Article Text

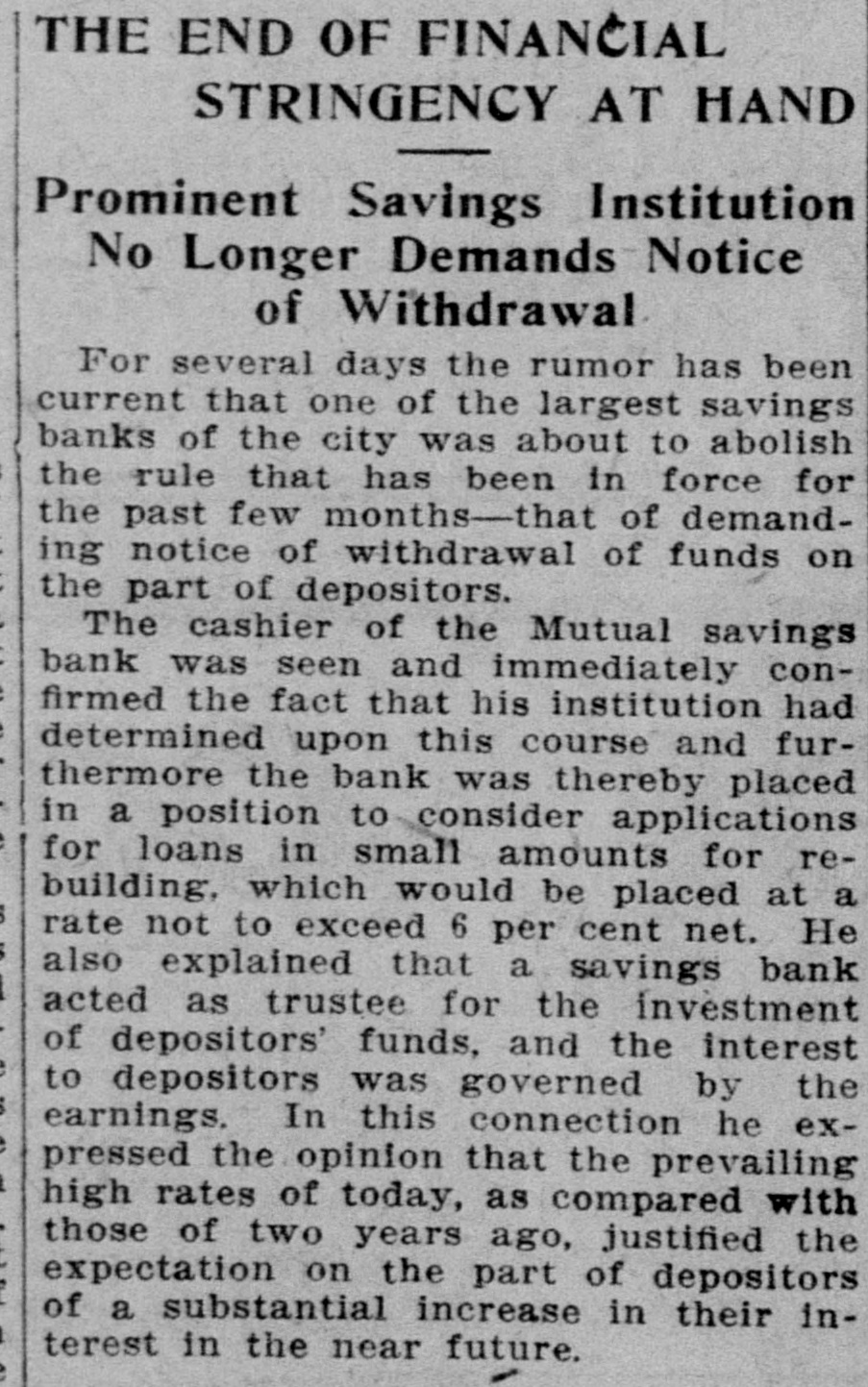

THE END OF FINANCIAL STRINGENCY AT HAND Prominent Savings Institution No Longer Demands Notice of Withdrawal For several days the rumor has been current that one of the largest savings banks of the city was about to abolish the rule that has been in force for the past few months-that of demanding notice of withdrawal of funds on the part of depositors. The cashier of the Mutual savings bank was seen and immediately confirmed the fact that his institution had determined upon this course and furthermore the bank was thereby placed in a position to consider applications for loans in small amounts for rebuilding, which would be placed at a rate not to exceed 6 per cent net. He also explained that a savings bank acted as trustee for the investment of depositors' funds, and the interest to depositors was governed by the earnings. In this connection he expressed the opinion that the prevailing high rates of today, as compared with those of two years ago, justified the expectation on the part of depositors of a substantial increase in their interest in the near future.