Click image to open full size in new tab

Article Text

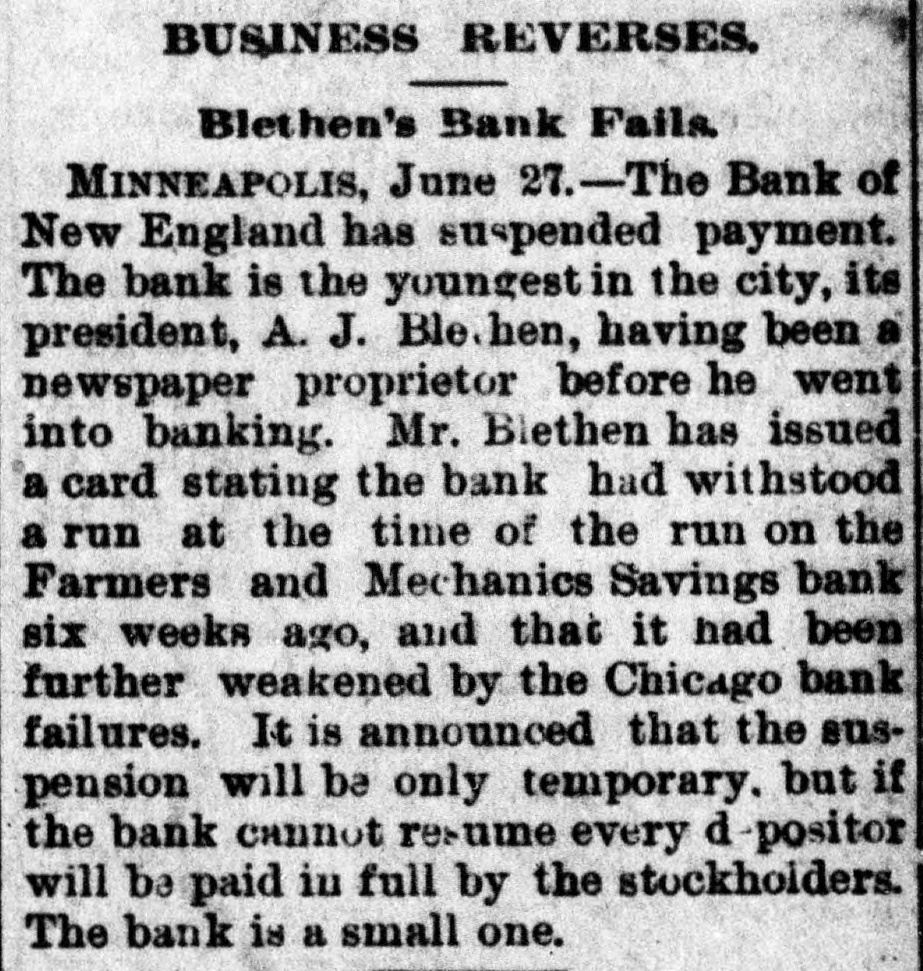

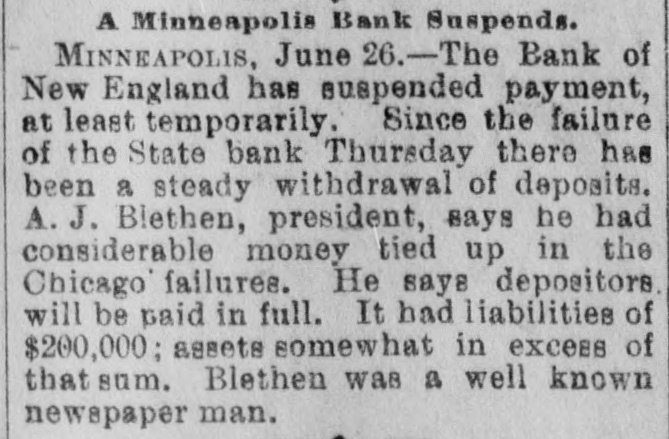

WEST AND SOUTH. THE firm of S. & G. Gump, dealers in art goods at Nan Francisco, made an assignment with liabilities of $140,000. THE death of Rev. W. W, Kone, aged 90 years, occurred at Denison, Tex. He was the oldest Baptist minister in the United States, having entered the ministry at the àge of 18, THE Bank of New England at Minneapolis, Minn, the Sabina (O.) bank and the bank of Ness City, Kan., closed their doors. The governor of Illinois has pardoned Michael Schwab, Samuel Fielden and Oscar Neebe, the anarchists sentenced to state's prison on the charge of complicity In the Haymarket massacre in Chicago May 4, 1886. Fielden and Schawb were sentenced to prison for life and Neebe for fifteen years. IN Detroit Frank Hayes, aged 20 years. was found guilty of murder and sentenced to imprisonment for life. THE Merchants' national bank at Moorhead, Minn., was entered by a masked man who covered the teller with a revolver and secured $2,600. T wo INDIANS, Kozine and Moneypenmy, were found guilty at Madison, Wis, of the murder of Boneash and his squaw last fall. At Lebanon, Ind., William Ransdell was bitten by a tarantula while handling bananas. In the bunch of bananas a bunch of 200 young tarantulas was found. Ransdell may recover, THE state liquor dispensary of South Carolina has begun business and all saloons would soon be closed. THE Savings bank at Fresno, Cal., and the Bank of Commerce at San Diego, Cal., which suspended recently, have resumed business. ON a bicycle H. H. Wyllie made the 1,000 miles from New York to Chicago in ten days and four hours. BERRY won the cowboy race to CHP began at Chadron, Neb., June 13. making the 1,040 miles in 13,days, 15 hours and 35 minutes-an average of 77 miles daily. Wine attempting to escape from the prison at Folsom, Cal., three convicts were shot dead by guards. AT Edinburg, Ill., G. P. Harrington, bankers failed for $200,000. American exchange bank of Minneapolis, Minn., and the Second national bank of Ashland, Ky., closed their doors. THE failure was reported of the Bedford (Ind.) Stone Quarries company, the largest producers of politic lime stone the world