Click image to open full size in new tab

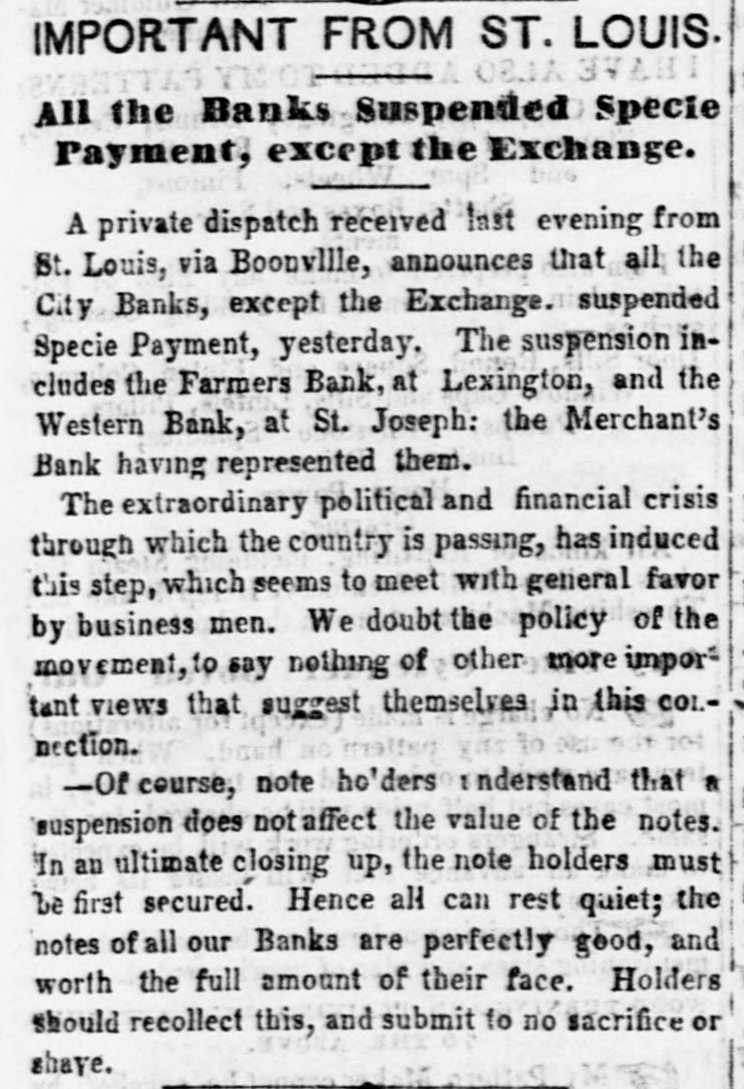

Article Text

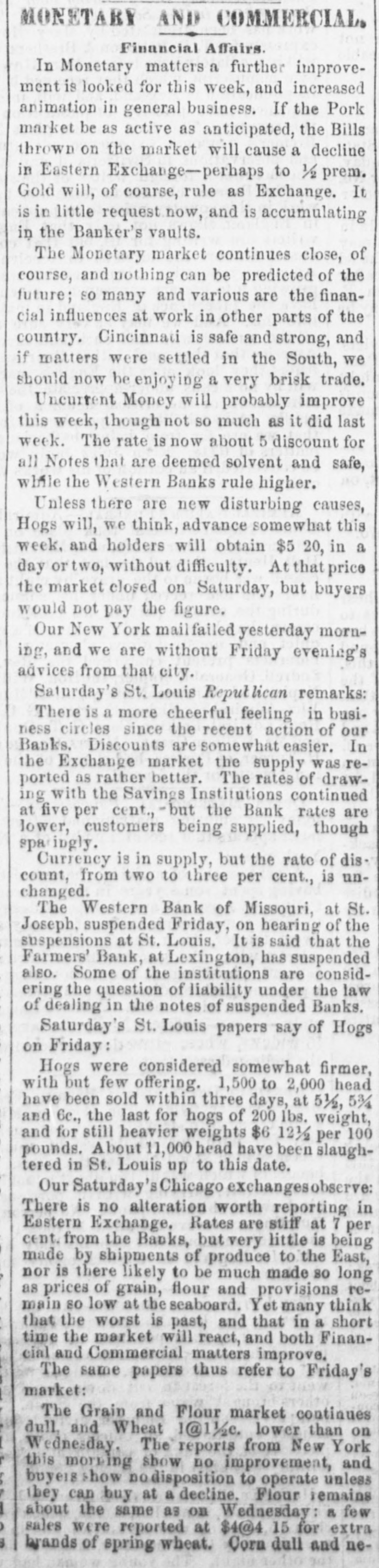

MONETARY AND COMMERCIAL. Financial Affairs. In Monetary matters a further improvement is looked for this week, and increased animation in general business. If the Pork market be as active as anticipated, the Bills thrown on the market will cause a decline in Eastern Exchange-perhaps to ½ prem. Gold will, of course, rule as Exchange. It is in little request now, and is accumulating in the Banker's vaults. The Monetary market continues close, of course, and nothing can be predicted of the future; so many and various are the financial influences at work in other parts of the country. Cincinnati is safe and strong, and if matters were settled in the South, we should now be enjoying a very brisk trade. Uncurrent Money will probably improve this week, though not so much as it did last week. The rate is now about 5 discount for all Notes that are deemed solvent and safe, while the Western Banks rule higher. Unless there are new disturbing causes, Hogs will, we think, advance somewhat this week, and holders will obtain $5 20, in a day or two, without difficulty. At that price the market closed on Saturday, but buyers would not pay the figure. Our New York mailfailed yesterday morning, and we are without Friday evening's advices from that city. Saturday's St. Louis Reputlican remarks: There is a more cheerful feeling in business circles since the recent action of our Banks. Discounts are somewhat easier. In the Exchange market the supply was reported as rather better. The rates of drawing with the Savings Institutions continued at five per cent., -but the Bank rates are lower, customers being supplied, though sparingly. Currency is in supply, but the rate of discount, from two to three per cent., is unchanged. The Western Bank of Missouri, at St. Joseph, suspended Friday, on hearing of the suspensions at St. Louis. It is said that the Farmers' Bank, at Lexington, has suspended also. Some of the institutions are considering the question of liability under the law of dealing in the notes of suspended Banks. Saturday's St. Louis papers say of Hogs on Friday: Hogs were considered somewhat firmer, with but few offering. 1,500 to 2,000 head have been sold within three days, at 5½, 53/4 and 6c., the last for hogs of 200 lbs. weight, and for still heavier weights $6 12½ per 100 pounds. About 11,000 head have been slaughtered in St. Louis up to this date. Our Saturday's Chicago exchangesobserve: There is no alteration worth reporting in Eastern Exchange. Rates are stiff at 7 per cent. from the Banks, but very little is being made by shipments of produce to the East, nor is there likely to be much made so long as prices of grain, flour and provisions remain so low at the seaboard. Yet many think that the worst is past, and that in a short time the market will react, and both Financial and Commercial matters improve. The same papers thus refer to Friday's market: The Grain and Flour market continues dull, and Wheat 1@1½c. lower than on Wednesday, The reports from New York this morning show no improvement, and buyers show nodisposition to operate unless they can buy at a decline. Flour remains about the same as on Wednesday: a few sales were reported at $4@4 15 for extra brands of spring wheat. Corn dull and ne-