Click image to open full size in new tab

Article Text

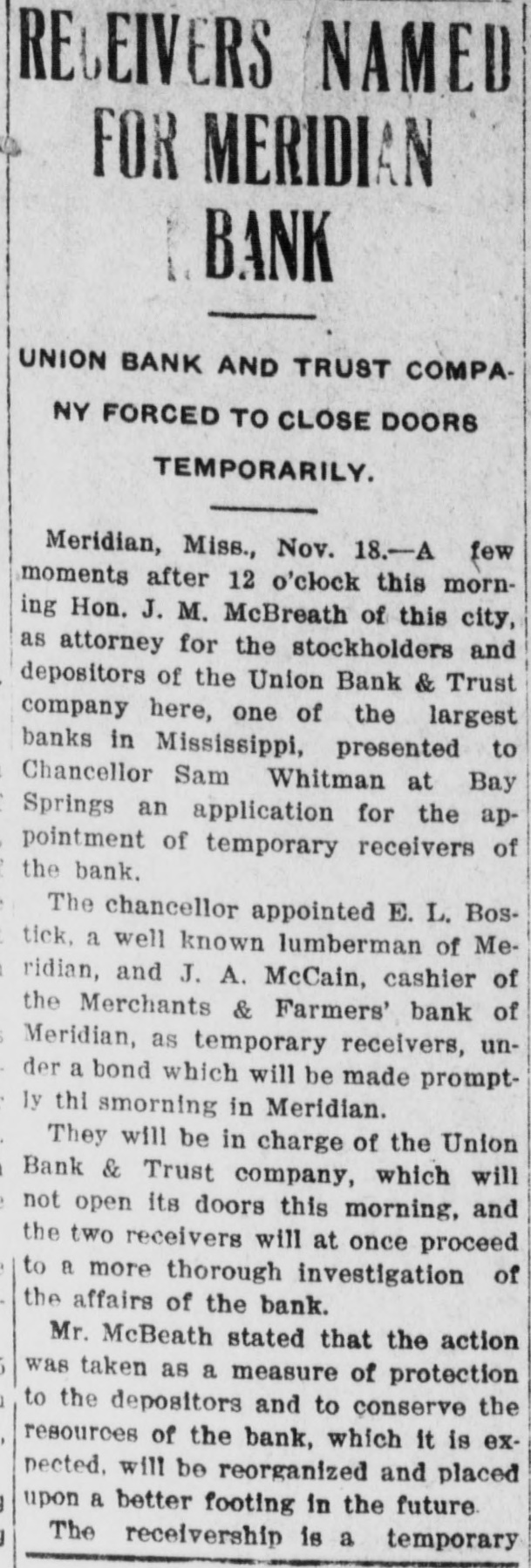

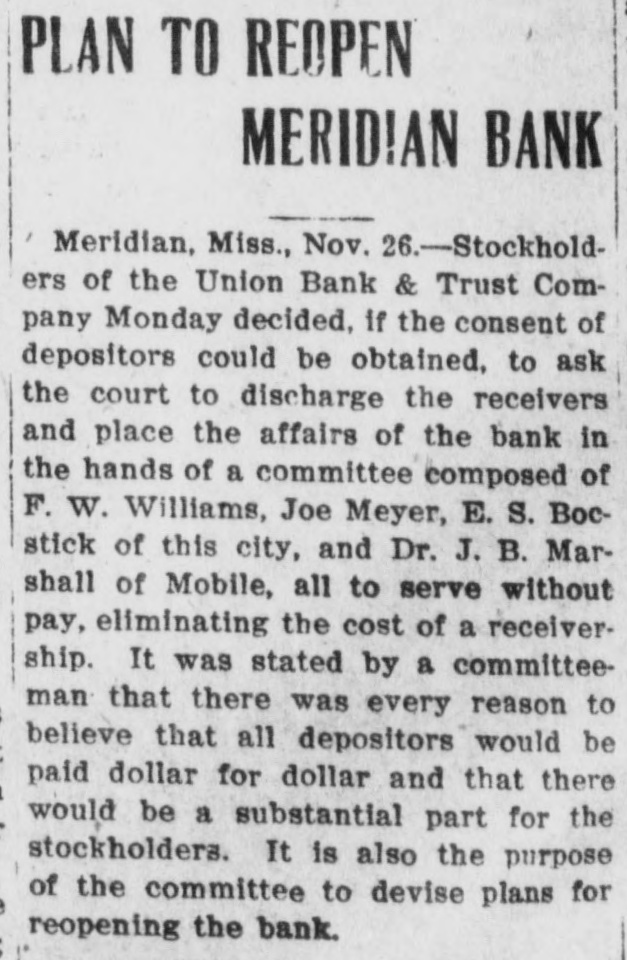

will Terry, 24 years of age, fell into Bear Creek, near Sontag, and was drowned. His body was recovered by & searching party. The cornerstone of the new city hall at Meridian was laid by Grand Master Jesse M. Brooks and other Grand Masonic lodge officers. Chancery court, which was to have convened at Quitman the second Monday in April, has ben pretermitted to the third Monday in April, the 19th. Contracts for the erection of the new high school in Greenville have been awarded to a Birmingham concern, who were lowest bi ers, within price of $34,000. The date of Gov. Brewer's speaking in ineBatesville has been changed from April 12 to April 17. The governor had accepted, an invitation to speak at Mendenhall April 12. The yarn mills of Yazoo City received a large order from one of the warring nations. Shipment will be made via Gulfport. The mill has been running on full time for several months, and the outlook is that every yard of yarn will be sold before " leaves the spindle. The most disastrous hall storm that has struck Hattiesburg in years swept a wide area of Forrest and adjoining counties, tearing the roofs-from build. ings, breaking out window panes and damaging early crops hundreds of dollars. Reports reaching Hattiesburg tell of the disaster caused by the hail stones, and local hardware companies have been filling orders for glass roofing and the like. Forty-five thousand dollars good cotn was turned loose in Meridian when checks for this amount, 50 per cent due creditors and depositors of the defunct Union Bank & Trust com. pany, were distributed by attorneys for Receivers J. A. McCain and