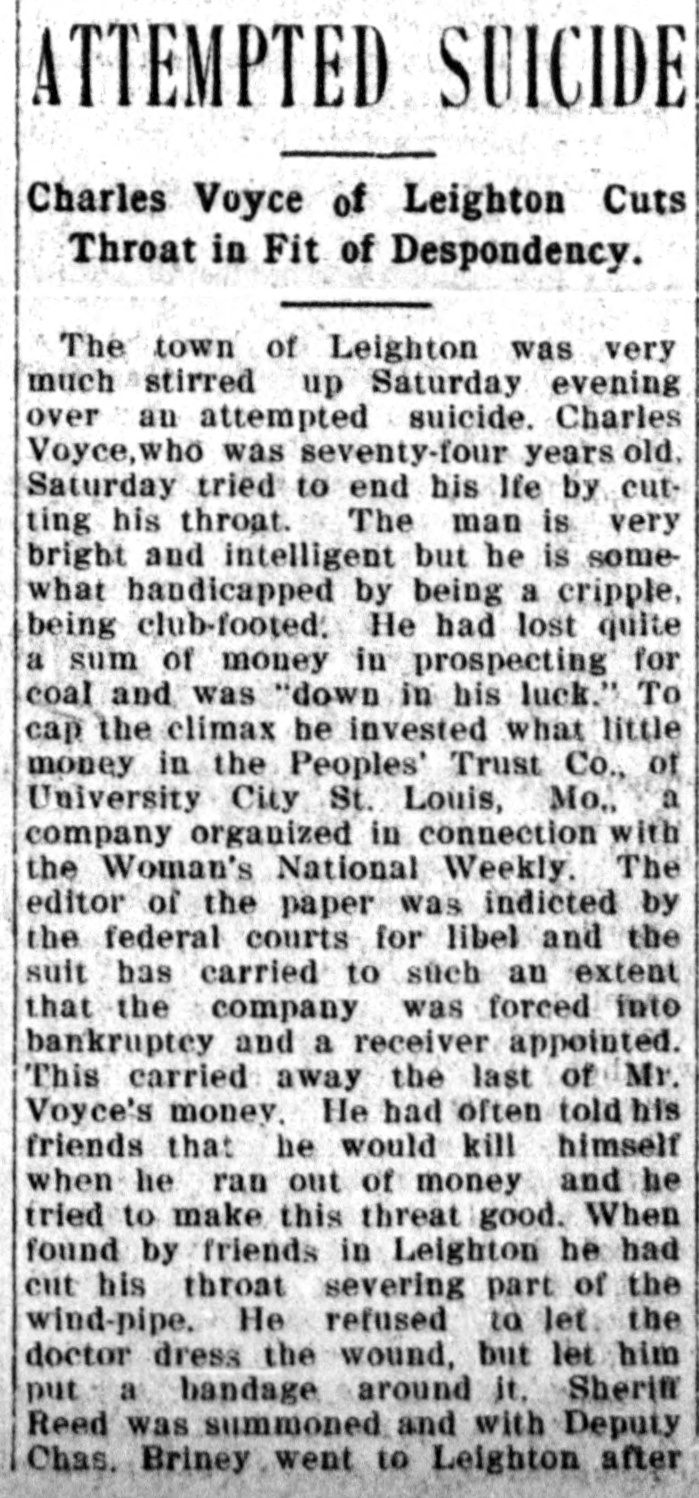

Article Text

RECEIVER IS ASKED Suit Filed by the Creditors of E. G. Lewis. Properties Involved Valued at Over $2,000,000. St. Louis, June 13.-A receiver for all of the properties of E. G. Lewis at University City, Mo., an injunction restraining the representatives of the syndicate of magazine publishers from exercising authority under the recent agreement taking over the properties, and a foreclosure on all improved property of the University Heights Realty and Development company, are sought by two suits filed today in the United States circuit court. The properties are valued, it is said, at between $2,000,000 and $3,000,000. The suit for a receiver was filed by 23 creditors. It is directed against E. G. Lewis, the Lewis Publishing company, the University Heights Realty and Development company, Peoples' Savings Trust company, United States Fibre Stopper company, University City Art Museum society, St. Louis County Land Title company and the representatives of the syndicate which took over the Lewis properties. The suit seeking to foreclose on the improved property was filed by seven plaintiffs. It makes as defendants the University Heights Realty and Development company, Peoples' Savings and Trust company, Metropolitan Life Insurance company and Nathan Frank, trustee. Charges are made against Lewis and his companies by the, creditors. In their petition it is represented that all of the Lewis corporations are insolvent and that their aggregate indebtedness amounts to more than $5,000,000. The allegation is made that Lewis and his wife have left St. Louis and that Lewis is now engaged in the work of inducing women to become members of the American Women's league. It is charged that ruin, destruction and death have followed in the wake of Lewis's enterprises due to misrepresentations made to investors in his corporations and securities. It is also charged that the reorganization plan of the syndicate of publishers is a scheme further to deprive the creditors of the corporations of their money. The reorganization plan was adopted recently and under an agreement was to continue for five years. A committee representing '108 magazines took charge of Lewis's proper ties as trustees to handle them for five years. At the end of five years the Lewis properties were to be returned to him free of debt, it was stated. The plan was. adopted to save throwing the valuable properties on the market at a forced sale. Federal Judge Dyer said today that he would pass upon the petitions tomorrow.