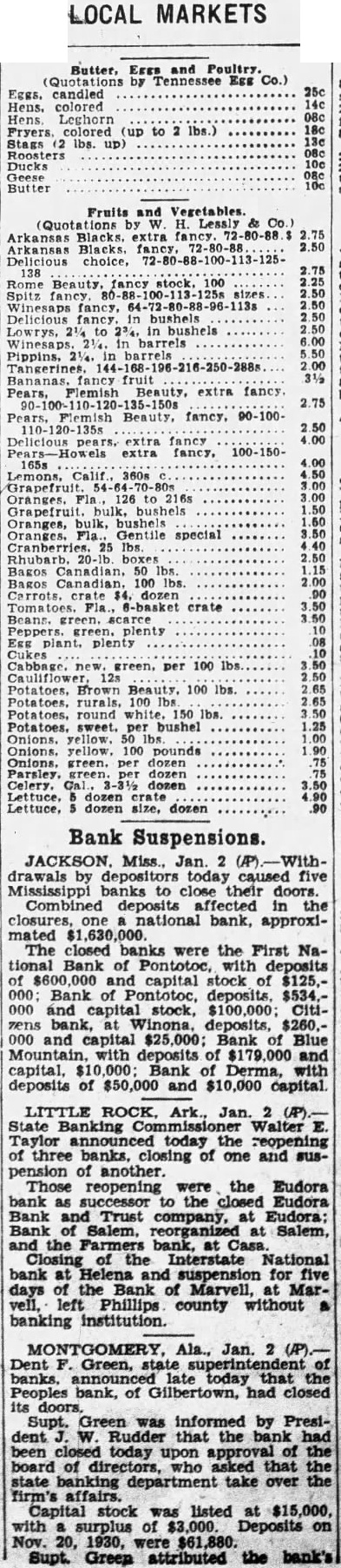

Bank Suspensions.

JACKSON. Miss., Jan. 2 (AP) Withdrawals by depositors today caused five Mississippi banks to close their doors. Combined deposits affected in the national bank, approximated The closed were the First National Bank of Pontotoc, deposits of $600,000 and capital stock of $125,000 Bank of Pontotoc, deposits. $534.000 and capital stock, $100,000; zens bank. deposits, $260.000 and capital $25,000; Bank of Blue with deposits of $179,000 and capital, Bank of Derma, with deposits of $50,000 and $10,000 capital.

LITTLE ROCK, Ark., Jan. (AP) State Banking Walter E. ylor announce today the reopening of three banks. closing of one and suspension of another Those reopening were the Eudora bank as successor the closed Eudora Bank and Trust company, at Eudora: Bank of Salem. reorganized at Salem, and the Farmers bank, at Closing of the Interstate National bank at and suspension for five days of the Bank of Marvell, at Marvell. left Phillips county without a banking institution.

MONTGOMERY, Ala., Jan. 2 (AP) Dent Green, of banks. announc late today that the Peoples bank, of had its doors. Supt. Green was informed by President W. Rudder that bank been today upon approval of the board of directors, asked that state banking department take over the firm's affairs. Capital stock was listed at $15,000, with surplus of Deposits on Nov. 20, 1930, were $61,880. Supt. Green attributed the bank's