Click image to open full size in new tab

Article Text

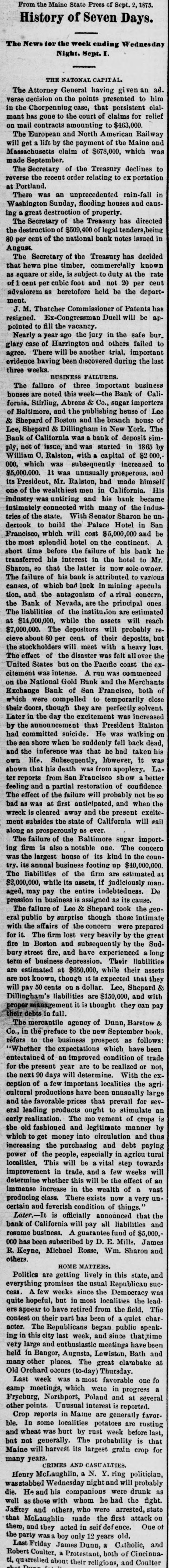

From the Maine State Press of Sept. 2, 1875. History of Seven Days. The News for the week ending Wednesday Night, Sept. I. THE NATONAL CAPIT The Attorney General having ven an ad. verse decision on the points presented to him in the Chorpenning case, that persistent claimant has gone to the court of claims for relief on mail contracts amounting to $463,000. The European and North American Railway will get a lift by the payment of the Maine and Massachusetts claim of $678,000, which was made September. The Secretary of the Treasury declines to reverse the recent order relating to ex portation at Portland. There was an unprecedented rain-fall in Washington Sunday, flooding houses and causing a great destruction of property. The Secretary of the Treasury has directed the destruction of $509, of legal tenders,being 80 per cent of the national bank notes issued in August. The Secretary of the Treasury has decided that hewn pine timber, commercially known as square or side, is subject to duty at the rate of cent per cubic foot and not 20 per cent advalorem as heretofore held be the department. J. M. Thatcher Commissioner of Patents has resigned. Ex-Congressman Duell will be appointed to fill the vacancy. Nearly a year ago the jury in the safe bur_ glary case of Harrington and others failed to agree. There will be another trial, important evidence having been discovered during the last three weeks. BUSINESS FAILURES. The failure of three important business houses are noted this week Bank of California, Stirling, Abrens & Co., sugar importers of Baltimore, and the publishing heuse of Lee & Shepard of Boston and the branch house of Lee, Shepard & Dillingham in New York. The Bank of California was bank of deposit simply, not of issue, and was started in 1865 by William C. Ralston, with capital of 000, 000, which was subsequently increased to $5,000.000. It was unusually prosperous, and its President, Mr. Ralston, had made himself one of the wealthiest men in California. His industry was untiring and his bank became intimately connected with many of the industries of the state. With Senator Sharon he undertook to build the Palace Hotel in San Francisco, which will cost $5,000,000 and be the most splendid hotel on the continent. A short time before the failure of his bank he transferred his interest in the hotel to Mr. Sharon, 80 that the latter is now sole owner. The failure of his bank is attributed to various causes, of which bad luck in mining specula tion, and the antagonism of a rival concern, the Bank of Nevada, are the principal ones The liabilities of the institution are estimated at $14,000,000, while the assets will reach $7,000,000. The depositors will probably recieve about 80 per cent. of their deposits, but the stockholders will meet with a heavy loss. The effect of the disaster was felt allover the United States but on the Pacific coast the excitement was intense. A run was commenced on the National Gold Bank and the Merchants Exchange Bank of San Francisco, both of which were compelled to temporarily close their doors, though they are perfectly solvent. Later in the day the excitement was increased by the announcement that President Ralston had committed suicide. He was walking on the sea shore when he suddenly fell back dead, and the inference was that he had taken his own life. Subsequently, however, it was shown that his death was from apoplexy. Later reports from San Francisco show better feeling and a partial restoration of confidence The effect of the failure will probably not be so bad as was at first anticipated, and when the wreck is cleared away and the present excitement subsides the state of California will sail along as prosperously as ever. The failure of the Baltimore sugar importing firm is also a notable one. The concern was the largest house of its kind in the country. its annual business footing up $40,000,000. The liabilities of the firm are estimated at $2,000,000, while its assets, if judiciously managed, may pay the entire indebtedness. De pression in business is assigned as its cause. The failure of Lee & Shepard took the general public by surprise though those intimate with the affairs of the concern were prepared for it. The firm lost very heavily by the great fire in Boston and subsequently by the Sudbury street fire, and have experienced long term of business depression. Their liabilities are estimated at $650,000, while their assets are not known, though it is expected that they will pay 50 cents on a dollar. Lee, Shepard & Dillingham's liabilities are $150,000, and with proper management it is thought they can pay their debts in full. The mercantile agency of Dunn, Barstow & Co., in the preface to the new September book, refers to the business prospect as follows: "Whether the expectations which have been entertained of an improved condition of trade for the present year are to be realized or not, the next 90 days will determine. With the exception of a few important localities the agricultural productions have been unusually large and the favorable prices that prevail for several leading products ought to stimulate an early realization. The mo vement of crops is the old fashioned and legitimate manner by which to get money into circulation and thus increasing the purchasing and debt paying power of the people, especially in agricu tural localities, This will be a vital step towards improvement in trade. and a few weeks will determine whether this will be the effect of an immense increase in the wealth of a vast producing class. There exists now a very uncertain and feverish condition of things. Later.-It is officially announced that the bank of California will pay all liabilities and resume business. A guarantee fund of $5,000,000 has been subscribed by D. E. Mills. James R. Keyne, Michael Rosse, Wm. Sharon and others. HOME MATTERS. Politics are getting lively in this state, and everything promises the usual Republican success. A few weeks since the Democracy was quite hopeful, but in most localities the leaders appear to have retired from the field. The contest on their part has been of quiet char acter. The Republicans began public speaking in this city last week, and since that;time very large and enthusiastic meetings have been held in Bangor, Augusta, Lewiston, Bath and many other places. The great clambake at Old Orchard occurs (to-day) Thursday. Last week was most favorable one fo eamp meetings, which were in progress a Fryeburg, Northport, Poland and at several other points. Unusual interest is reported. Crop reports in Maine are generally favorble. In some localities potatoes are rusting and wheat was hurt by rust week before last, but not generally. The probability is that Maine will harvest its largest grain crop for many years. CRIMES AND CASUALTIES. Henry McLaughlin, a N. Y. ring politician, wasstabbed Wednesday nightand will probably die. He and his companions were drunk as well as those with whom he had the fight. Jaffrey and others, who were arrested, state that McLaughlin made the first attack on them, and they acted seif defence. One of