Article Text

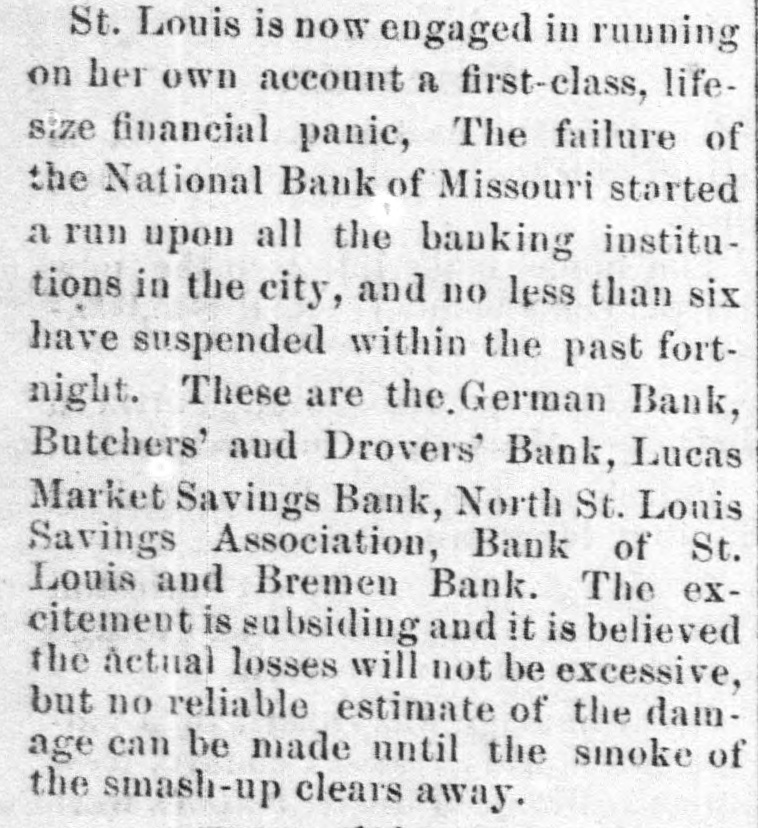

St. Louis is now engaged in running on her own account a first-class, lifesize financial panic, The failure of the National Bank of Missouri started a run upon all the banking institutions in the city, and no less than six have suspended within the past fortnight. These are the, German Bank, Butchers' and Drovers' Bank, Lucas Market Savings Bank, North St. Louis Savings Association, Bank of St. Louis and Bremen Bank. The excitement is subsiding and it is believed the actual losses will not be excessive, but no reliable estimate of the damage can be made until the smoke of the smash-up clears away.