Article Text

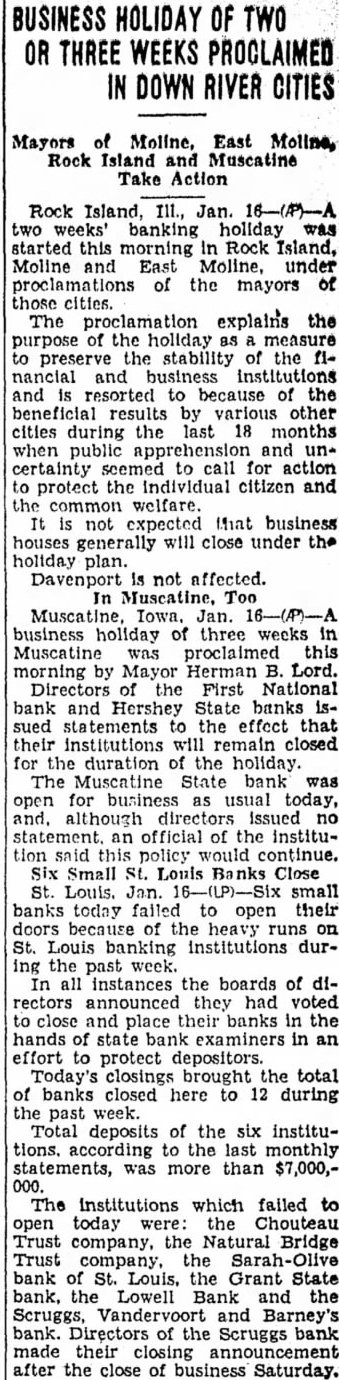

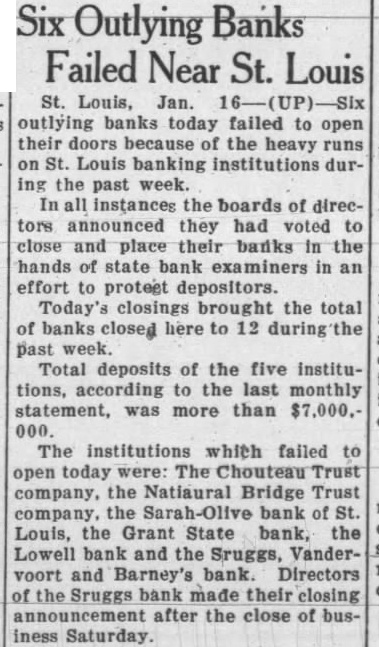

OF TWO OR THREE WEEKS RIVER Mayors of Moline, East Moline, Rock Island and Muscatine Take Action Rock Island, Jan. two weeks' banking holiday was started this morning In Rock Island, Moline and East Moline, under proclamations of the mayors of those cities. The proclamation explains the purpose of the holiday measure preserve the stability the flnancial and business institutions and resorted to because of the beneficial results by various other cities during the 18 months when public apprehension and uncertainty seemed call for action protect the individual citizen and the common welfare. not expected that business houses generally will close under the holiday plan. Davenport not affected. Muscatine, Too Muscatine, Iowa. Jan. business holiday of three weeks Muscatine was proclaimed this morning by Mayor Herman Lord. Directors the First National bank and Hershey State banks sued statements to the effect that their institutions will remain closed for the duration the holiday. The Muscatine State bank was open for usual today, and, directors issued statement. an official of the institution said this policy would continue. Six Small St. Louis Close Louis. Jan. small banks today failed to open their doors because of the heavy runs on St. Louis banking institutions during the past week. In all instances the boards of directors announced they had voted close and place their banks in the hands state bank examiners in an effort to protect depositors. closings brought the total of banks closed here to 12 during the past week. Total deposits of the six institutions. according to the last monthly statements, was more than $7,000,000. The Institutions which failed to open today the Chouteau Trust company, the Natural Bridge Trust company, the bank of Louis, the Grant State bank, the Lowell Bank and the Scruggs, Vandervoort and Barney's bank. of the Scruggs bank made their after the close of business Saturday.