Article Text

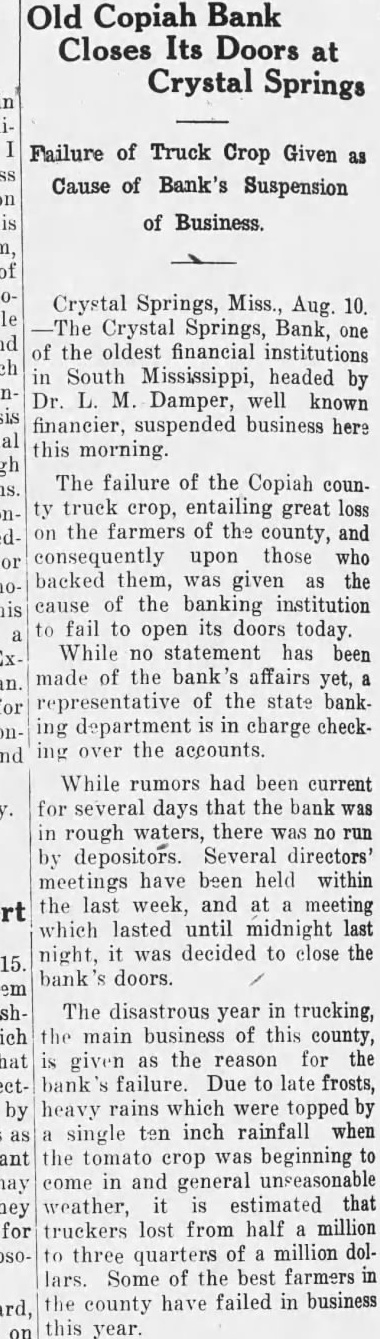

Old Copiah Bank Closes Its Doors at Crystal Springs Failure of Truck Crop Given Cause of Bank's Suspension of Business Crystal Springs, Miss., Aug. 10. Crystal Springs, Bank, one the oldest financial institutions South Mississippi, headed by Damper, well known financier, suspended business here this morning. The failure of the Copiah countruck entailing great loss crop, the farmers of the county, and consequently upon those who backed them, was given as the cause of the banking institution to fail to open its doors today. While no statement has been made of the bank's affairs representative of the state bank department is in charge checkthe accounts. While rumors had been current for several days that the bank rough waters, there was run by depositors. Several directors' have been held within the last week, and meeting which lasted until midnight last night, it was decided to close the doors. The disastrous year in trucking, the main business of this county, given as the reason for the failure. Due to late frosts, heavy rains which were topped by ten inch rainfall when single the tomato was beginning to crop in and general unseasonable come weather, estimated truckers lost from half million three of million dolquarters lars. Some of the best farmers the have failed in business county this year.