W. C. Moore. The remainder of the amount due depositors and creditors of the bank $45,000, will be paid on or be fore November 23. At Pearlhaven, Lincoln county, 24 houses were more or less damaged by a tornado, about a dozen being torn off of their sills and totally demolished. Just north of the Central Lumber com pany a residence owned by Capt. Mor ton and W. H. Seavey was completely destroyed, and, although occupied, no one was seriously hurt. The tops of four box cars were also blown off. At the gravel pit east of Brookhaven sev eral houses were also blown down. Rats gnawing a match are believed to have started a fire in Pontotoc that destroyed six business establishments, causing $50,000 loss. The flames orig. inated in Carr Bros.' store, destroying that building, the Southern Express company's office, N. M. Wheeler's grocery, R. B: Carr & Co.'s and I. C. Henderson's general mery andise stores and the Campbell garage. I. H. Daniel, a traveling salesman of New Orleans, and Ike Bell, an express wagon driver, were painfully injured when a wall of the Carr building fell on the building of the Southern Express company, demolishing the structure. The two men were in the express officer at the time. Gov. Brewer has issued pardons to Gus Bradley, serving fifteen years from Tate county for shooting a negro woman, and Will Clayton, of Pontotoc, convicted in September, 1913, on a charge of murder and sent up for life. George W. Wilkes, proprietor of the Biloxi Daily Herald and Guifport Daily Herald, died in Biloxi, after an illness of seven weeks. Mr. Wilkes' death was due to complication of allments from which he had suffered for some time. He was born on Jan. 11, 1854, in Princeton, Ind., emigrating to the south in 1877. Whatever effect the cold weather