Article Text

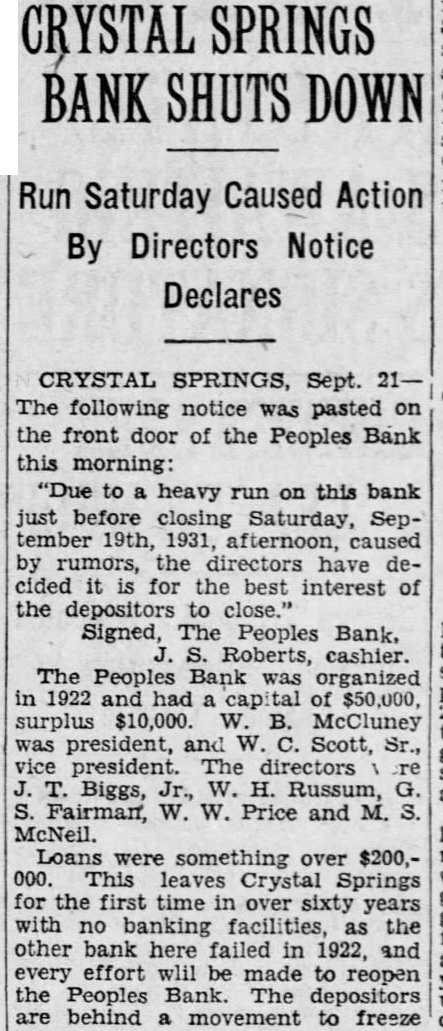

CRYSTAL SPRINGS BANK SHUTS DOWN Run Saturday Caused Action By Directors Notice Declares CRYSTAL SPRINGS, Sept. The following notice was pasted on the front door of the Peoples Bank this morning: "Due to heavy run on this bank just before closing Saturday, September 19th, 1931, afternoon, caused by rumors, the directors have decided it is for the best interest of the depositors to close." Signed, The Peoples Bank, S. Roberts, cashier. The Peoples Bank was organized in 1922 and had of $50,000 surplus $10,000. W B. McCluney was president, and W. Scott, Sr., vice president. The directors Biggs, Jr., W. H. Russum, Fairman, W. W. Price and M. McNeil. Loans were something over $200,000. This leaves Crystal Springs for the first time in over sixty years with no banking facilities, as the other bank here failed in 1922 and every effort wlil made to reopen the Peoples Bank. The depositors are behind movement to freeze